My country Belarus asks me to be resident somewhere. I can live there 0 days, and if I can’t present tax residency certificate, then I’m considered tax resident.

“You are tax resident if you spend 183 or more days. You are not tax resident if you spend less than 183 days.

In case you don’t have tax residency anywhere, then you are tax resident in Belarus.”

I’m digital nomad and not residing anywhere for more than 80 days. I’m single. I consulted with Belarusian local lawyers and some told me that any tax residency will work, specifically, Cyprus for 60 days, UAE for 90 days. But for Georgia they didn’t see any cases, however, it should work. I run US LLC and I don’t want to become UAE or Cyprus resident, because those countries enforce their P/E rules.

What I want: to get paper from any state that will state that I’m tax resident there, and Belarus accepts it.

What I’m willing to do: I can afford to buy apartments in the state that I need to obtain tax residency. And can open company with getting some money, to make my economic ties there as well. I don’t have anything (income / property) in Belarus except family.

Why I need that to do: the country likes to take money from its citizens in 5-9 years. And by that time Belarus might get information from CRS, and for sure will chase any chance to get money.

I don’t see any issue just to get paper to get out of it.

What I’m considering now:

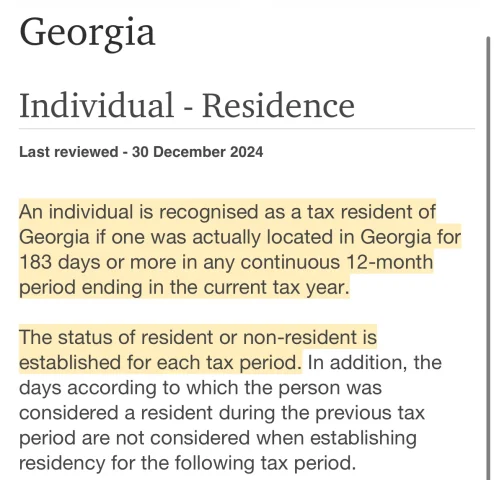

1) Georgia HNWI

Extremely good, but not sure if they accept it.

As I think they must accept it, because under domestic rules I’m not resident (less than 183 days, just one rule), and I have country (Georgia) where I chose pay taxes. Georgia accept my taxes and me as their tax resident under their domestic rules.

Local Georgian lawyer said that it’s a nice idea.

2) UAE 90 days

Not good because the country likes to take money if they can. And they can under P/E.

3) Cyprus 60 days

Too many rules, and it’s under pressure of EU.

What do you think, any country where I can establish tax residency by buying property and making business, to make it consider me a tax resident, but not taking my income for P/E rules?

“You are tax resident if you spend 183 or more days. You are not tax resident if you spend less than 183 days.

In case you don’t have tax residency anywhere, then you are tax resident in Belarus.”

I’m digital nomad and not residing anywhere for more than 80 days. I’m single. I consulted with Belarusian local lawyers and some told me that any tax residency will work, specifically, Cyprus for 60 days, UAE for 90 days. But for Georgia they didn’t see any cases, however, it should work. I run US LLC and I don’t want to become UAE or Cyprus resident, because those countries enforce their P/E rules.

What I want: to get paper from any state that will state that I’m tax resident there, and Belarus accepts it.

What I’m willing to do: I can afford to buy apartments in the state that I need to obtain tax residency. And can open company with getting some money, to make my economic ties there as well. I don’t have anything (income / property) in Belarus except family.

Why I need that to do: the country likes to take money from its citizens in 5-9 years. And by that time Belarus might get information from CRS, and for sure will chase any chance to get money.

I don’t see any issue just to get paper to get out of it.

What I’m considering now:

1) Georgia HNWI

Extremely good, but not sure if they accept it.

As I think they must accept it, because under domestic rules I’m not resident (less than 183 days, just one rule), and I have country (Georgia) where I chose pay taxes. Georgia accept my taxes and me as their tax resident under their domestic rules.

Local Georgian lawyer said that it’s a nice idea.

2) UAE 90 days

Not good because the country likes to take money if they can. And they can under P/E.

3) Cyprus 60 days

Too many rules, and it’s under pressure of EU.

What do you think, any country where I can establish tax residency by buying property and making business, to make it consider me a tax resident, but not taking my income for P/E rules?