You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Malta or Bulgaria?

- Thread starter Cabbage500

- Start date

Congrats with the good result. It must have cost you are fortune to get this done by these professionals?

I'm sure it was quite expensive. I know we currently pay hefty accounting fees and retainer fees for our lawyer / secretary service. Like I said though, that was before my time. Best to do it right the first time.

Hello, I assume you did set up a bank account in BG. How easy would it be to set up a bank account in another EU country with a BG company?if you want to incroporate a company in BG, it will cost around 500-700€ for a full set-up (company, bank, etc.)

Could profits and therefor taxes in BG be lowered when invoicing from another own company e.g. a

BZ IBC to the BG company for some kind of services?

BZ IBC to the BG company for some kind of services?

Got Maltese company for 1.5 years. It depends on your corp income. I would say with 5-6k Eur a month or higher it is hands down the cheapest solution. If you need to extract money of course.

Got around 200invoices annually and it cost me below 3k for all the running reports and audit.

Considering to move to Estonia where you can reinvest with 0 corp tax.

Might be selling Maltese company with Maltese corp bank account.

Got around 200invoices annually and it cost me below 3k for all the running reports and audit.

Considering to move to Estonia where you can reinvest with 0 corp tax.

Might be selling Maltese company with Maltese corp bank account.

If you are not going to live in Malta then forget Malta. You will end up paying 35% corporate tax rate and will not get the tax refund. Tax refund requires having a local Malta iban to get it. Plus to open a corporate account you really need to be resident in Malta. All Malta banks are closing the doors to non-residents so if your not a resident of Malta then forget it long term. Satabank was last hope among the international banks in Malta but has compliance issues. So does the other bank I don't want to mention that has issues with U.S also.

...or you will fight against the Malta tax office to on end make a deal with 15% tax and huge invoice for a local lawyer and much lost time. Lesson learned never pay upfront 35% tax and need to ask later to got 30% back.

Bulgaria is great in many ways.

This with translated Invoices never heard, never seen. Same with BGN currency.

There is a big difference on the Bulgarian Providers regarding service. Important is to know your preferences to go with the right one. For the 100% proper stuff you have serious law agencies who will fit you and for the opposide there are great suppliers too.

as a Maltese non-dom you can run any offshore company without taxes so why do you bother with the Maltese company?...or you will fight against the Malta tax office to on end make a deal with 15% tax and huge invoice for a local lawyer and much lost time. Lesson learned never pay upfront 35% tax and need to ask later to got 30% back.

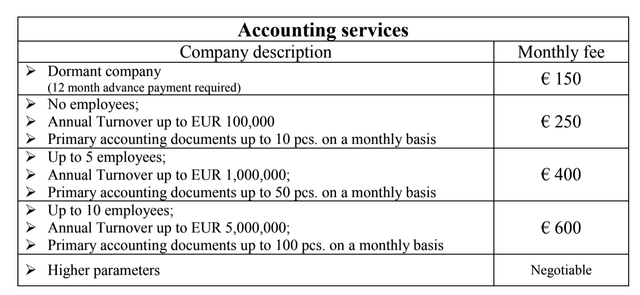

I have a company in BG, setup and maintained by a well known accountant office in Sofia. Everything goes fine, except accounting fees are quite high (€250 / month up to 100 invoices) compared to other EU countries (at least where I live, Western Europe). I deliver my invoices in English. One problem no-one is mentioning though are BG banks, they charge quite huge fees for every transaction made (incoming / outgoing, for example €700 incoming= €7 fee, €495 cash withdrawing (which is the maximum) costs €16), and besides this a monthly fixed fee, something which is not the issue with my other company in Western Europe where we have EURO.

So for me I can't really recommend Bulgaria, if I could do it again I would surely check other countries first with Euro currency, as BG also have limited PayPal accounts (you can't withdraw to bank etc) which isn't positive either.

So for me I can't really recommend Bulgaria, if I could do it again I would surely check other countries first with Euro currency, as BG also have limited PayPal accounts (you can't withdraw to bank etc) which isn't positive either.

I have a company in BG, setup and maintained by a well known accountant office in Sofia. Everything goes fine, except accounting fees are quite high (€250 / month up to 100 invoices) compared to other EU countries (at least where I live, Western Europe). I deliver my invoices in English.

This is quite surprising given that BG has the 2nd lowest income level in EU, only slightly above Romania.

Are you sure your accountant is giving you competitive rates?

This is quite surprising given that BG has the 2nd lowest income level in EU, only slightly above Romania.

Are you sure your accountant is giving you competitive rates?

No, I'm not sure, but for setup I want to be sure everything was perfect, as you will not understand one single word of Bulgarian (totally different language, looks a bit like Russian), and my accountant provided a notary setup in both English and Bulgarian. May switch later to a cheaper one as I first want to see how everything goes.

IS €250 / month much for this service ? I think it's cheap or not?

Don't think so, I'm in West Europe where wages are around 2K€ a month, and here I pay €125 / month for lot's of more accountant activities, and €100 / year for banking fees incl. multiple creditcards. And like blockchain4ever mentioned, people don't earn a lot in BG, so accountant rates should be cheaper. Biggest issue is in my opinion the banking system, even if you pay a 2€ local mobile phone bill you have to pay €0,50 fees - and it's not about the 50 cents, but if you have to pay a bank a few thousand € a year for fees you will think different. Hope BG can change to EUR soon, so these ridiculous banking fees will change hopefully

is this with a certified accountant ?Don't think so, I'm in West Europe where wages are around 2K€ a month, and here I pay €125 / month for lot's of more accountant activities, and €100 / year for banking fees incl. multiple creditcards.

Yes, normal rates here , it even includes yearly report etc. I will not disclose my country where I live (I also run a company here), but with a tax rate of 50-60% you will still gladly pay €250 a month for a Bulgarian accountant. Again, my biggest issue are banking fees which are very high - another sample, $50 / month for a just having a USD account is outrageous IMO.

Best thing about BG is it's tax rate, which is just 10%

Best thing about BG is it's tax rate, which is just 10%

I didn't want to say it but glad someone else did but Romania is a poor country. Are these expat/foreigner prices or do locals who speak the local linguafranca get charged a lower rate?

Something sounds off with the pricing.

Something sounds off with the pricing.

do you have to have a BG bank account? I mean you can use any other EU bank account...Again, my biggest issue are banking fees which are very high - another sample, $50 / month for a just having a USD account is outrageous IMO.

do you have to have a BG bank account? I mean you can use any other EU bank account

Exactly what I was going to say. A bank account in any other EU country doesn't create a "permanent establishment" in OECD lingo. You should feel free to bank anywhere.

As far as I know, there's a requirement in BG to have SOME bank account in BG, but that's for tax purposes I guess. Leave it at that and do your banking elsewhere.

Hi Guys,

A little late but I know a lot about Bulgaria. The accounting fees you are quoting are really high. Locals pay much less. My example is not VAT registered company so no monthly accounting, about 3-5 invoices a month and yearly turnover bellow 25K - the accountancy cost me 300Euro per year. Friend of myne has VAT company and 10-20 invoices per month with turnover above 100k and pays 150 euro per month and these are real prices from 2018.

A little late but I know a lot about Bulgaria. The accounting fees you are quoting are really high. Locals pay much less. My example is not VAT registered company so no monthly accounting, about 3-5 invoices a month and yearly turnover bellow 25K - the accountancy cost me 300Euro per year. Friend of myne has VAT company and 10-20 invoices per month with turnover above 100k and pays 150 euro per month and these are real prices from 2018.

Hi Guys,

A little late but I know a lot about Bulgaria. The accounting fees you are quoting are really high. Locals pay much less. My example is not VAT registered company so no monthly accounting, about 3-5 invoices a month and yearly turnover bellow 25K - the accountancy cost me 300Euro per year. Friend of myne has VAT company and 10-20 invoices per month with turnover above 100k and pays 150 euro per month and these are real prices from 2018.

Do you think that some bulgarian accounting company increases their price only for foreigners?

I'm using Zara, the fees LisaSimpson is stating are correct. Setup and service is outstanding (esp. setup, took less then 1 hour in Sofia, everything perfectly arranged in dual language with a notary coming to their office), but monthly fees are really really way too high, esp with the volume I do (sometimes no monthly invoices at all).

If someone can advise a good reputable company for a 'normal' price please mention it here or pm me, thanks so much!

If someone can advise a good reputable company for a 'normal' price please mention it here or pm me, thanks so much!

Share:

Latest Threads

-

Destination Thailand Visa – Guide to the Official Digital Nomad Visa in Thailand

- Started by Kim-OTC

- Replies: 2

-

Crypto exchange platform without Licensing

- Started by Ann1892

- Replies: 5

-

Cheap OFFshore, no taxes, no audit what country for a 5k income freelancer?

- Started by Lex00

- Replies: 6

-

-

Moving to Cyprus – Is the HK offshore structure still viable? What are the real risks?

- Started by jiejq

- Replies: 3

, but I can give you more info in PM.

, but I can give you more info in PM.