What are you talking to private bankers on the phone and telling them your situation? It is like talking to a used car salesman lol

And why do you want to get into the banking system so desperately right now, what has changed?

Who should I contact other than the used car salesman? xD I tried two law firms in Monaco to help me get my residency there, but they seem to have so much else to do, it's unbelievable... So I stopped running after them to take the steps myself to settle in Monaco, so I called a private banker directly because I have to open an account there.

I explained the origin of my funds (amateur crypto mining in 2015) with an invoice authenticated by a bailiff of the purchase of the mining equipment. But that didn't seem to convince him because the traceability of the funds afterwards is no longer possible because I played too much with my cryptos in seven years...

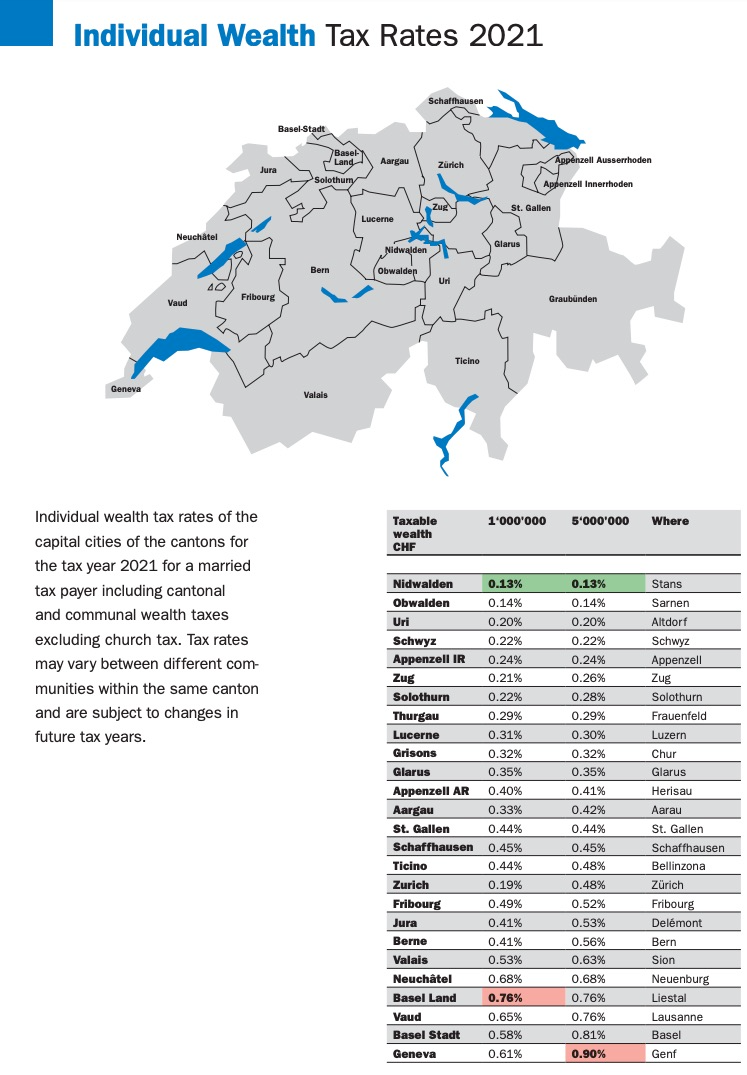

For Switzerland, I will also need an account to be able to make nice deposits in 1 to 2 years, or why not make loans against collateral and thus not touch my assets and therefore enrich myself. Could it also make me more credible in the eyes of the Monegasque private banker if I wanted to try my luck in Monaco again?