„Bank of the Censorship“ – Kunden-Aufstand bei Bunq | FinanceFWD

(English Translation)

----------

"Bank of the Censorship" - customer uprising at Bunq

The banking startup Bunq is actually known for its close contact with its own customers. Now there are allegations that the company is deleting critical contributions. The community is upset.

Bunq wanted to do everything right: Together - that's the name of the company's forum, which offers a banking app with a credit card. "Together", users from the Bunq community should discuss which feature they would like to see next, but also what is going wrong. When the startup presents a new app version, it stages the Dutch fintech as an event. The company does not communicate how many customers Bunq has, according to the estimation tool Priori Data, the app has a total of around 1.6 million downloads. Since its launch in 2015, the smartphone bank has been a company that binds its users particularly closely - and the search for contacts has been well received by customers in the past.

This affects not only the Together forum, but also

posts on Reddit . Bunq employees are also said to have removed critical posts from the social network. Until other moderators who do not work for the company intervened. The former fans express their disappointment through various channels such as Facebook, Reddit and in a telegram group - and are considering changing banks. It is a lesson in how a fintech with many fans is squandering its lead.

An app update as a point of contention

Bunq - which has 1.6 million

downloads - had announced the app update big, the expectations of the community were correspondingly high. V3, the third version, was officially launched at the end of May. A handful of particularly interested customers can test the beta version, Finance Forward has also been given access. But the feedback from the community was critical. Above all, a technical detail excited the minds: In the beta version, the company integrates the Instagram feed from Bunq. This not only disrupted optically, but also violated the EU General Data Protection Regulation (GDPR), wrote a user. By integrating the social network, the group receives user data behind it - without the corresponding consent of Bunq customers.

Leipzig IT lawyer Peter Hense also shares this assessment. The integration of Instagram enables Facebook to link the data collected about Bunq users with their own data. "Since Facebook also provides data for third-party credit checks, this is a very bad situation for those affected and a wake-up call for the authorities to ensure that the bank maintains orderly data protection laws," says Hense. Bunq claims, however, that the Instagram integration is legal

. "Bunq always adheres to all rules and regulations, and the Instagram function will be no different," said a spokesman when asked by Finance Forward.

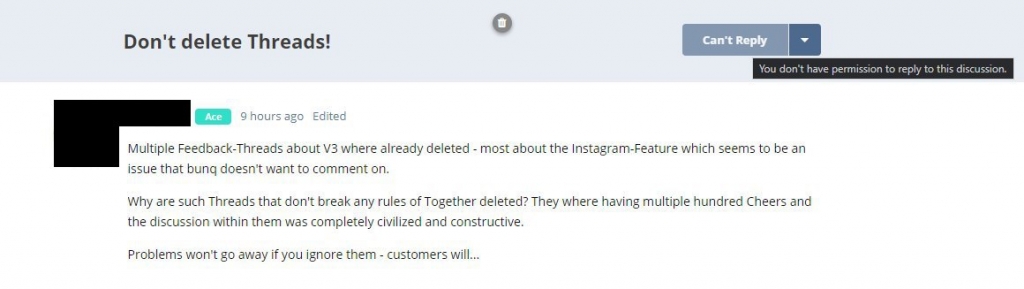

Since the new version of the app is still in beta, users had expected Bunq to respond to the inquiries and criticism, as in the past. But in the company's forum, corresponding discussions on Instagram were deleted instead, screenshots are available for Finance Forward. Two contributions were particularly popular - and can no longer be found.

"We want to make for a fun and safe place"

The community didn't give up. In the forum, they asked the startup about the deleted articles. These questions were also deleted. Several users also report to Finance Forward that their accounts in the discussion forum have been completely blocked.

The forum will be moderated, Bunq says on request, that is common. “We want to provide a fun and safe place where everyone feels welcome to share their thoughts. Unfortunately, sometimes people cannot hold back and repeatedly violate our forum guidelines. In the interests of everyone, we blocked their access to the forum, ”writes a spokesman. He does not deal more specifically with questions about the deletions of the contributions.

A user complained about the deletion of comments on the Instagram function - and was blocked.

Meanwhile , there was also conflict in the

Reddit forum on Bunq . Until a few days ago, Bunq employees had moderation rights for the forum. Sums are said to have been deleted here too, users of the forum complain in a post that they have called “Bank of the Censorship”. However, when this was revealed, the Bunq employees were removed as moderators. "It would not be surprising if posts were removed," the spokesman said on request. This is the case if users have posted posts comparable to those in the Bunq forum.

The users are still waiting for an official answer to the question of the legal position of Instagram integration, which they address in the various Telegram and Facebook groups. There is no response from Bunq, neither in the Together forum nor on Reddit. At the request of Finance Forward, the company said on Friday: "Bunq always adheres to all rules and regulations, and the Instagram function will be no different."

There is a need to catch up not only in customer communication

On Saturday, the embedding of the Instagram posts in the beta version of the app was first removed and reinserted in a different design a short time later. A data query shows that the app no longer embeds the images, meaning that no data is passed on to Instagram. Instead, they are now apparently inserted manually and only link to Instagram, which actually complies with the GDPR. So Bunq responded to the criticism.

In the meantime, the disappointed news of loyal customers, who are now considering switching to another bank, are increasing. They are bothered by the lack of communication through Bunq and the sovereign handling of criticism. Competitors such as N26, Tomorrow and the DKB - but also

Fintech Vivid ,

which was launched a few days ago - are already being discussed as possible successors in the Telegram group .

The company does not only have some catching up to do when it comes to customer communication. The data protection problems with Instagram are "just the icing on the cake," says Peter Hense. "Even the data protection information that can be displayed when installing the app is non-transparent, incomplete and therefore illegal," is the IT lawyer’s verdict.

-----------

. It's literally like a child designed it compared to how the old one looked in V2 with actual pictures of cards and ability to scroll back and forth and freeze and unfreeze cards.

. It's literally like a child designed it compared to how the old one looked in V2 with actual pictures of cards and ability to scroll back and forth and freeze and unfreeze cards. .

. .

. . It's literally like a child designed it compared to how the old one looked in V2 with actual pictures of cards and ability to scroll back and forth and freeze and unfreeze cards.

. It's literally like a child designed it compared to how the old one looked in V2 with actual pictures of cards and ability to scroll back and forth and freeze and unfreeze cards. .

.