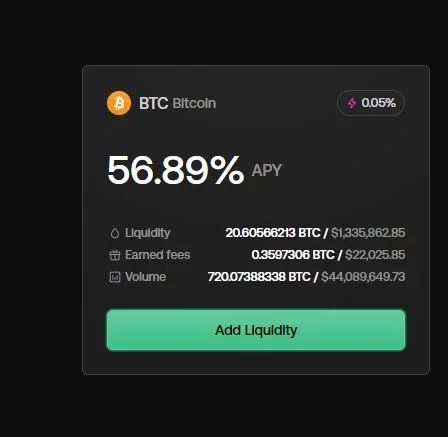

Hello, i am holding BTC with 68k USD average net cost. i will hold it till i get a profit but i am bothered by the btc sits by itself.

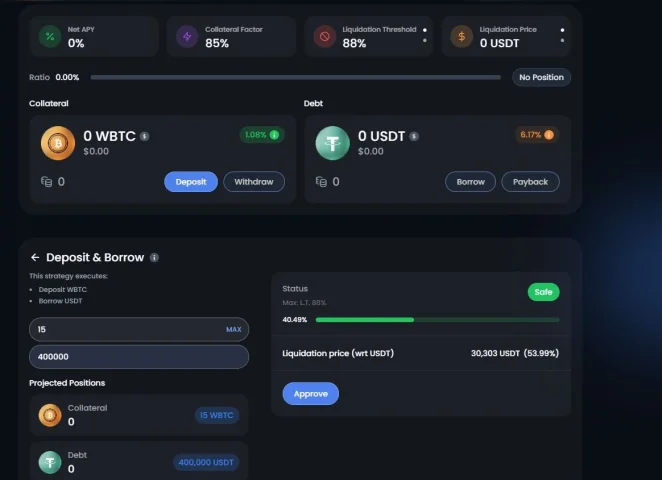

So i am thinking to borrow something like 400k usdt by showing btc as collateral and cashing out it to buy a property as investment. (i also hold enough usdt to pay the loan anyway)

But i dont know where to start. i dont even know if its good idea tho, i am just wanting to make a some profit while my btc's are sitting so i am also open to any other idea.

You will say you hold that much btc but you dont know what to do; well yes.. if i am not financially idiot my average net cost wouldnt be 68k usd anyway

Thanks

So i am thinking to borrow something like 400k usdt by showing btc as collateral and cashing out it to buy a property as investment. (i also hold enough usdt to pay the loan anyway)

But i dont know where to start. i dont even know if its good idea tho, i am just wanting to make a some profit while my btc's are sitting so i am also open to any other idea.

You will say you hold that much btc but you dont know what to do; well yes.. if i am not financially idiot my average net cost wouldnt be 68k usd anyway

Thanks

) is working on a crypto protocol which will

) is working on a crypto protocol which will  investment

investment

and let your money work for you

and let your money work for you