There isn't any.

They all have to have Gov based debt on their books, in the case of the US thats levered up-to 45 x (meaning there's 45 claims per Treasury, and the Treasuries underwrite the collateral and the funds -> as the funds are lent into existence) and your bank balance makes up a mere % of the collateral converted into Gov debt that sits on the balance sheet) -> the last bank that had full reserve banking was EuroPacific Bank and the G5 closed that down quickly under dubious reasons (saying AML) but finding no violations, and its offering was 'full reserve banking'.

People believe we live in a fractional reserve banking system, or your funds are lent out to others, this is not how it works.

Technically the only safe bank is the following due to the time it takes to seep through to the system, and the time in which you can react immediately without a counter-party.

- multiple stablecoin(s) (USDC, USDT, DAI etc) which will give you time to move to something else whilst taking a 5-15% haircut. (if you instead opt to keep the funds in the bank you'll be hit nominally via debasement as the banking system is bailed out and the markets sniff it as it unfolds).

Non 'banks' and different 'asset as a store of value' is Bitcoin, Gold of-course, both rise in monetary inflation periods (banking collapse = post collapse re-liquidifying the system) but have volatility during the banking collapse itself.

But when it comes to banks, you are reliant on so many parties and counter parties and of-course clearing houses etc.

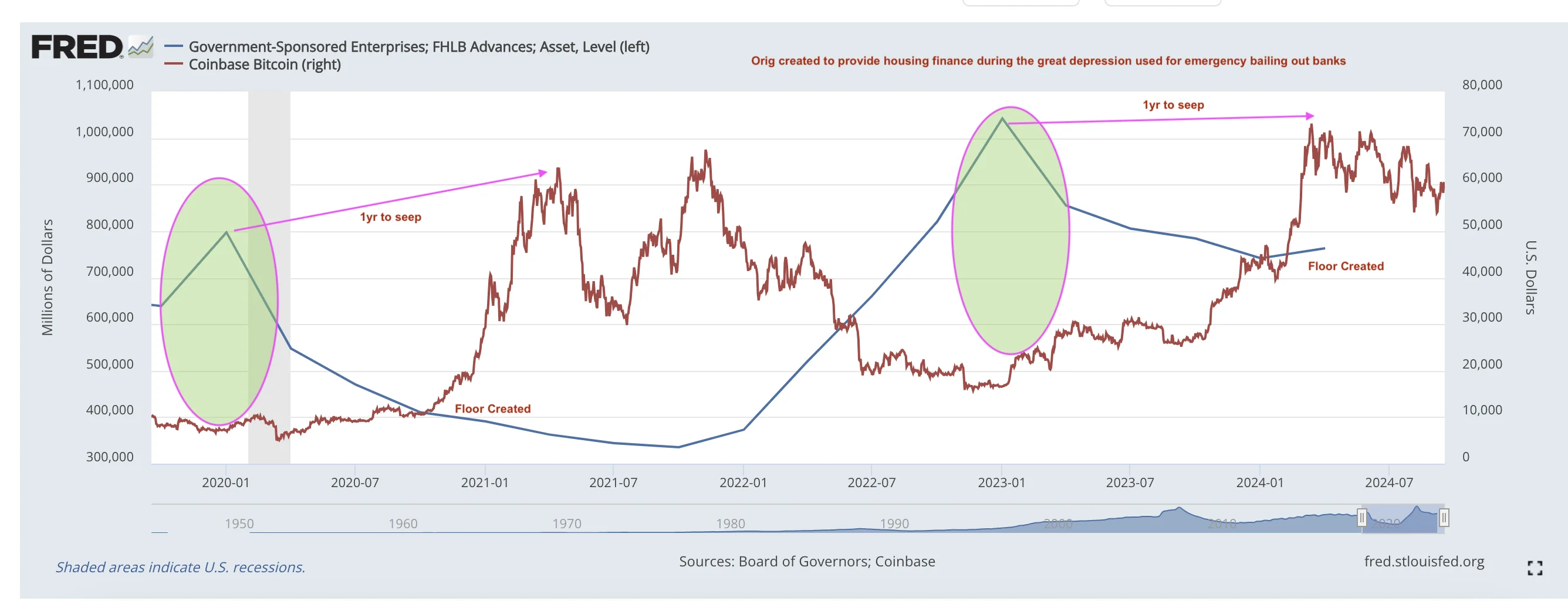

FYI there shouldn't be a banking collapse per-se... the Gov (US) used a prior facility to bail out the banks in 2023, and are using Treasury Fed swap lines for overseas systemic banks currently (UK, Japan, Switzerland tapping into it)

Government-Sponsored Enterprises; FHLB Advances; Asset, Level