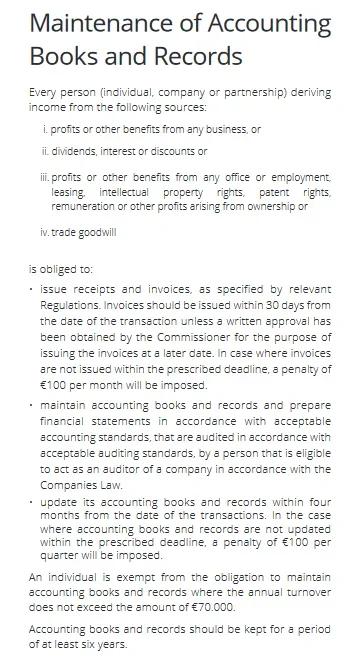

Cyprus tax authority requires private persons to maintain accounting books and records, if one's turnover exceeds 70K EUR. Does anyone have first-hand experience about fulfilling this rule? Do I just need to contact a bookkeeper to check my online brokers' accounts and prepare a report?

I recently moved to Cyprus and have capital gains from outside Cyprus, exceeding the above figure. Zero income from Cyprus. I'd like to keep things as low-key as possible, without breaking the law. I am not yet a tax resident, but as far as I understand, if I apply for a tax number, I'll need to have audited books also for this tax year.

(The Cyprus tax forum is very quiet, so I'll posted my question here instead. I hope nobody takes offence.)

I recently moved to Cyprus and have capital gains from outside Cyprus, exceeding the above figure. Zero income from Cyprus. I'd like to keep things as low-key as possible, without breaking the law. I am not yet a tax resident, but as far as I understand, if I apply for a tax number, I'll need to have audited books also for this tax year.

(The Cyprus tax forum is very quiet, so I'll posted my question here instead. I hope nobody takes offence.)