Hello guys. As a Maltese resident (Italian Citizen), opening and using a company in Cyprus (nominee director and secretary) + local address provided by the lawyer's office, can it be problems for the place of management rules? All board meetings will take place in Cyprus. And if it can help, at least once every couple of months I can go to Cyprus. Could Malta cause problems? Thank you.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Residence in Malta, Company in Cyprus

- Thread starter MarkusCostigan

- Start date

-

- Tags

- cyprus cyprus company malta poem

Why not just form two companies in Malta and enjoy 5% corporate tax?

If you form a company in Cyprus while controlling it from Malta, that company is at risk of becoming tax resident in Malta and liable for 35% corporate tax. Malta isn't exactly spending a lot of time and effort to look into these matters, so you'd probably be fine only paying Cypriot corporate tax. Especially if you go to Cyprus for board meetings.

But it just seems a little pointless when you have a completely legitimate option available to you with lower tax. Corporate tax in Cyprus is 12.5%, while you can achieve 5% in Malta.

If you form a company in Cyprus while controlling it from Malta, that company is at risk of becoming tax resident in Malta and liable for 35% corporate tax. Malta isn't exactly spending a lot of time and effort to look into these matters, so you'd probably be fine only paying Cypriot corporate tax. Especially if you go to Cyprus for board meetings.

But it just seems a little pointless when you have a completely legitimate option available to you with lower tax. Corporate tax in Cyprus is 12.5%, while you can achieve 5% in Malta.

Get your self sorted out in Malta as already suggested and enjoy 5% corporate tax. It's worth to speak with an professional there for the setup.

If you form a company in Cyprus while controlling it from Malta, that company is at risk of becoming tax resident in Malta and liable for 35% corporate tax

This is completely wrong.

@MarkusCostigan read about the benefit non domiciled resident companies and why you should manage your Cyprus company from Malta.

https://www.offshorecorptalk.com/th...as-a-self-sufficient-malta.37240/#post-211942

I'll have to immediately notify the two leading Maltese law firms I recently had a discussion about this with. Thanks, @marzio!This is completely wrong.

By any chance, did you notice I used the wording "is at risk of"? I just want to double check before I tell these lawyers that they're wrong and marzio is the new go-to person for Maltese tax law.

I'll have to immediately notify the two leading Maltese law firms I recently had a discussion about this with. Thanks, @marzio!

No worries, i'm always glad to be helpful.

I just want to double check before I tell these lawyers that they're wrong and marzio is the new go-to person for Maltese tax law.

Yes please, it's very risky to be wrong about tax matters.

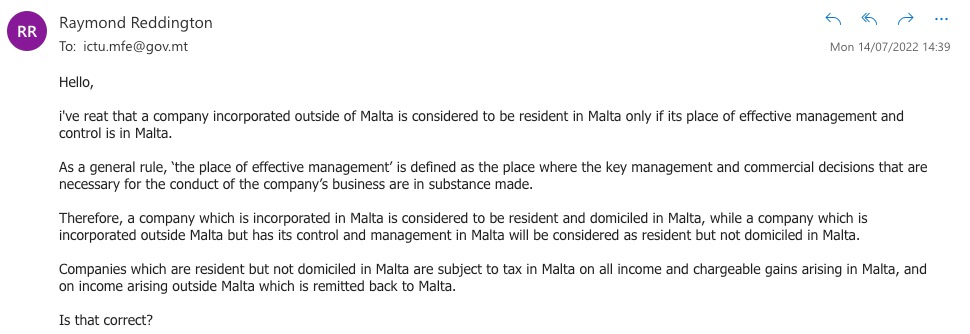

And BTW i emailed this very question to the maltese office of the Commissioner for Revenue just to see what the answer would be.

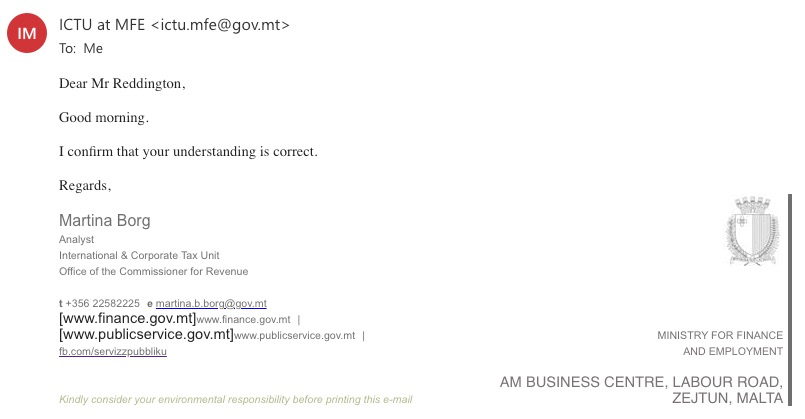

And here's the answer they gave me

Also @CyprusLawyer101 said in another thread that he implemented the same setupt we are talking about here with 0% tax.

Now i'm curious to know why two of the leading maltese firms say that this is not possibile and the only reason that comes to mind is that they earn more with a maltese setup.

Last edited:

Indeed, which is why it's risky to provide definite answers without assessing the full scope.Yes please, it's very risky to be wrong about tax matters.

That's very promising and can be used as guidance when setting up a structure. What you have here isn't a ruling, though. My caution stems from having seen a lot of tax structures blow up because people drew conclusions and made assumptions without firm basis (i.e. legal opinions, official rulings, and other things you can take to a court if you ever have to).And BTW i emailed this very question to the maltese of office of the Commissioner for Revenue just to see what the answer would be.

And here's the answer they gave me

I have seen one specific case where someone had asked a tax authority some generic, leading questions and later got prosecuted. The actual structure was different than how it was portrayed in the questions. That wasn't in Malta, though. But it's one of many reasons I stay away from definite statements.

I did not write that they had said it wasn't possible. I trust @CyprusLawyer101 more than Maltese lawyers when it comes to setting up a structure which would be lawful and deprive Maltese lawyers of billable hours. But I would make sure to get the specific structure checked.Now i'm curious to know why two of the leading maltese firms say that this is not possibile and the only reason that comes to mind is that they earn more with a maltese setup.

But it's one of many reasons I stay away from definite statements

I understand but in this case the question is very narrow plus we got a positive feedback from the field so if i was in @MarkusCostigan i would contact @CyprusLawyer101 to get help about this setup as he already did it and understands what needs to be done.

Why not just form two companies in Malta and enjoy 5% corporate tax?

If you form a company in Cyprus while controlling it from Malta, that company is at risk of becoming tax resident in Malta and liable for 35% corporate tax. Malta isn't exactly spending a lot of time and effort to look into these matters, so you'd probably be fine only paying Cypriot corporate tax. Especially if you go to Cyprus for board meetings.

But it just seems a little pointless when you have a completely legitimate option available to you with lower tax. Corporate tax in Cyprus is 12.5%, while you can achieve 5% in Malta.

Thank you for the answers. Being a 'self sufficient' resident in Malta I could not work, in fact, with this type of residence you do not even have a social security number (you need private insurance). If both director and secretary are nominee in Malta can it work?

Self sufficient: may apply for residence in Malta on the basis that they are economically self-sufficient by proving that they are able to support their lifestyle without the need to work in Malta either because they have significant savings or they are in receipt of some form of income (such as a pension).

If I open a company in Malta even with a nominee director and secretary, should I pay for social security?

Last edited:

Would this work the other way around as well?This is completely wrong.

@MarkusCostigan read about the benefit non domiciled resident companies and why you should manage your Cyprus company from Malta.

https://www.offshorecorptalk.com/th...as-a-self-sufficient-malta.37240/#post-211942

Let's say you are tax resident in Cyprus and you incorporate a company in Malta and have a resident non domiciled company from Cyprus?

Would this work the other way around as well?

Nope, this is specific to Malta.

Pretty cool however most people probably don't want to live in MaltaNope, this is specific to Malta.

Pretty cool however most people probably don't want to live in Malta

The article says that the company needs to be managed from Malta but it doesn't say that the company needs to be managed by the shareholder resident in Malta.

Maybe @CyprusLawyer101 could chime in and tell us if my speculation about hiring a maltese director fo manage a resident non domiciled company is accepted.

Hello Marzio,The article says that the company needs to be managed from Malta but it doesn't say that the company needs to be managed by the shareholder resident in Malta.

Maybe @CyprusLawyer101 could chime in and tell us if my speculation about hiring a maltese director fo manage a resident non domiciled company is accepted.

I guess you should be able to appoint someone else locally. If someone is of true interest I can find out.

1. Are there any filing requirements if you don't have Malta sourced income?

2. Is income the company makes while the management is staying in Malta considered Malta sourced?

I guess we need a precise definition of "income arising in Malta".

2. Is income the company makes while the management is staying in Malta considered Malta sourced?

I guess we need a precise definition of "income arising in Malta".

1. They follow a specific tax accounting system so It should be reportable;1. Are there any filing requirements if you don't have Malta sourced income?

2. Is income the company makes while the management is staying in Malta considered Malta sourced?

I guess we need a precise definition of "income arising in Malta".

2. No , malta source = it must arise from Malta sources like immovable property , or sales in the local markets etc.

What is your type of income and where does it arises from ?

What about VAT registration of a non-dom foreign company in Malta?

I guess since it's tax resident in Malta it sould be possible to register as a VAT payer.

Question about the Maltese corporate resident/non-domiciled regime:

Would it be possible to set up a foreign company somewhere (in the UK, Gibraltar, BVI maybe?), appoint a Maltese nominee director and register it as resident, non-domiciled in Malta in order to get a tax ID + tax certificate?

What would be the setup/running costs for this excluding company formation/registered fees (as I haven't defined a specific country on purpose)?

Would it be possible to set up a foreign company somewhere (in the UK, Gibraltar, BVI maybe?), appoint a Maltese nominee director and register it as resident, non-domiciled in Malta in order to get a tax ID + tax certificate?

What would be the setup/running costs for this excluding company formation/registered fees (as I haven't defined a specific country on purpose)?

Would it be possible to set up a foreign company somewhere (UK, Gibraltar, BVI maybe?), appoint a Maltese nominee director and register it as resident, non-domiciled in Malta in order to get a tax ID + tax certificate?

What would be the setup/running costs for this excluding company formation/registered fees (as I haven't defined a specific country on purpose)?

This is really a good question and i guess the only way to know is to contact a maltese firm and ask.

Latest Threads

-

-

Plutus.it CEO is on Coffeezilla's 2nd channel.

- Started by diatessaron

- Replies: 0

-

Paying freelancers in crypto: accounting compliance

- Started by 2125432

- Replies: 4

-

Argentina halts banknote printing as Milei turns to Chinese suppliers

- Started by Martin Everson

- Replies: 0

-

Argentina's Milei fires foreign minister for opposing US embargo on Cuba

- Started by Martin Everson

- Replies: 0