Australia seems to be a real sh1th0le, huh?Yes from Thailand and then they contacted him about his potential taxes as they knew where he was based

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thailand 0% tax

- Thread starter yngmind

- Start date

Thailand wants to be a member of the OECD. And what are the criteria for joining...

Quote: According to Mr Prommin, for a country to become an OECD member, it must have (1) open, transparent and free-market economies and political freedom, (2) safety and good governance, (3) strong rule of law, (4) a quality education system, and (5) environmental sustainability.

https://www.bangkokpost.com/business/general/2777899/thailand-begins-oecd-membership-process

Quote: According to Mr Prommin, for a country to become an OECD member, it must have (1) open, transparent and free-market economies and political freedom, (2) safety and good governance, (3) strong rule of law, (4) a quality education system, and (5) environmental sustainability.

https://www.bangkokpost.com/business/general/2777899/thailand-begins-oecd-membership-process

Wet dream.Thailand wants to be a member of the OECD. And what are the criteria for joining...

Quote: According to Mr Prommin, for a country to become an OECD member, it must have (1) open, transparent and free-market economies and political freedom, (2) safety and good governance, (3) strong rule of law, (4) a quality education system, and (5) environmental sustainability.

Thailand wants to be a member of the OECD. And what are the criteria for joining...

Quote: According to Mr Prommin, for a country to become an OECD member, it must have (1) open, transparent and free-market economies and political freedom, (2) safety and good governance, (3) strong rule of law, (4) a quality education system, and (5) environmental sustainability.

Thailand has 0 of the 5 points required lol

And good luck changing thatThailand has 0 of the 5 points required lol

I've got a associate/friend, multi-PhD high up within the Gov-adjunct cross over to-Navy been trying to get me to move there for five years due to my skillset he observed in the private sector (AI Military Application) - fast track residency/citz.Australia seems to be a real sh1th0le, huh?

I've always been hesitant, mainly because i've had enough of Western society.

But as each year passes my decision and reinforced position remains.

He came here recently, and kept on trying to steer the discussion that way, in the end i laid out standard of living, lifestyle, health, environment, costs, and self-control of environment (wealth/etc), surveillance (lack-off) etc and he couldn't put up a counter argument, like i said at the end, if i wanted to join a prison-cum-debt-camp, i'd head to the UK.

For me, Asia, South America, Africa, Middle East suit me fine.

Thailand has 0 of the 5 points required lol

Looking forward to the next coup and roll back of CRS.

One thing you have to understand, EUROPEANS/SWISS actually are required to register with their embassy where they live abroad when outside of the EU as i understand based on my discussions with friends/neighbours, i balked at the idea, and in some cases they even have to file taxes....Yes from Thailand and then they contacted him about his potential taxes as they knew where he was based

UK / and i guess Australia (at a time) don't give a s**t, having said that they've now enabled voting for those outside of the UK for more than 5 yrs and i am guessing this is a prelude towards introducing some sort of World Wide Tax... -> but in this case thats why Australia didn't know where he was, they were going through CRS information (HK) for his bank but he never bothered to update it to Thailand as he has the right to reside in HK due to the period he was there etc.

But the wealth he earned whilst living but not working in HK (Flew around the world as a specialist) was tax free there, and when he moved to Thailand it was tax free remittance (changed this year).

So he didn't need to file anything but Australia were notified under CRS i suppose, the wealth he had in HK and started digging to see if they could get their claws in, now he's been retired 10 yrs so perhaps now yes, but at the time certainly not based on what he was saying.

He's about to sell his home 10m$ -> and buy bullion for the bulk - said he can't trust Australian banks, if war breaks out in China his wealth would be seized, and in Thailand he doesn't (probably right) trust the banking system.

Probably has 10-30 yrs left (had skin cancer twice)

Last edited:

yes that has been evidenced and broadcasted since 2020, worldwide and in high definition .Australia seems to be a real sh1th0le, huh?

its a good way to keep on friendly terms with the oecd fatf terrorist gang. However 0 chance for that happening, including all of southeast asia ex singapore.Thailand wants to be a member of the OECD. And what are the criteria for joining...

Quote: According to Mr Prommin, for a country to become an OECD member, it must have (1) open, transparent and free-market economies and political freedom, (2) safety and good governance, (3) strong rule of law, (4) a quality education system, and (5) environmental sustainability.

https://www.bangkokpost.com/business/general/2777899/thailand-begins-oecd-membership-process

The oecd gang is really nasty these days and are pushing the poor ones around quite a lot more than before.

Obviously we have other friends and one Canadian has a trust, that pays him out the profits annually...

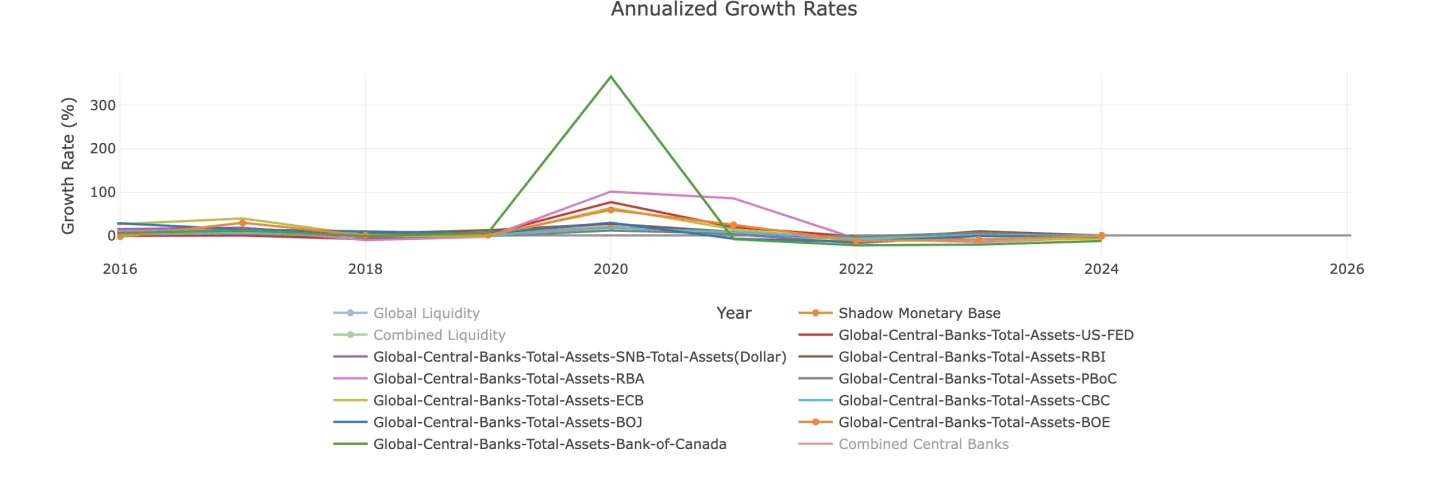

Seen the news recently 67% tax on profits, whilst they debase the currency, note debasement isn't just represented by inflation, inflation is variable goods increase, debasement is best observed/represented by how fixed assets appreciate and can be calculated by looking at CB Balance sheets..

So he's getting fucked from both sides, the inflation + debasement, and can't withdraw the funds from the trust due to the rules his mother placed on them (she didn't like his wife so did a trust).

So i kinda get why he doesn't want to keep his wealth in Australia.... as he may get restricted to a small amount of expenditure annually.

https://www.wnd.com/2023/05/u-s-may-freeze-bank-withdrawals-currency-fear-rises-expert-warns/

-> Glad my exposure to 'Western Financial System EURGBPUSD..etc' is now very very low and decreasing rapidly.

Seen the news recently 67% tax on profits, whilst they debase the currency, note debasement isn't just represented by inflation, inflation is variable goods increase, debasement is best observed/represented by how fixed assets appreciate and can be calculated by looking at CB Balance sheets..

So he's getting fucked from both sides, the inflation + debasement, and can't withdraw the funds from the trust due to the rules his mother placed on them (she didn't like his wife so did a trust).

So i kinda get why he doesn't want to keep his wealth in Australia.... as he may get restricted to a small amount of expenditure annually.

Reinforcing (Western Approach)he may get restricted to a small amount of expenditure annually.

https://www.wnd.com/2023/05/u-s-may-freeze-bank-withdrawals-currency-fear-rises-expert-warns/

-> Glad my exposure to 'Western Financial System EURGBPUSD..etc' is now very very low and decreasing rapidly.

Attachments

Last edited:

#Biiingooooooooooi laid out standard of living, lifestyle, health, environment, costs, and self-control of environment (wealth/etc), surveillance (lack-off) etc and he couldn't put up a counter argument, like i said at the end, if i wanted to join a prison-cum-debt-camp, i'd head to the UK.

For me, Asia, South America, Africa, Middle East suit me fine.

I wrote something along these lines here agreeing 100% with & reinforcing @TheCryptoAnt 's statement : Inexpensive Citizenship and Tax Residence Options For Indian Freelancer

This hit me like a sledgehammer! I've been experiencing this in the West. F******ck!Reinforcing (Western Approach)

https://www.wnd.com/2023/05/u-s-may-freeze-bank-withdrawals-currency-fear-rises-expert-warns/

When you see one of the most ‘famous’ French business/investor YouTuber (he is living in BKK since few years), talking with a real agency owner in BKK (sorry it’s in french, from 1h.01min) that :

"If you are owner of some flats in Thailand, and you don’t rent them with a contract of 3years+ (so by making lease agreement for 1 or 2 years for exemple) then you don’t need the register the rental agreement, either to pay the 12.5% flat tax on rental income (and also not the progressive income tax on it..), if you ask the tenant to send the money abroad."

Loophole again or classic tax evasion ?

"If you are owner of some flats in Thailand, and you don’t rent them with a contract of 3years+ (so by making lease agreement for 1 or 2 years for exemple) then you don’t need the register the rental agreement, either to pay the 12.5% flat tax on rental income (and also not the progressive income tax on it..), if you ask the tenant to send the money abroad."

Loophole again or classic tax evasion ?

is this still valid? I heard that Elite visa is been taxed now, and soon will be taxed with the worlwide income.So you pay roughly 17K euro one off in taxes and don't have to worry about it again as long as you don't do local business. WAOW.

thanks for your story @wellington and @Fred - I enjoyed reading your replies here.

Also: If one gets Elite, or LTR, will it be tax free really or PE will still be an issue?

Something like that?? or I understood wrong ?Seems fine then.

When i was 'working' even in country, you'd have a salary upto 150,000 THB (decade ago) 10% increase x 2 each year, and taxes paid for, then your real meaty salary would be done overseas as a consultant servicing a overseas company from a company you owed.

@offsiteguy @unth72 did you find anything ?I’d suggest to consult big firms like KPMG, BDO, Grand Thorntons etc, all is very tricky, you subject to 35% tax but I’m not sure, please check with serious high level companies.

Also do you have a work permit?

Thank you

@offsiteguy @unth72 did you find anything ?I’d suggest to consult big firms like KPMG, BDO, Grand Thorntons etc, all is very tricky, you subject to 35% tax but I’m not sure, please check with serious high level companies.

Also do you have a work permit?

Thank you

Are you sure about this? today i met one of the "famous" accountants in BKK and he told me that is considered as CT /PE (tech. company outside thailand, owned by Thai resident (shareholder only). Even if there is director etc, they check the UBO and prove that is yours and you have to get tax as local company. Is this the case? In this case one more reason to leave asap.Because the company is managed from Thailand, in theory, you're liable for the CT.

If you hire a director from another country, then it's not managed from Thailand; just don't remit the money to Thailand if you're a tax resident, then it's a completely legal tax-free structure.

Also, as I'm on owned company business visa & wp here, he proposed to invoice from the thai company to the offshore that the offshore is paying the local company to provide me; that will "reason" and invalidate the PE. But I believe the opposite. That if I invoice from one to the other (thai company to pay the offshore to provide me) then this might really create a PE as the offshore will be actually doing business in Thailand (now there is nothing related with thailand, the offshore is doing business in other countries, never remitting here those money).

What do you think?

Last edited:

who is a "famous" accountant? Share a name.is this still valid? I heard that Elite visa is been taxed now, and soon will be taxed with the worlwide income.

Also: If one gets Elite, or LTR, will it be tax free really or PE will still be an issue?

Something like that?? or I understood wrong ?

@offsiteguy @unth72 did you find anything ?

@offsiteguy @unth72 did you find anything ?

Are you sure about this? today i met one of the "famous" accountants in BKK and he told me that is considered as CT /PE (tech. company outside thailand, owned by Thai resident (shareholder only). Even if there is director etc, they check the UBO and prove that is yours and you have to get tax as local company. Is this the case? In this case one more reason to leave asap.

Also, as I'm on owned company business visa & wp here, he proposed to invoice from the thai company to the offshore that the offshore is paying the local company to provide me; that will "reason" and invalidate the PE. But I believe the opposite. That if I invoice from one to the other (thai company to pay the offshore to provide me) then this might really create a PE as the offshore will be actually doing business in Thailand (now there is nothing related with thailand, the offshore is doing business in other countries, never remitting here those money).

What do you think?

Theres is no better client than a rich scared foreigner.

.

Agree with you. I want to be typical and on the safe side. Is one of the many tax advisors you see around this period. That’s why I say “famous”, I don’t think he is really though. I’d appreciate it if you can share your opinionwho is a "famous" accountant? Share a name.

Theres is no better client than a rich scared foreigner.

.

who is a "famous" accountant? Share a name.

Theres is no better client than a rich scared foreigner.

You ain't kidding! F*ck! Foreigners get exploited by accountants & lawyers ALL the time!

for me to share opinion, you must provide the name of that person so we can look him up online on youtube etc.Agree with you. I want to be typical and on the safe side. Is one of the many tax advisors you see around this period. That’s why I say “famous”, I don’t think he is really though. I’d appreciate it if you can share your opinion

id say youre on the safe side if no one knows your private affairs.

After 20 years in Thailand I can confidently say the Thai government have no ability in any way to tax your overseas companies if they do not trade in Thailand. Any lawyer or accountant who says otherwise is fleecing you.

Yes and I’m very concerned; it’s not the ability is if I’m obliged to be taxed or no as this income never gets into Thailand. If I’m obliged to be taxed then I’ll leave asap but no one can give a straight forward answer.After 20 years in Thailand I can confidently say the Thai government have no ability in any way to tax your overseas companies if they do not trade in Thailand. Any lawyer or accountant who says otherwise is fleecing you.

Yes and I’m very concerned; it’s not the ability is if I’m obliged to be taxed or no as this income never gets into Thailand. If I’m obliged to be taxed then I’ll leave asap but no one can give a straight forward answer.

Yeah, but it is the ability, the de facto situation on the ground, that matters in most of the world. Whether you are obliged or not is very often not clear, and sure you can pay local lawyers who will be happy to take your money and give some seemingly smart answer that will contradict what seemingly smart answer another lawyer told you.

Trying to find clarity/ a straight forward answer in a chaotic third world place is falling for the fallacy that the whole world operates like Germany.

Share:

Latest Threads

-

-

-

Where to get a free USA TEXTING/CALL NUMBER ?

- Started by JAKINSMITH

- Replies: 3