Hello!

There seems to be a change of rules for the companies registered in Cyprus starting from December 2022, thus, it makes it a bit unclear for me, so I would hugely appreciate your help and advice.

I want to move my tax residency to Cyprus. I am a software developer from Austria, working as self-employed and mainly contracting for companies in the UK.

Now I would have to register a company in Cyprus as a non-dom and be sure to spend 60 days per annum there. I would be the director and a shareholder. I would need to rent an office (?) and will hire a company to do accounting for me.

This should give a corporate taxe at the rate of 12.5%, the rest of which I am going to distribute to me as dividends afterward under a 0% tax rate if I understand the scheme correctly. Does my personal bank location matter in this case? Austria or Cyprus?

Please correct me I am wrong somewhere.

Now another question is whether this scheme still holds true or are there any changes coming up to this by the end of the year?

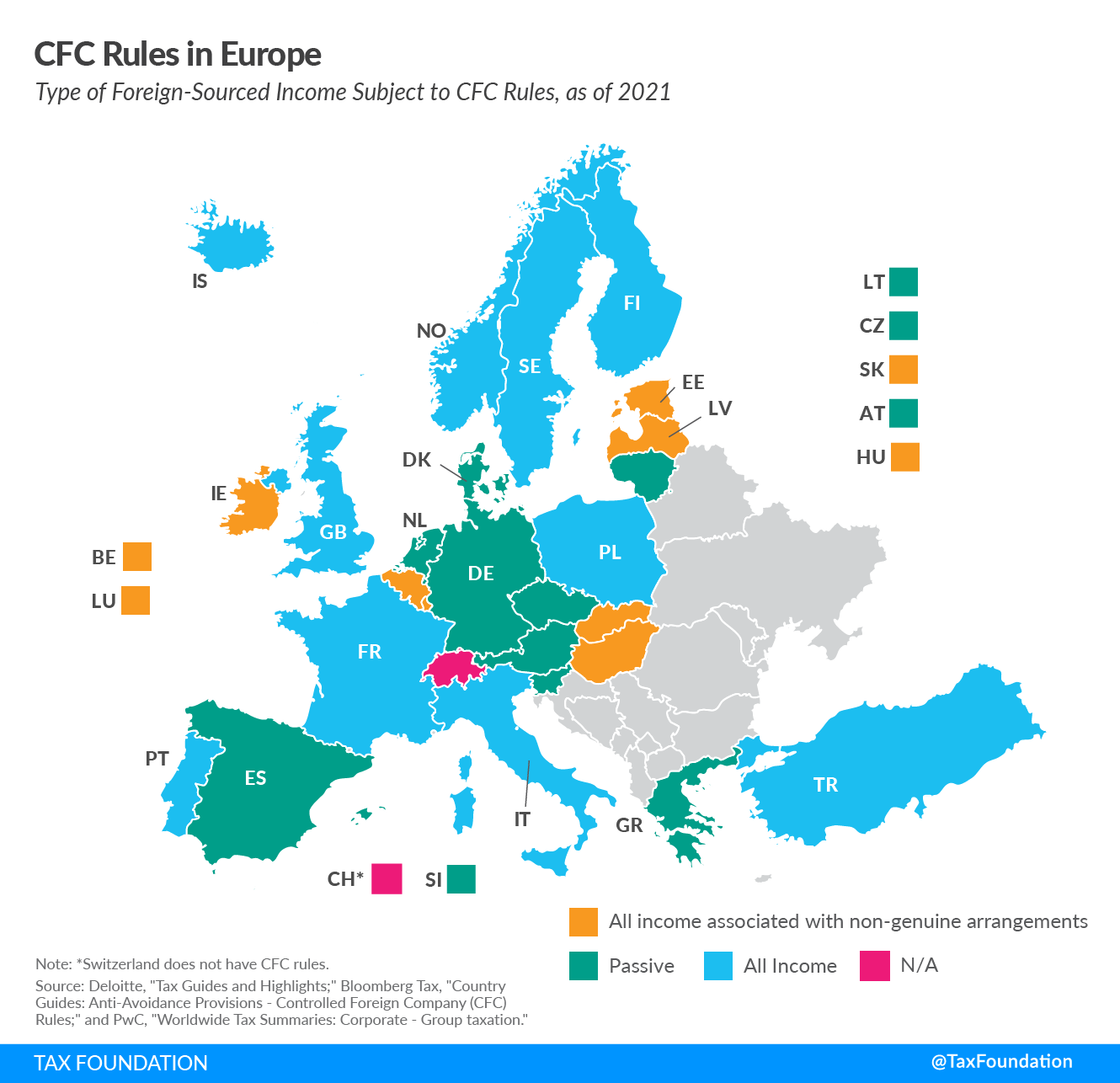

Moreover, in case I won't move out of Austria, will only my dividends be taxed at a rate that sets the Austrian government, or company income as well per Austrian rate too?

Does this mean that to have these sweet low tax rates I would have to move to Cyprus for at least 60 days per annum and then make sure I don't spend more than 183 days in Austria so that I don't get tax residency of Austria once again?

And if I eventually decide to stay all the time at Cyprus, does that mean that after 17 years or so, is my tax rate going to be greater? Considering that I am still going to be working as a software developer through my LTD in Cyprus and pay myself dividends.

Thank you in advance.

There seems to be a change of rules for the companies registered in Cyprus starting from December 2022, thus, it makes it a bit unclear for me, so I would hugely appreciate your help and advice.

I want to move my tax residency to Cyprus. I am a software developer from Austria, working as self-employed and mainly contracting for companies in the UK.

Now I would have to register a company in Cyprus as a non-dom and be sure to spend 60 days per annum there. I would be the director and a shareholder. I would need to rent an office (?) and will hire a company to do accounting for me.

This should give a corporate taxe at the rate of 12.5%, the rest of which I am going to distribute to me as dividends afterward under a 0% tax rate if I understand the scheme correctly. Does my personal bank location matter in this case? Austria or Cyprus?

Please correct me I am wrong somewhere.

Now another question is whether this scheme still holds true or are there any changes coming up to this by the end of the year?

Moreover, in case I won't move out of Austria, will only my dividends be taxed at a rate that sets the Austrian government, or company income as well per Austrian rate too?

Does this mean that to have these sweet low tax rates I would have to move to Cyprus for at least 60 days per annum and then make sure I don't spend more than 183 days in Austria so that I don't get tax residency of Austria once again?

And if I eventually decide to stay all the time at Cyprus, does that mean that after 17 years or so, is my tax rate going to be greater? Considering that I am still going to be working as a software developer through my LTD in Cyprus and pay myself dividends.

Thank you in advance.