I have recently left the UK for Thailand and informed HMRC that I am no longer a resident. I have yet to inform the Thai tax authorities of my presence however, nor have I informed my UK banks of the change in status. I am also considering leaving Thailand for another country also, entering into a state of nomadic travelling, and I guess a nomadic tax situation. Although not fully decided on this.

In 8-9 months if I used those UK bank accounts to cash out cryptocurrency, what would happen in terms of CRS and tax reporting. The bank would i'm sure rely the information to HMRC given they still believe me to be resident. Would HMRC just say ignore this reporting given I am no longer present? I am hesitant to inform the banks of my change in situation as it is the best FIAT off ramp I currently have and accepts large sums from crypto, and I suppose they would my accounts?

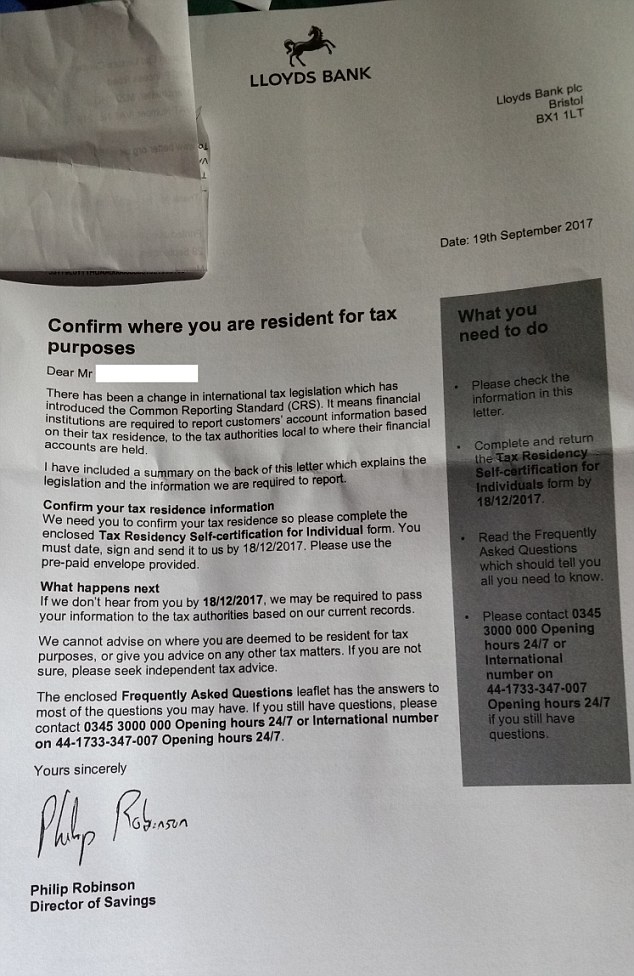

Is there any issues that might arise from not informing the banks of my change in residence?

In 8-9 months if I used those UK bank accounts to cash out cryptocurrency, what would happen in terms of CRS and tax reporting. The bank would i'm sure rely the information to HMRC given they still believe me to be resident. Would HMRC just say ignore this reporting given I am no longer present? I am hesitant to inform the banks of my change in situation as it is the best FIAT off ramp I currently have and accepts large sums from crypto, and I suppose they would my accounts?

Is there any issues that might arise from not informing the banks of my change in residence?