Update after 1 year: It wasn't worth it! It's a waste of time and resources. I had purchased their HK and ES setup.

None of their setups are stable and

can NEVER be stable. They create everything in Bulk with same techniques and Stripe's AI engines are quick to detect their methods.

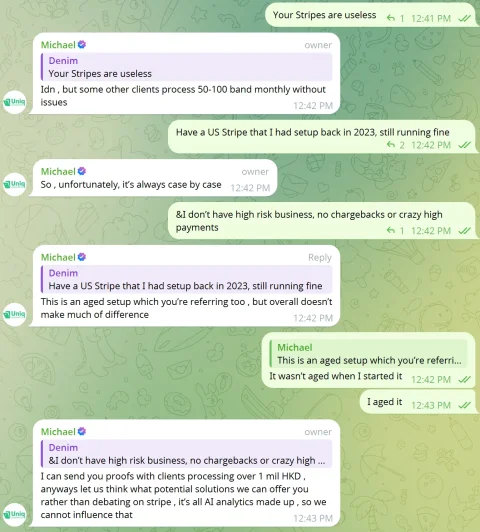

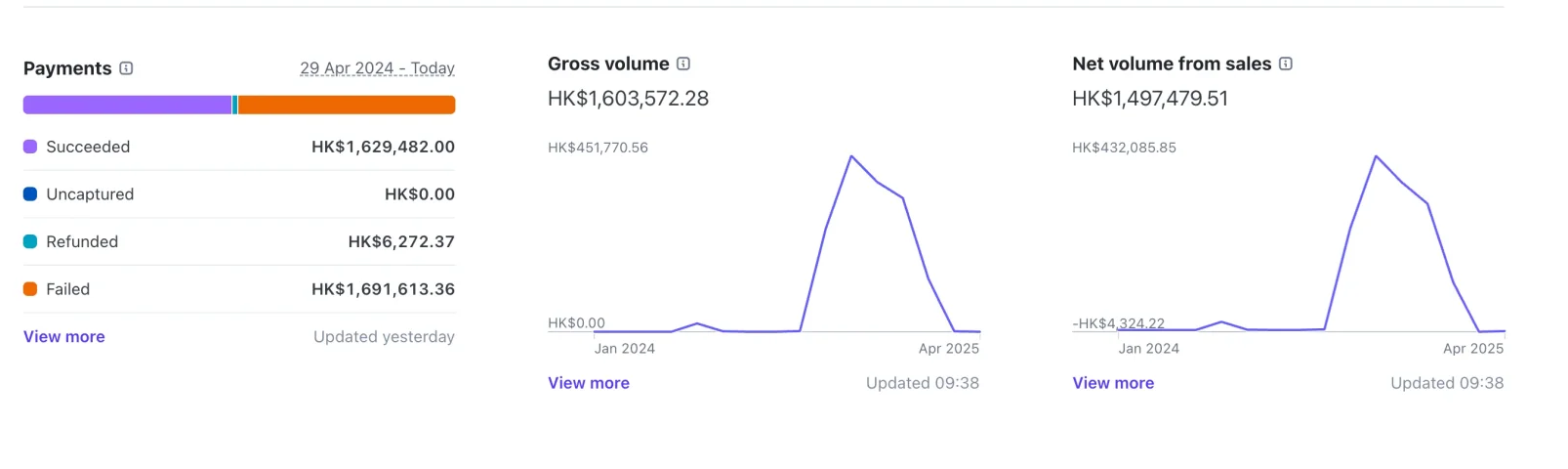

The Stripe accounts get banned after 2-3 payments, (no disputes whatsoever, while using all of their recommendations of "warming up", Dolphin Anty etc). Their support is friendly and responsive but you are waiting for months for any resolution/replacement

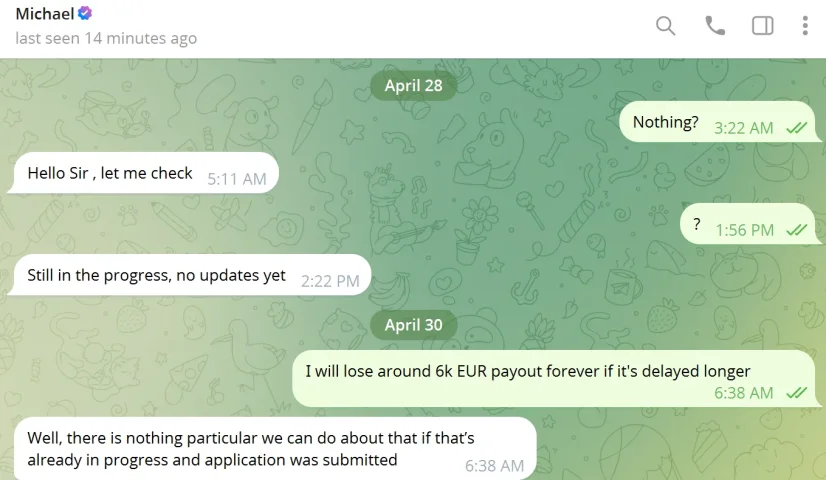

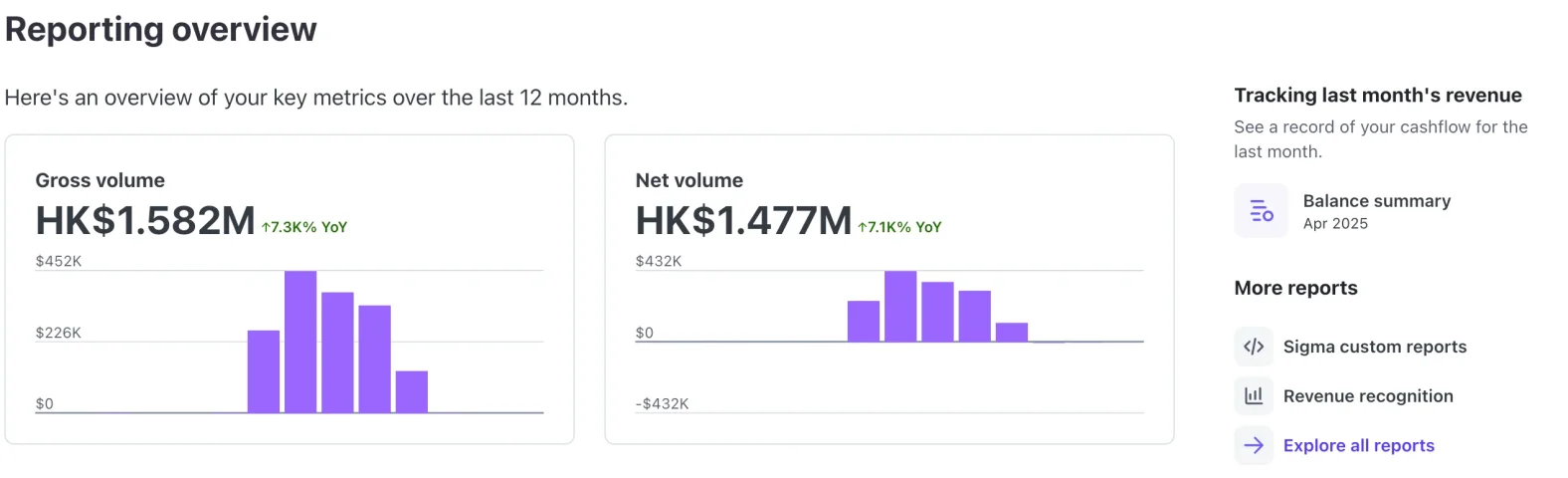

and the replacement is equally trash. I've waited patiently for 1 year! Literally trying to make things work. They will claim that, "I can send you proofs with clients processing over 1 mil HKD" , but I think those are aged stripes, Outliers, not the norm. Their Payoneer is also unreliable and useless. I had setup a different gateway on the ES company after Stripe didn't work out. Turns out that Payoneer also got banned and now my payout from the new gateway is stuck

I AM NOT NEW TO STRIPE. I have a legitimate business model and a couple of accounts which have been running for years and we have low chargeback ratio ( less than 0.2%). It's just that Stripe is not supported in my country.

My Recommendation: Get a real (physical bank account, neobanks are s**t) with a responsible Nominee. A residential static IP is a must! The MangoProxy/Gonzoproxy that they recommend to access the Stripe are eventually blacklisted, if not at the time of login. Stripe has past IP logs.

Look, I get that you had a bad experience, but saying “it never works” just isn’t accurate. We have multiple clients doing 1.5M+ HKD per year with the same setups, no issues. It all comes down to your business model, traffic quality, chargebacks, proxies, login patterns - the usual stuff.

Sorry it didn’t work out for you, but that doesn’t mean the structure is broken. Some people process hundreds of transactions a week just fine. Everyone uses these setups differently, and if you’re in a high-risk niche using flagged proxies, mango or gonzo , are recommendations , not must to do , however other clients using them and it’s fine.

Let’s be real: this isn’t a magic button. We provide working setups - the same ones you'd get if you opened everything properly yourself under your company or website - we can always customize everything according to your requirements. There's no trick here. Success depends more on how you run it than the setup itself.

We’re constantly working on improving and adding new options and alternatives , investing to research and replacements for our clients , managing and expending the support team, but when you buy from us, you’re paying for the company, nominee work, verifications… the full package. Everything we promise, we deliver.

As for EMI/Payoneer/etc. - we’ve had solid experiences helping clients move funds across different EMI’s, for sure physical banks could be useful , but if you run with an issue with the Nominee and physical bank they can request much more info regarding the nature of the funds comparing to EMI. We’ve got proof from clients who scaled big with the same tools we offered you.

I agree that not all cases go smooth - it’s volatile by nature. If your structure failed, odds are it’s more about usage patterns than the structure itself and it doesn’t mean it’s working stable for someone else. But again, if you’re asking for full anonymity and running high-risk business, there are always risks. That’s part of the game.

Let’s focused on finding a solution which is working for you rather than debate on that.

Will surely deal again and definitely would prefer realistic timelines. I am a patient human being and I prefer transparency.