https://www.pwc.ch/en/services/tax-advice/corporate-taxes-tax-structures/dac6.html

What’s DAC6 all about?

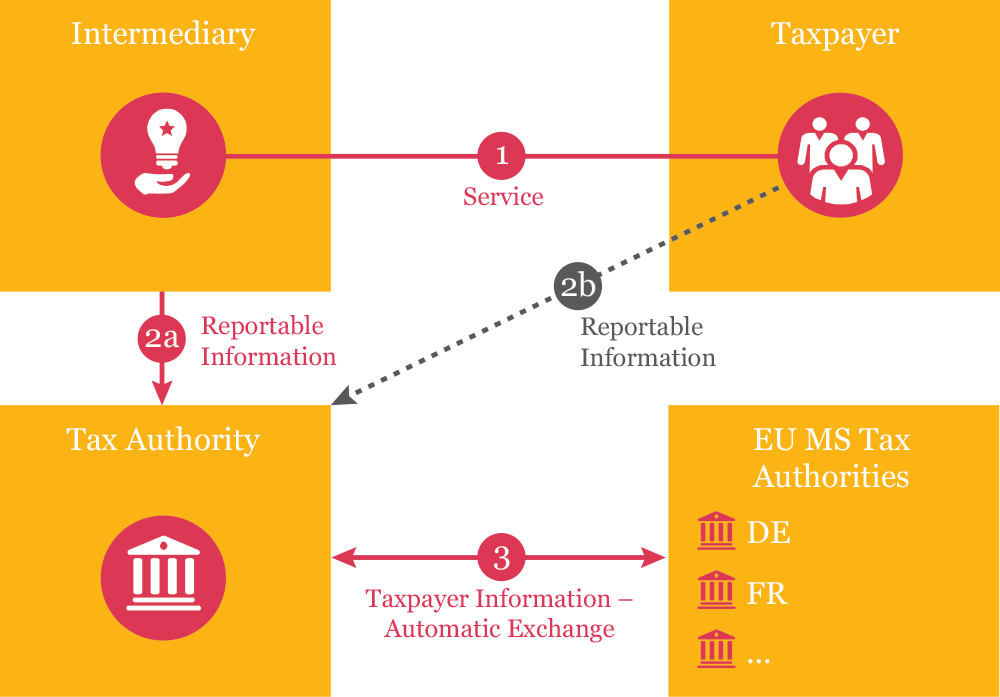

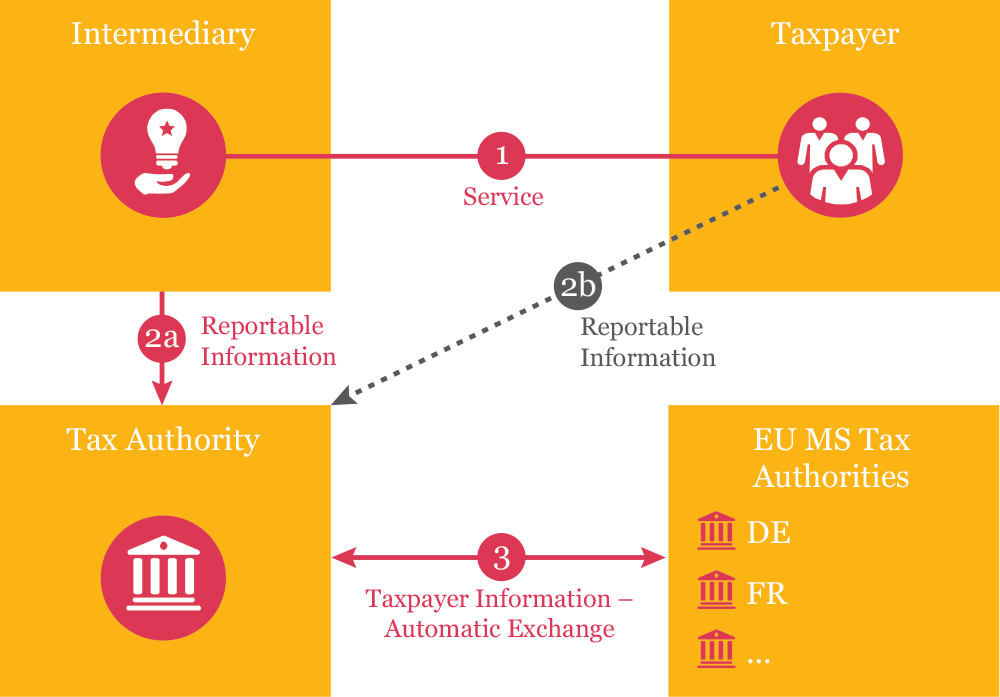

The EU is introducing an additional level of transparency in order to detect potentially aggressive tax arrangements.

The amendment to Directive 2011/16/EU on mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements (DAC6 for short) will have far-reaching consequences for tax advisors, service providers and taxpayers – including organisations and individuals in Switzerland and Lichtenstein.

DAC6 imposes mandatory disclosure requirements for certain arrangements with an EU cross-border element where the arrangements fall within certain "hallmarks" mentioned in the directive and in certain instances where the main or expected benefit of the arrangement is a tax advantage. There will be a mandatory automatic exchange of information on such reportable cross-border schemes via the Common Communication Network (CCN) which will be set-up by the EU.

Although the directive is not effective until 1 July 2020, taxpayers and intermediaries need to monitor their cross-border arrangements already as of 25 June 2018. Therefore the time to act is now.

What’s DAC6 all about?

The EU is introducing an additional level of transparency in order to detect potentially aggressive tax arrangements.

The amendment to Directive 2011/16/EU on mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements (DAC6 for short) will have far-reaching consequences for tax advisors, service providers and taxpayers – including organisations and individuals in Switzerland and Lichtenstein.

DAC6 imposes mandatory disclosure requirements for certain arrangements with an EU cross-border element where the arrangements fall within certain "hallmarks" mentioned in the directive and in certain instances where the main or expected benefit of the arrangement is a tax advantage. There will be a mandatory automatic exchange of information on such reportable cross-border schemes via the Common Communication Network (CCN) which will be set-up by the EU.

Although the directive is not effective until 1 July 2020, taxpayers and intermediaries need to monitor their cross-border arrangements already as of 25 June 2018. Therefore the time to act is now.