------------

Revolut is dealing with potential money laundering activity

UK neobank Revolut discovered potential money laundering activity on its digital payments system a few months back, according to the Financial Times. It has since informed the National Crime Agency (NCA) and the Financial Conduct Authority (FCA) about the suspected illicit activity. Contacting both regulators about the matter suggests that the severity of the issue is high, as conventionally companies just inform the NCA.

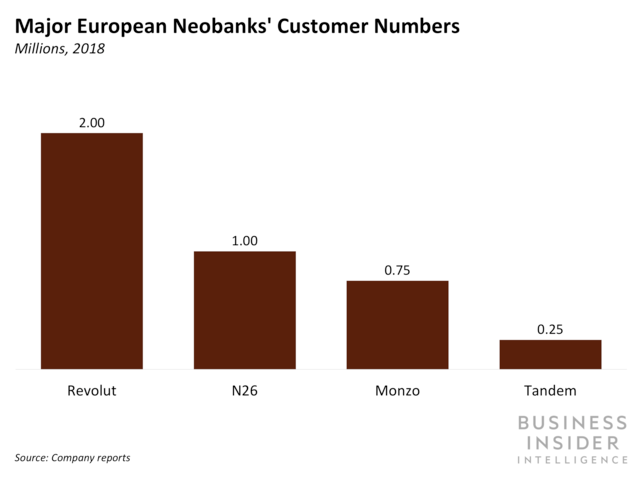

BI Intelligence

Here are two key takeaways from this development:

As such, it would be wise of the neobank to now look into ways it can improve these efforts, so there will be no repeat of this in the future and to reassure regulators and customers. This, in turn, could potentially hamper its expansion plans for the time being.

Revolut is dealing with potential money laundering activity

UK neobank Revolut discovered potential money laundering activity on its digital payments system a few months back, according to the Financial Times. It has since informed the National Crime Agency (NCA) and the Financial Conduct Authority (FCA) about the suspected illicit activity. Contacting both regulators about the matter suggests that the severity of the issue is high, as conventionally companies just inform the NCA.

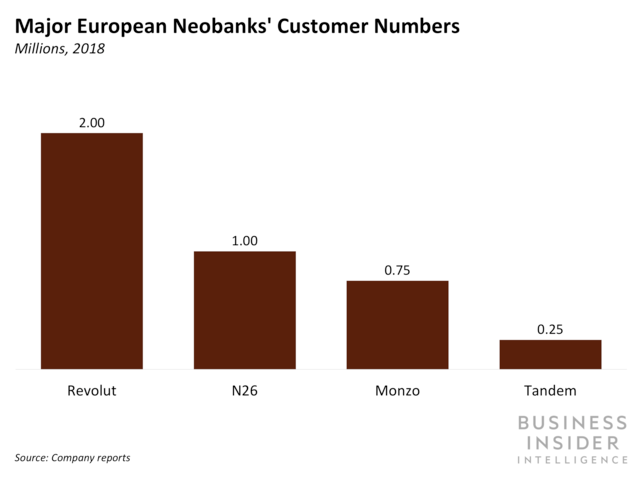

BI Intelligence

Here are two key takeaways from this development:

- Revolut's compliance checks may not be sufficient. People familiar with the matter told the FT that Revolut uses automated compliance checks to allow customers to open accounts within minutes. They explained that these automated checks could leave it vulnerable to illegal activity. Revolut founder Nikolay Storonsky said the company was recently re-authorized under the EU's second payments services directive, and its anti-money laundering controls passed a review from the FCA. However, that money laundering has potentially occurred does call into question whether the checks are enough.

- The neobank's rapid expansion could be eating up resources. Revolut has announced many expansion efforts recently, including plans to move into the US, Canada, Australia, New Zealand, Singapore, Hong Kong, and Japan. Additionally, it expanded its crypto offering earlier this year. These moves are likely taking a toll on the neobank's resources, which could be pulling its focus away from shoring up defenses against financial crime.

As such, it would be wise of the neobank to now look into ways it can improve these efforts, so there will be no repeat of this in the future and to reassure regulators and customers. This, in turn, could potentially hamper its expansion plans for the time being.