I agree with you a lotIt is simply historical cycles repeating themselves. I listed three books on the topic in this post:

https://www.offshorecorptalk.com/th...r-legit-earned-money.33150/page-2#post-172977

When you study history, and understand that it repeats, it really provides a great incentive to get prepared. The world is not comprised of random events. Human nature is such that humanity continues to repeat the same mistakes over-and-over again. By the time that the generation that made a catastrophic mistake dies off (roughly 80 years later), a new generation is now ready to make similar mistakes. It has not learned the lessons of history and, in its hubris, believes that it knows best.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

German taxes based on nationality like USA

- Thread starter 369

- Start date

In general, yes, but as long as an option has more upsites than downsitesAgain, life is all about maximizing your options, not reducing them. Renouncing citizenship limits your options.

In general, yes, but as long as an option has more upsites than downsites

exactly

Hi, I did a short 10min research and was not able to find evidence to it in the programm of "Die Grünen". (Grünes Wahlprogramm zur Bundestagswahl 2021).In September in germany are new elections.High probably green/red/red will win who are planning to increase massivly taxes.Nothing what we didn't thought already but it is now also high probable that they will implement global taxation based on nationality like the US.

Could you share a link or the exact passage its mentioned? (in German is fine)

Die Grünen didn't mention a global taxation IIRC in their Wahlprogramm. However, in the event of germany getting an R2G (Rot Rot Grün, Red Red Green, Socialists, Left Wing and Greens), the lefts are dreaming about adding a wealth tax and a one time wealthj fee (I think it was 10% starting from 2m EUR) to fund their communist bulls**t. So a global taxation for germans (again only in case of a R2G and it will last longer than 1 election periode) right now is no that unrealistic.Hi, I did a short 10min research and was not able to find evidence to it in the programm of "Die Grünen". (Grünes Wahlprogramm zur Bundestagswahl 2021).

Could you share a link or the exact passage its mentioned? (in German is fine)

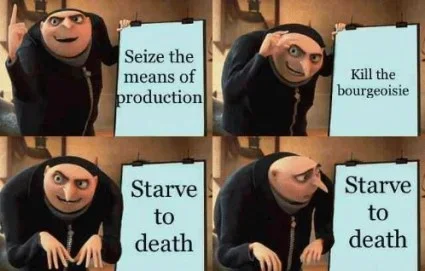

Even the French were smart enough to repeal the wealth tax. The problem is that socialists do not learn from history.

https://www.investorschronicle.co.u...-france-s-wealth-tax-did-more-harm-than-good/What’s more, it led to an exodus of France’s richest. More than 12,000 millionaires left France in 2016, according to research group New World Wealth. In total, they say the country experienced a net outflow of more than 60,000 millionaires between 2000 and 2016. When these people left, France lost not only the revenue generated from the wealth tax, but all the others too, including income tax and VAT.

French economist Eric Pichet estimated that the ISF ended up costing France almost twice as much revenue as it generated.

Attachments

Hey sorry i'm currently outside of home town .Its all over the internet where people are discussing the big changes.Die Grünen didn't mention a global taxation IIRC in their Wahlprogramm. However, in the event of germany getting an R2G (Rot Rot Grün, Red Red Green, Socialists, Left Wing and Greens), the lefts are dreaming about adding a wealth tax and a one time wealthj fee (I think it was 10% starting from 2m EUR) to fund their communist bulls**t. So a global taxation for germans (again only in case of a R2G and it will last longer than 1 election periode) right now is no that unrealistic.

10-30% Vermoegensabgabe of all assets splitted for 20 years

1% Vermoegensteuer

63% highest tax from 4800 brutto which is arround 2850 netto

world wide taxation based on citizenship

there are more hidden taxation but these are the major ones.

Well, the big issue is whether they will implement global taxation akin to the U.S. If not, then simply leaving the country and establishing a tax residency elsewhere will do the trick (provided that you have a portable business to generate an income or a job offer from a business located in another country).Hey sorry i'm currently outside of home town .Its all over the internet where people are discussing the big changes.

10-30% Vermoegensabgabe of all assets splitted for 20 years

1% Vermoegensteuer

63% highest tax from 4800 brutto which is arround 2850 netto

world wide taxation based on citizenship

there are more hidden taxation but these are the major ones.

On the other hand, if the socialists implement global taxation, then you have much bigger problems.

The problem is that most people probably wouldn't care too much. Only a minority of people would leave their home country due to tax changes.

The rest is happy that someone in a different country is subsidizing them.

Unfair system.

The rest is happy that someone in a different country is subsidizing them.

Unfair system.

Okay, just to turn this discussion into something useful for OP I would say that the best answer in this thread so far is the one to consider a corporate structure. You may not find a way around high personal taxes but with a corporate structure (GmBH or even AG) you will have certain benefits and able to reduce your taxes in some way without to compromise on personal live standard.

There are so many entrepreneurs and self employees that are doing it. I don't say you will get the same out of it as if you could get rid off to pay tax, but at least you can get more for every euro you spend.

There are so many entrepreneurs and self employees that are doing it. I don't say you will get the same out of it as if you could get rid off to pay tax, but at least you can get more for every euro you spend.

I know in places like France, populist movements like that of Jean-Luc Melanchon also want to propose taxation based on citizenship. But whether its Germany, France or anywhere else in the EU, I am of the opinion that it would be near impossible to impose. EU Treaties would need to be renegotiated amongst many, many other hurdles. Things would get tied up in the courts and take years to implement. I remember back in 2012 when Francois Hollande of France tried to push down a 75% tax rate on salaries over 1M EUR and that got struck down very quickly by the courts. Whoever comes into power in Germany will still be subject to the German legal system so I'd brush this off as political/populist talk for now and perhaps not much substance to it.

This, + Greens will have to coalition with someone, they will not get their way 100% with everything they want to implement. Their approval is high, but not high enough to win enough votes to govern alone and even this current approval will drop before any election.I know in places like France, populist movements like that of Jean-Luc Melanchon also want to propose taxation based on citizenship. But whether its Germany, France or anywhere else in the EU, I am of the opinion that it would be near impossible to impose. EU Treaties would need to be renegotiated amongst many, many other hurdles. Things would get tied up in the courts and take years to implement. I remember back in 2012 when Francois Hollande of France tried to push down a 75% tax rate on salaries over 1M EUR and that got struck down very quickly by the courts. Whoever comes into power in Germany will still be subject to the German legal system so I'd brush this off as political/populist talk for now and perhaps not much substance to it.

If they are in a coalition government they will focus on the things on their current agenda. Since citizenship taxation isn’t even on their current list of things they want to implement, I wouldn’t worry about it for now either.

Only US has really the reach and resources to enforce citizenship taxation. I don’t see any EU country being able to enforce it, not even Germany. If they tried to enforce it, it would cost so much more than it would bring in.

Most people are just jealous of how great the German passport is and are trying to scare you with these fantasies.

As for EU trying it EU-wide: this will never happen. Countries like Poland or Greece who have large diasporas value these diaspora citizens much more than to jeopardise their bond with them with citizenship taxation. They would veto any such ridiculous idea right away.

Even if the islamic failedstate Germoney implements the global taxation by citizenship or not, it does not have the political, economical power or partners to go after someone who lives outsite that shithole country, even with the German citizenship. Since they imported millions of islamic antisemites and social welfare scammers in 2015, Germany is a global clown-country with almost zero global support from outside the EUSSR. Sure some latin ameican countries still stick to them, but if someone lives in the power-nations (China, USA, UK + their Caribbean/Offshore Islands, Russia etc.) you're absolutely save. Well beside Germoney, the EUSSR wouldn't be save as well, but as the EU is a socialist state association, it is not that much desirable to live and work there anyhow.

When the communist parties take over the power in Germany, the days of this nation are limited. It will go down the same path as South Africa, plus icreasingly Islamization and inner social conflicts. So how such a so called "nation" could threat someone like us?

When the communist parties take over the power in Germany, the days of this nation are limited. It will go down the same path as South Africa, plus icreasingly Islamization and inner social conflicts. So how such a so called "nation" could threat someone like us?

In Germany there isn’t a problem to renounce. The moment you obtain a non-EU citizenship you have legally lost your German citizenship. So no difficult formal procedure like in France or the US.So, after my previous post, a response for OP :

As you can read in the french report this (page 56) : "Finally, the applicability of such a reform would also require tightening the rules for unjustified change of nationality, or to countries with privileged legality in terms of personal tax. This would imply a legal definition of these countries with privileged taxation but also the introduction of a notion of presumed departure for essentially fiscal reasons, accompanied by significant sanctions."

I called a lawyer who help french with big fortune to renounce their french nationality since 15 years. He said it's difficult or impossible in certain case if the government knows you are very rich and/or you are not living outside the country since 10 years minimum.

When I was trying to renounce my french nationality in anonymous way for grabbing informations, one of the questions was "is it for tax reasons ?" even if the citizenship based taxation isn't ready. The second question was "list all your incomes since X years".

So imagine when this new tax will be ready.

If you have another good nationality (for traveling in EU), and if you are sure that Germany has planed this s**t, I deeply recommend you to renounce your nationality before it's too late.

Actually Germany already had a taxation based on the German passport. This occurred if someone left Germany without having a pro forma (tax) residence anywhere else. There is a court ruling which then determined the German passport as the place to pay tax in the absence of other criteria which would determine a tax residency somewhere else. This hit some digital nomads who wanted to do this without having another tax residency somewhere quite hard. So this is basically the same as in France.

I don't think that it will be possible to do a taxation just based on the passport like in the US (where just holding the passport is the criteria and not the last resort in case other tax residency rules are absent). It would take away the sovereignity to move freely and incorporate freely within the EU, which is one of the most important pillars of the EU and I am sure that this will violate EU law and will therefore be overruled by the EU court. So they may have it on their agenda, but it will not be possible by EU law.

Germany is going down like crazy.... Guys, leave this stupid country as soon as you can. If Baerbock will become chancellor I will laugh my a*s off, hahaha.

I don't think that it will be possible to do a taxation just based on the passport like in the US (where just holding the passport is the criteria and not the last resort in case other tax residency rules are absent). It would take away the sovereignity to move freely and incorporate freely within the EU, which is one of the most important pillars of the EU and I am sure that this will violate EU law and will therefore be overruled by the EU court. So they may have it on their agenda, but it will not be possible by EU law.

Germany is going down like crazy.... Guys, leave this stupid country as soon as you can. If Baerbock will become chancellor I will laugh my a*s off, hahaha.

Last edited:

@The Sovereign Individual , if it is easy to make false statements or not doesn't make it legal  . Of course you can make false statements everywhere and may come through without paying tax, but it's still illegal and a very easy to prove offense if you are in the spotlight of tax authorities.

. Of course you can make false statements everywhere and may come through without paying tax, but it's still illegal and a very easy to prove offense if you are in the spotlight of tax authorities.

Of course countries frequently violate EU law, but in this case this regards the pillar of the European spirit and idea and I am sure that this will not be tolerated by the EU. The "Grünen" are orientating their approach on the US system, but they forget that Germany is not the US, Germany is a part of the EU. The only possibility for a tax like this would be that the EU is establishing an EU tax authority and everybody with an EU passport has to pay to the EU tax authority. That would be plausible.

I highly doubt that a tax system solely based on the German passport can be established in reality.

Of course countries frequently violate EU law, but in this case this regards the pillar of the European spirit and idea and I am sure that this will not be tolerated by the EU. The "Grünen" are orientating their approach on the US system, but they forget that Germany is not the US, Germany is a part of the EU. The only possibility for a tax like this would be that the EU is establishing an EU tax authority and everybody with an EU passport has to pay to the EU tax authority. That would be plausible.

I highly doubt that a tax system solely based on the German passport can be established in reality.

If there is such a ruling you just move to another EU country for a while and then move further away. Done.Actually Germany already had a taxation based on the German passport. This occurred if someone left Germany without having a pro forma (tax) residence anywhere else. There is a court ruling which then determined the German passport as the place to pay tax in the absence of other criteria which would determine a tax residency somewhere else. This hit some digital nomads who wanted to do this without having another tax residency somewhere quite hard. So this is basically the same as in France.

I don't think that it will be possible to do a taxation just based on the passport like in the US (where just holding the passport is the criteria and not the last resort in case other tax residency rules are absent). It would take away the sovereignity to move freely and incorporate freely within the EU, which is one of the most important pillars of the EU and I am sure that this will violate EU law and will therefore be overruled by the EU court. So they may have it on their agenda, but it will not be possible by EU law.

Germany is going down like crazy.... Guys, leave this stupid country as soon as you can. If Baerbock will become chancellor I will laugh my a*s off, hahaha.

If you renounce a nationality you will have to disclose your new nationality to the country you renounce from. So I doubt you can do it anonymously. Without knowing your new or 2nd nationality, France will not let you renounce.So, after my previous post, a response for OP :

As you can read in the french report this (page 56) : "Finally, the applicability of such a reform would also require tightening the rules for unjustified change of nationality, or to countries with privileged legality in terms of personal tax. This would imply a legal definition of these countries with privileged taxation but also the introduction of a notion of presumed departure for essentially fiscal reasons, accompanied by significant sanctions."

I called a lawyer who help french with big fortune to renounce their french nationality since 15 years. He said it's difficult or impossible in certain case if the government knows you are very rich and/or you are not living outside the country since 10 years minimum.

When I was trying to renounce my french nationality in anonymous way for grabbing informations, one of the questions was "is it for tax reasons ?" even if the citizenship based taxation isn't ready. The second question was "list all your incomes since X years".

So imagine when this new tax will be ready.

If you have another good nationality (for traveling in EU), and if you are sure that Germany has planed this s**t, I deeply recommend you to renounce your nationality before it's too late.

Share:

Latest Threads

-

-

Driver’s License in the Philippines – Fast and Painless

- Started by Overtrade

- Replies: 1

-

Remote Company Formation Options for Sanctioned Country IT Professional with Minimal Bureaucracy and Zero Local Taxes

- Started by IllIlllIII

- Replies: 1

-

-

Seeking Offshore Capital Partner for Short-Term Private Operation

- Started by user12345

- Replies: 0