You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Public debt of Cyprus and banking crisis

- Thread starter RealDude

- Start date

Hello

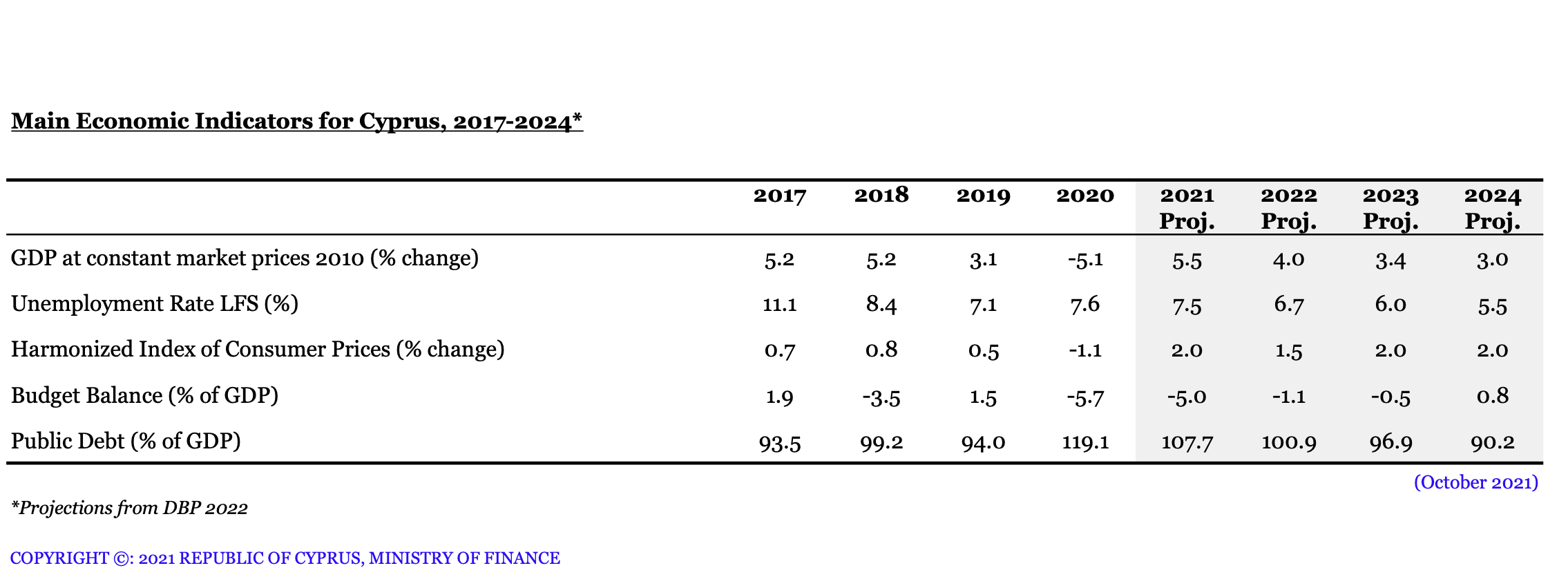

Here is some projections from Ministry of finance shown below. The macroeconomic indicators although display a strenuous position in 2020, substantially due to COVID as big government grants were offered (and still are) to individuals and businesses affected by covid, the Credit rating agencies have maintained a positive outlook for Cyprus with an investment grade rating.

With regards to banking sector substantial amount of NPLs (non performing loans) have been sold by the banks to credit acquiring agencies and their balance sheets have been significantly decompressed and now (Q3 2021) displaying healthy ratios including strong capital and liquidity ratios.

So I would not say that banking sector is currently facing an imminent threat, but on the contrary they enjoy surplus liquidity that want to inject into the market.

Here is some projections from Ministry of finance shown below. The macroeconomic indicators although display a strenuous position in 2020, substantially due to COVID as big government grants were offered (and still are) to individuals and businesses affected by covid, the Credit rating agencies have maintained a positive outlook for Cyprus with an investment grade rating.

With regards to banking sector substantial amount of NPLs (non performing loans) have been sold by the banks to credit acquiring agencies and their balance sheets have been significantly decompressed and now (Q3 2021) displaying healthy ratios including strong capital and liquidity ratios.

So I would not say that banking sector is currently facing an imminent threat, but on the contrary they enjoy surplus liquidity that want to inject into the market.

Your forgetting if Turkey goes into an internal meltdown it might invade just to deflect...the old Weimar Rep. pinzer move.

Are there any new findings?

www.reuters.com

www.reuters.com

Cyprus has never opposed SWIFT ban on Russia -finance minister

Cyprus has not opposed proposals to cut Russia off from the SWIFT global payment system, Cypriot Finance Minister Constantinos Petrides said on Saturday.

French aircraft carrier Charles De Gaulle arrives in Limassol port

Cyprus agrees to close EU airspace to Russian planes

Island life…

www.reuters.com

www.reuters.com

Russia imposes sweeping flight bans on airlines from 36 countries

Russian flights bans hit airlines from 36 countries - aviation authority

Russia has closed its airspace to airlines from 36 countries, including all 27 members of the European Union, in response Ukraine-related sanctions targeting its aviation sector.

Against 36 countries! That says it all. Putin has kicked over a hornet's nest. Now he will get stung badly.

Russian ambassador: Cyprus has shot itself in the foot with flight ban

Russian citizens in Cyprus being threatened, embassy says

ˋthey have been receiving threats, insults and demands to “get out of Cyprus”´„Meanwhile a special repatriation flight carrying Russian and Belarusian citizens to Russia will depart from Larnaca airport at 2.45pm on Friday“

„Due to difficulties with bank card payments, the embassy advises passengers to carry cash for any payments they are required to make.“

Tales from the Coffeeshop: Mother Russia loses her shine in Kyproulla

Latest Threads

-

-

Crypto-friendly Liechtenstein/Swiss banks

- Started by WorldCitizen99

- Replies: 5

-

-

Best Bank Option for a US LLC for International Trading

- Started by Laowei

- Replies: 0

-

Merchant account for POS

- Started by pre3psi

- Replies: 8

-

In which countries you can form a company and get a residency?

- Started by yngmind

- Replies: 8

-

UK Company Ready Made with High Street bank account opened

- Started by AdH

- Replies: 1

-

-