Hello,

One of my client is considering this schema.

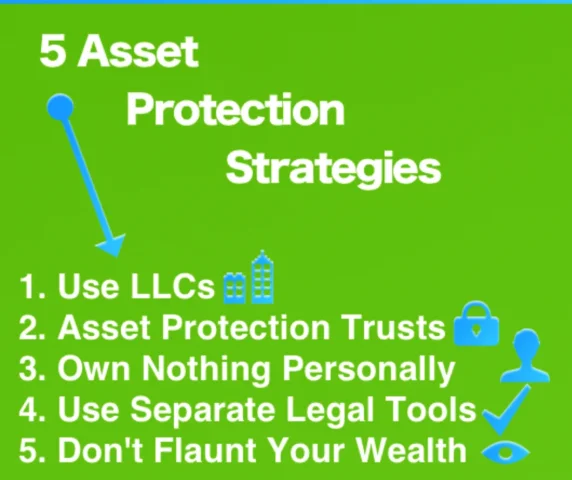

Setup a Trust or Fondation (for example Panama) somewhere, move inside all stocks, assets and create a new LLC (which will be owned by the Trust).

1.- Where to register a cheap / safe trust?

2.- Do the owner of the trust need to report it to his national taxation office?

3.- It is dangerous to let people know you own a trust or you can even tell this so that anyone will forget the idea to take you to Court?

The aim is ONLY for Assets protections. Taxes will be paid in Europe where the Directors will also get salaries etc.

Thanks!

One of my client is considering this schema.

Setup a Trust or Fondation (for example Panama) somewhere, move inside all stocks, assets and create a new LLC (which will be owned by the Trust).

1.- Where to register a cheap / safe trust?

2.- Do the owner of the trust need to report it to his national taxation office?

3.- It is dangerous to let people know you own a trust or you can even tell this so that anyone will forget the idea to take you to Court?

The aim is ONLY for Assets protections. Taxes will be paid in Europe where the Directors will also get salaries etc.

Thanks!

Attachments

Last edited:

what a sentence - I like

what a sentence - I like