I reside in an EU country A and I want to create a company in an EU country B. This company would outsource all its work, so that the only activity for me to do is management. It would have an office in the country B and I would travel there once a month to manage the company there. The work would be outsourced to my sole proprietorship or a company in country A, where I would perform the work in the name of this company from country A. I would do no management or work in the name of the company from country B in country A. Will the company from country B be appropriated by country A for taxation?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Owning and managing a company in another EU country

- Thread starter gnud

- Start date

-

- Tags

- cfc cfc rules european union poem

It depends on the laws of the applicable countries, and how they are enforced.

It's a very different story if Country A is Cyprus and country B is Malta than if Country A is Finland and Country B is Malta.

If Country A is aggressive, they may seek to tax you and your company as a resident on its entire, worldwide income. If Country B is also aggressive, you might end up with dual tax burdens and have to sort things out under a tax treaty.

It's a very different story if Country A is Cyprus and country B is Malta than if Country A is Finland and Country B is Malta.

If Country A is aggressive, they may seek to tax you and your company as a resident on its entire, worldwide income. If Country B is also aggressive, you might end up with dual tax burdens and have to sort things out under a tax treaty.

It depends on the laws of the applicable countries, and how they are enforced.

It's a very different story if Country A is Cyprus and country B is Malta than if Country A is Finland and Country B is Malta.

If Country A is aggressive, they may seek to tax you and your company as a resident on its entire, worldwide income. If Country B is also aggressive, you might end up with dual tax burdens and have to sort things out under a tax treaty.

Thanks. But how can a country A demand anything when no work or management in the name of the company B is being performed on its territory?

Because you own and/or control the company and you are resident in Country A. Some tax authorities will use that as reason enough to consider you tax resident (see for example Finland, Germany, Sweden).

You can of course take the tax authority to court and try to have their ruling overturned.

You can of course take the tax authority to court and try to have their ruling overturned.

Because you own and/or control the company and you are resident in Country A. Some tax authorities will use that as reason enough to consider you tax resident (see for example Finland, Germany, Sweden).

You can of course take the tax authority to court and try to have their ruling overturned.

Only a residency of the owner / manager is enough? I thought it's about the place of effective management and permanent establishment.

I'll tell you what could work.

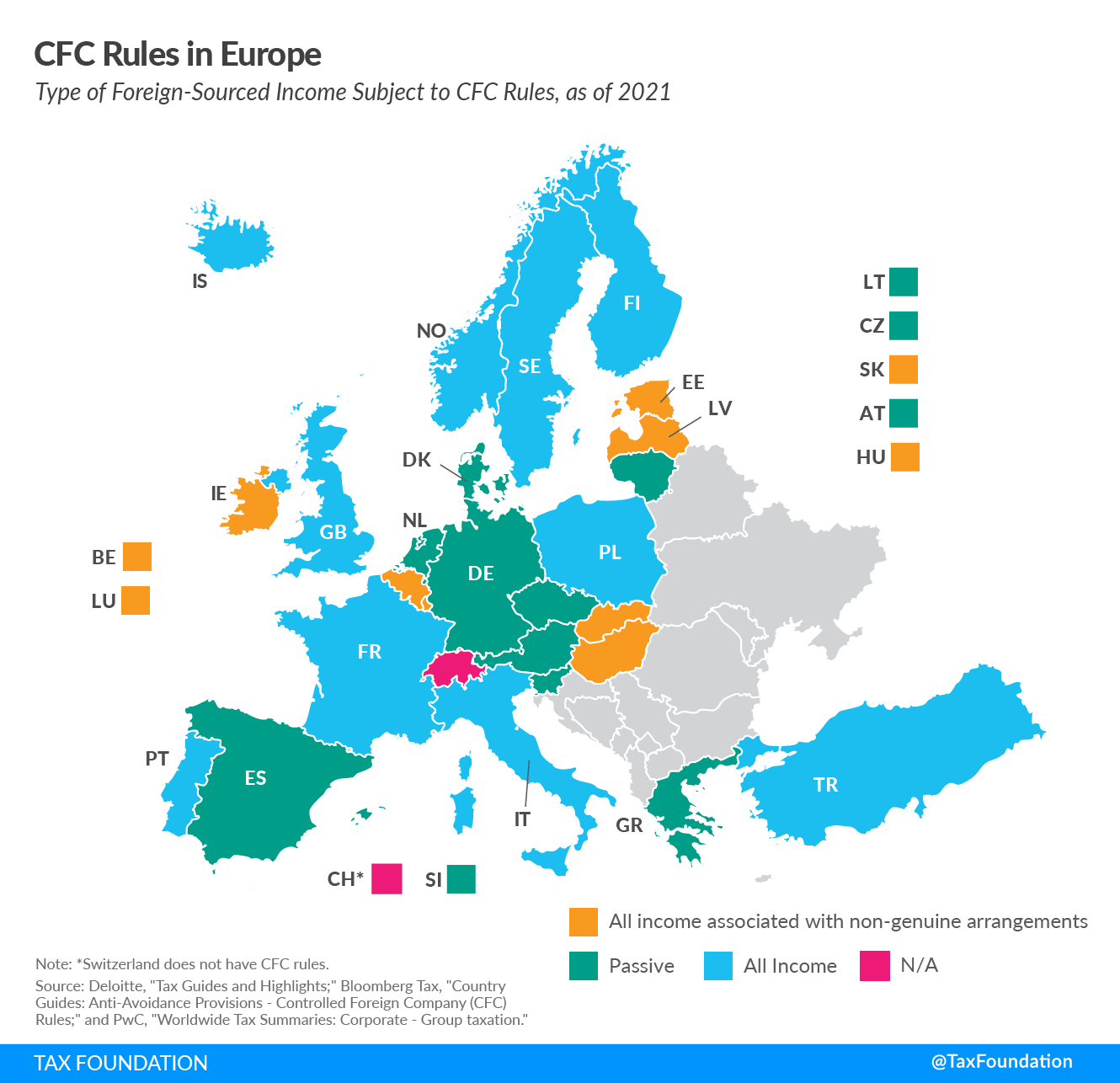

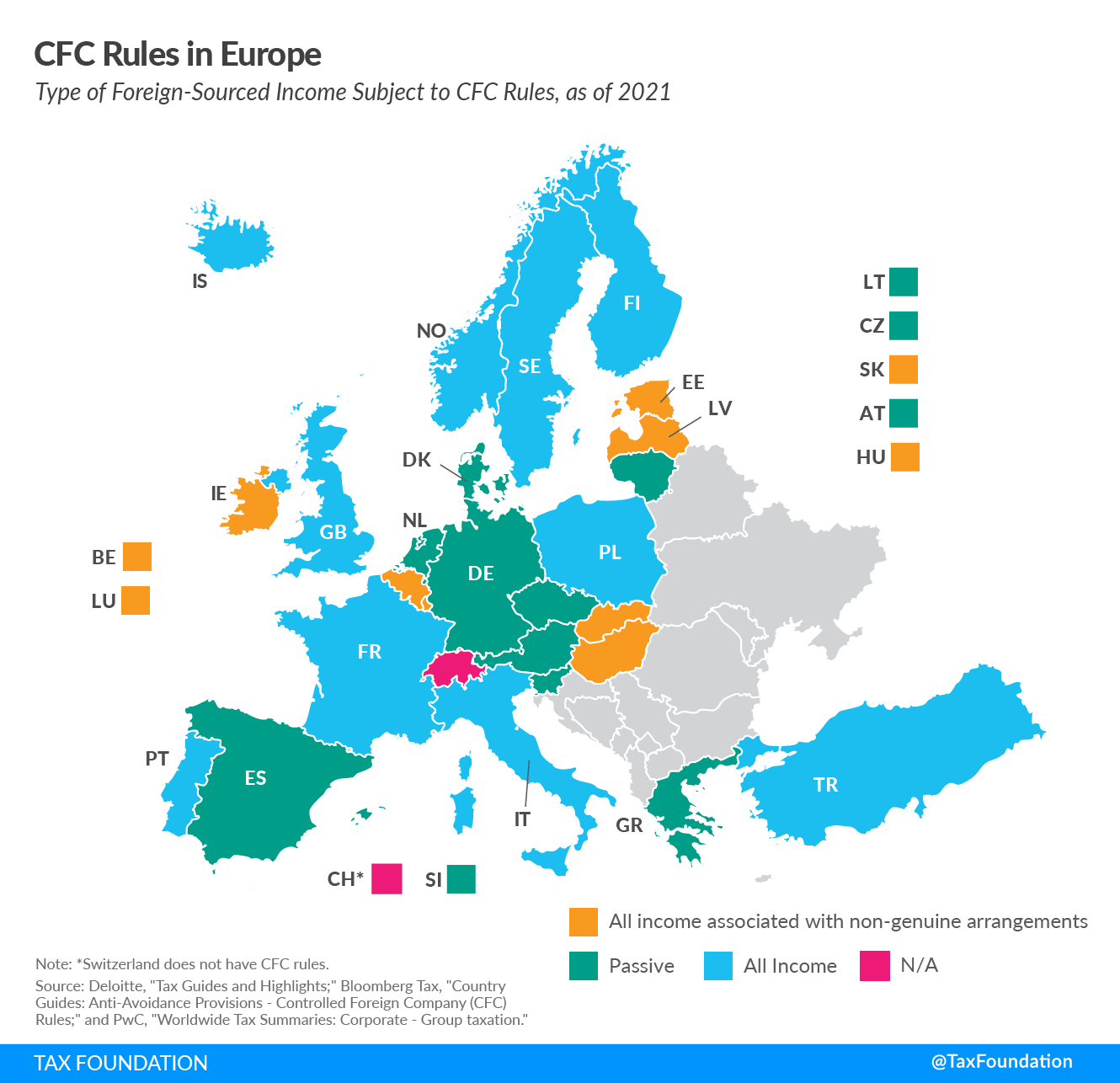

Test 1: CFC rules country A?

If country A considers CFC only for passive income you could get away with a trading company in country B.

Test 2: PE in country A?

If you only work for company in country B you are seen as a dependent agent in country A. Not only that but it also depends on the type of work that you are doing in country A. If you are closing sales type of work you are most likely creating a PE in country A

Your only way to escape this is to work for an intermediary company.

Depending on the type of work that you will do for company in country B you could register to a freelancer site like codeable.io and invoice them instead of invoicing your company in country B.

Even if that "could" work on paper you are really looking for troubles.

Test 1: CFC rules country A?

If country A considers CFC only for passive income you could get away with a trading company in country B.

Test 2: PE in country A?

If you only work for company in country B you are seen as a dependent agent in country A. Not only that but it also depends on the type of work that you are doing in country A. If you are closing sales type of work you are most likely creating a PE in country A

Your only way to escape this is to work for an intermediary company.

Depending on the type of work that you will do for company in country B you could register to a freelancer site like codeable.io and invoice them instead of invoicing your company in country B.

Even if that "could" work on paper you are really looking for troubles.

Yes, it can be enough under certain circumstances.Only a residency of the owner / manager is enough? I thought it's about the place of effective management and permanent establishment.

When you get to this level of nitty gritty, you need to be speaking to lawyers.

Thanks.

Unfortunately lawyers don't want to talk to me. I've contacted tens of them, got about 5 replies, 3 of which were "sorry we don't do this", and 2 were free mini advices that helped a bit but don't give me a guarantee. Not sure if this is normal or if I'm doing something wrong.

Unfortunately lawyers don't want to talk to me. I've contacted tens of them, got about 5 replies, 3 of which were "sorry we don't do this", and 2 were free mini advices that helped a bit but don't give me a guarantee. Not sure if this is normal or if I'm doing something wrong.

As Sols mentioned above it depends on the jurisdiction. If you are open to using Cyprus it could work provided you have a solid structure in place and be advised properly. Happy to PM if you want to discuss this more.Thanks.

Unfortunately lawyers don't want to talk to me. I've contacted tens of them, got about 5 replies, 3 of which were "sorry we don't do this", and 2 were free mini advices that helped a bit but don't give me a guarantee. Not sure if this is normal or if I'm doing something wrong.

Good legal advice isn't free. You need to formally engage with them and pay them for their time.2 were free mini advices that helped a bit but don't give me a guarantee. Not sure if this is normal or if I'm doing something wrong.

If you want a guarantee (i.e. something like a formal Legal Opinion), that's going to cost even more. But it can help you in case the tax authority eventually does come after you.

If you're having a hard time finding lawyers, you can try looking at some website like Legal500 or ask for specific recommendations within your local professional network. Be careful not to spook lawyers by putting all your dodgy stuff in the first email. Let them get to know you a little first. Most law firms won't touch anything that comes at them looking suspicious.

Good legal advice isn't free. You need to formally engage with them and pay them for their time.

If you want a guarantee (i.e. something like a formal Legal Opinion), that's going to cost even more. But it can help you in case the tax authority eventually does come after you.

If you're having a hard time finding lawyers, you can try looking at some website like Legal500 or ask for specific recommendations within your local professional network. Be careful not to spook lawyers by putting all your dodgy stuff in the first email. Let them get to know you a little first. Most law firms won't touch anything that comes at them looking suspicious.

Well that's good to know. I used to describe the situation in the first e-mail. But it's not dodgy or illegal, in fact that's why I was contacting them, so that I don't break any law.

I asked them for a quote for an advice in this situation, not for the advice right away for free. So I don't get what's their problem. I thought they're running a business and want new clients.

There are no CFC inside EEC if the company has substance in the other country. But the country can become tax resident in country A.

As mentioned, to know if country a will consider the company locally tax resident, you'd have to hire local lawyers that can look into local court cases or know how the tax office treats these cases.

As mentioned, to know if country a will consider the company locally tax resident, you'd have to hire local lawyers that can look into local court cases or know how the tax office treats these cases.

Latest Threads

-

Company and Payment Solution for Replica Products

- Started by peoplesdesire

- Replies: 0

-

-

-

-

Discover the Benefits of Joining the OffshoreCorpTalk Forum!

- Started by JohnLocke

- Replies: 2

-

Bank for NM LLC non-resident?

- Started by johanmichel

- Replies: 7

-

-

Hong Kong company: Is a Salary Taxed in Hong Kong or not?

- Started by banafinfodafuggiano

- Replies: 12

-

FOR SALE I will manage the customer service of your e-commerce store Shopify, Woocommerce, Prestashop…

- Started by COLTEO

- Replies: 0

-