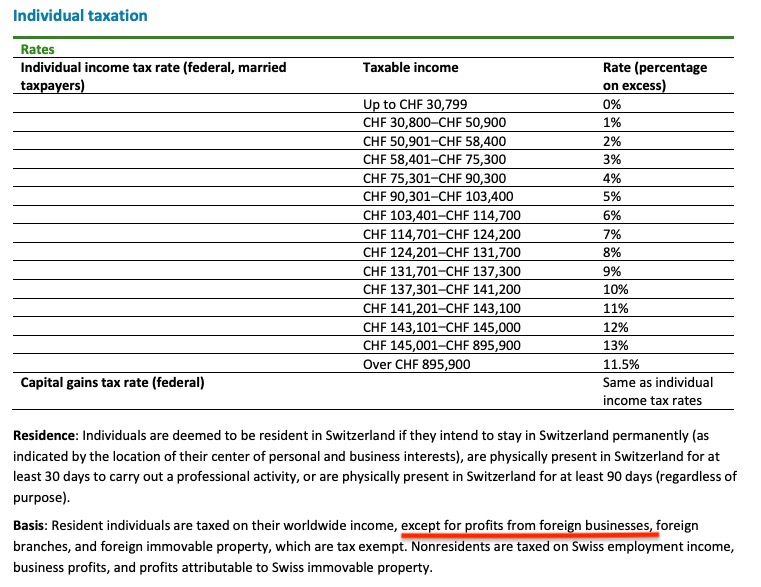

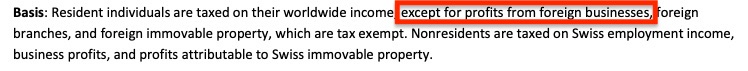

According to Deloitte, profits from foreign business are tax exempt for Swiss resident individuals.

https://www2.deloitte.com/content/d...s/Tax/dttl-tax-switzerlandhighlights-2022.pdf

What are considered foreign business profits? Dividends from foreign businesses?