Hi,

I recently discovered that debit and credit cards in most or all Georgian banks appear to be uninsured against fraudulent transactions.

The cards are usually linked to the current account.

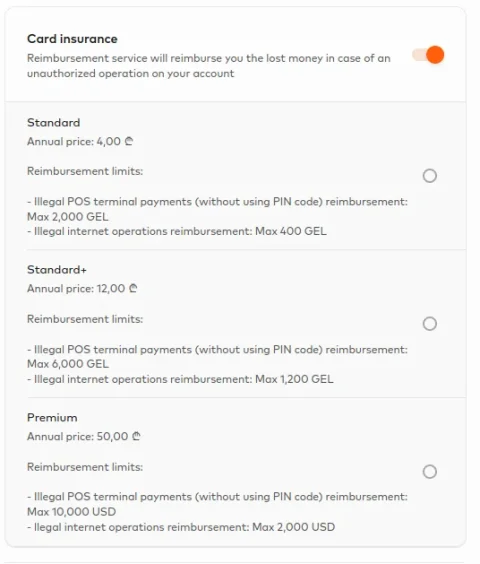

Additional insurance is available at extra cost.

Let's focus on BoG for now. But the same applies to TBC Bank (and I suspect all the others).

Let's say you have 20,000 USD in your current account and have paid for the Premium insurance plan (the highest available, see attached image).

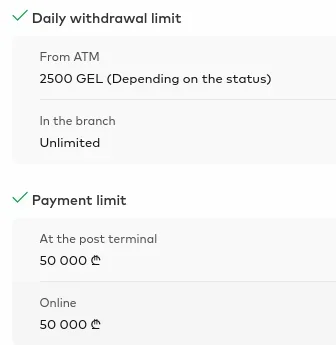

If someone uses your card to shop online, they can spend up to the card's limit of 50,000 GEL (around 19,000 USD).

The insurance only covers 2,000 USD for illegal internet operations. So 17,000 USD will be lost.

How can you prevent this?

Of course, you can freeze the card and unfreeze it each time before using it.But I have some recurring payments on my cards. So freezing and unfreezing is not an option.

How did you solve that problem?

I recently discovered that debit and credit cards in most or all Georgian banks appear to be uninsured against fraudulent transactions.

The cards are usually linked to the current account.

Additional insurance is available at extra cost.

Let's focus on BoG for now. But the same applies to TBC Bank (and I suspect all the others).

Let's say you have 20,000 USD in your current account and have paid for the Premium insurance plan (the highest available, see attached image).

If someone uses your card to shop online, they can spend up to the card's limit of 50,000 GEL (around 19,000 USD).

The insurance only covers 2,000 USD for illegal internet operations. So 17,000 USD will be lost.

How can you prevent this?

Of course, you can freeze the card and unfreeze it each time before using it.But I have some recurring payments on my cards. So freezing and unfreezing is not an option.

How did you solve that problem?