Hi all,

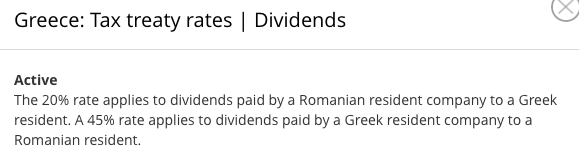

Romania has a withholding tax rate of 8% on dividends disbursed by a Romanian legal entity to non-(tax)resident individuals.

If the individual is a ta resident in the EU (not in Romania), can this 8% be claimed back from Romania?

Thanks

Romania has a withholding tax rate of 8% on dividends disbursed by a Romanian legal entity to non-(tax)resident individuals.

If the individual is a ta resident in the EU (not in Romania), can this 8% be claimed back from Romania?

Thanks