Hello,

I have an offshore company in hong kong,

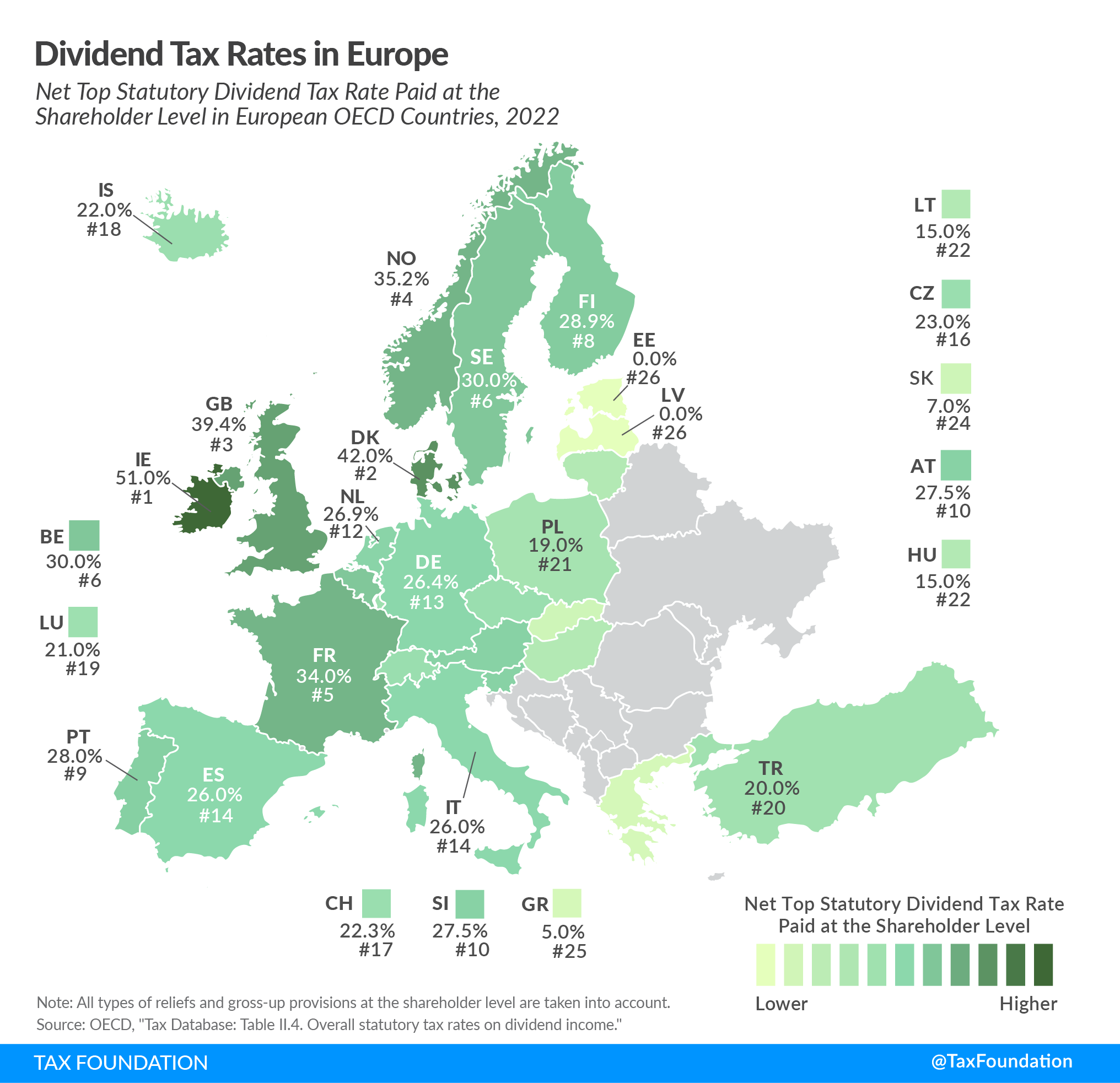

I am considering to take a secondary residence in a "tax heaven" jurisdiction,

I am considering to take it on Czech republic because it doesn't look hard to take and expensive,

And since i want to stay closer to Europe i think this is the best place,

What would you guys suggest me ?

I have an offshore company in hong kong,

I am considering to take a secondary residence in a "tax heaven" jurisdiction,

I am considering to take it on Czech republic because it doesn't look hard to take and expensive,

And since i want to stay closer to Europe i think this is the best place,

What would you guys suggest me ?