You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Permanent Establishment rules UAE, with new CT on Companies

- Thread starter andrew28fl

- Start date

Your freezone company will be subjected to 9% CIT since the company has no substance in UAE if the director/owner of the company (you in this case) is resident in another country.How about someone (resident in another tax free country) owning a freezone company but not resident in Dubai?

If you live in a tax free company that has territorial taxation it may make sense to adopt other solutions, like a passthrough US LLC.

If you live in a tax free company that has territorial taxation it may make sense to adopt other solutions, like a passthrough US LLC.

This coud be a good or bad advice depending on the territorial jurisdiction.

There are some territorial countries that don't give a damn if you manage a foreign LLC from there and some that will immediately consider income from the foreign LLC as local source income and taxed at normal rates.

He said he is from a tax-free country so in theory this won't be an issue. Clearly if he enlightens us of what country that is a better advice can be givenThis coud be a good or bad advice depending on the territorial jurisdiction.

There are some territorial countries that don't give a damn if you manage a foreign LLC from there and some that will immediately consider income from the foreign LLC as local source income and taxed at normal rates.

Thailand and some other countries in South East Asia for example.what countries would be a good option to run the us llc from?

can you list them please???

Costa Rica also may be an interesting solution.

Panama and Dominican Republic too.

You can also consider tax-free countries like Bahamas or Cayman Islands.

Before doing any setup also speak with a local tax advisor to check if some of those countries may consider the fact that you manage a US LLC from their country as local income, even though they have very lax tax enforcement rules so I really doubt it.

what countries would be a good option to run the us llc from?

This BTW is not the right question because:

1. Do you have at your disposal unlimited budget?

2. Are you willing to relocale to a 8sqm island like Sark?

You are limited eiter by budget or lifestyle requirements.

Can you move to Monaco? Probably not so it's not an option

Are you willing to move to Western Sahara? Probably not so it's not an option.

Thailand and some other countries in South East Asia for example.

In Thailand there could be some surprising tax consequences

https://www.linkedin.com/pulse/broken-flag-theory-taxation-digital-nomads-thailand-dr-ulrich-eder/

Probably the safest solution in SE Asia are Philippines as Bagpacker explained here and validated by The Professor (if he decided to move there, i would trust him he did his homeworks)

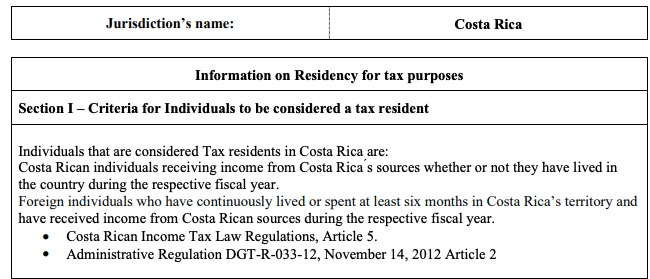

Costa Rica also may be an interesting solution.

It's not an option because you are tax resident only if you are taxed.

And if you are not considered a tax resident because you do not pay taxes in Costa Rica, but you reside the whole year there (and maybe also own a property), where are you consider tax resident? In your home country even if you de-registered from the local population, do not own anything, and haven't spent a single day during the year there?It's not an option because you are tax resident only if you are taxed.

where are you consider tax resident?

In any country that will consider you tax resident.

If no country considers you tax resident, you will be considerd tax resident in your home country because of your citizenship.

Your freezone company will be subjected to 9% CIT since the company has no substance in UAE if the director/owner of the company (you in this case) is resident in another country.

If you live in a tax free company that has territorial taxation it may make sense to adopt other solutions, like a passthrough US LLC.

So in both cases (substance/residency or non residency of the 100% shareholder) a freezone IT company would be subject to 9%?

If no country considers you tax resident, you will be considerd tax resident in your home country because of your citizenship.

That may be the case for some countries (especially the US), but for most countries, this isn't the case at all. It's a complete urban myth.

You could have a passport from a country you've never lived in (this would be the case for most expats born in the UAE, for example). For the vast majority of countries, they would never tax you.

And if you are not considered a tax resident because you do not pay taxes in Costa Rica, but you reside the whole year there (and maybe also own a property), where are you consider tax resident? In your home country even if you de-registered from the local population, do not own anything, and haven't spent a single day during the year there?

You may end up in a position where you're tax resident nowhere.

Last edited:

That may be the case for some countries

This is exactly his case: to be de-registerd you need at the same time be registered somewhere else.

If you don't become tax resident somewhere else they won't let you go.

You may end up in a position where you're tax resident nowhere.

This will be more and more fantasyland.

As more and more people have made the jump to a nomadic lifestyle, governments have paid more attention and these folks are now hearing from them. Because they never met all of the requirements to become a tax non-resident in their home country, they now owe thousands in back taxes.

They did not realize that leaving their home country was not enough to avoid paying tax.

This is the nomad tax trap!

I follow these cases and the biggest thing that I have seen in the rulings is that the court wants to know where you live. Where is your center of life? Do you have a home somewhere else? Do you have an apartment lease? Have you set up a tax residence in another country? Do you have some type of connection to another country?

The folks who have been unable to show proof of any of these things are the ones who have had to pay back taxes to their home countries.

This is a quote from Andrew Henderson and while i don't agree on many things he says, I do 100% agree on the nomad tax trap.

Last edited:

This is exactly his case: to be de-registerd you need at the same time be registered somewhere else.

If you don't become tax resident somewhere else they won't let you go.

This is not true in such absolute terms. Yes, some countries are like that, and have always been like that.

But there also are many countries that aren't like that at all.

This is a quote from Andrew Henderson and while i don't agree on many things he says, I do 100% agree on the nomad tax trap.

Obviously, if "they never met all of the requirements to become a tax non-resident in their home country", then they would get in trouble.

You can also get in trouble if you return to your "home country" after a few years of nomading - they could say it was just an extended vacation and you never really left from a tax perspective.

But something like "you have to pay tax in your passport country if you don't get tax residency" is just bulls**t.

To take an extreme example, even if you don't get tax residency in Costa Rica because you don't have a local job (so you don't pay local taxes), most countries should recognize that you've permanently moved to Costa Rica if you spend 183+ days there and 0 days in your "home country".

And I don't like the term "home country" because it's such an outdated system.

Say a British-Swiss couple living in Dubai travels to Brazil and their kid is born there. The child would probably be eligible for citizenship of the UK, Switzerland and Brazil, but grow up in the UAE.

After graduating from highschool in the UAE, the child moves to Costa Rica, where he/she doesn't have tax residency because they don't have a local job.

Their UAE visa isn't renewed because it would cost the parents money to have an additional visa and the child also isn't in the UAE anyway (would also require a new medical exam).

So now you have a person with three different passports living in Costa Rica, where that person isn't a tax resident, and that person also cannot be a UAE tax resident (where they spent all their life before moving to Costa Rica), because that would require 183+ days in the country or a residency visa (but they didn't spend a single day in the UAE).

Are you going to tell me that person owes taxes in Brazil, the UK and Switzerland, despite never having set foot into any of those countries? What is their "home country"?

It's an extreme example, but it shows that what you wrote definitely isn't some general truth.

However, for some countries like Spain or France, it might actually be the case that you would have to show them a tax residency certificate from some other country as proof that you've really moved somewhere new.

But that's specific to those countries and it usually has nothing to do with your citizenship - but rather with how long you have lived in that country.

The real nomad tax trap is returning to the same country (especially your citizenship country) after a few years abroad. That's when they might really start investigating. But even then, a tax residency certificate might not be required.

It's always the domestic tax law that is relevant, and very few countries have anything about citizenship in their tax code. You can have a look at the UK tax residency rules for example, they are extremely clear. If you don't match any of the criteria, you aren't tax resident, period. I even know a guy who was working for a UK company as a digital nomad. He was living in the UK before and then went nomad, HMRC accepted that without any issues. He only had to prove that he didn't have an apartment in the UK and that he wasn't spending much time there. He legally lived tax free (and now he has settled somewhere new, but that's a different story).

Are you going to tell me that person owes taxes in Brazil, the UK and Switzerland, despite never having set foot into any of those countries? What is their "home country"?

I don't know what is their home country and probably because they never lived in BR, UK and CH neither of those countries will ever ask to pay anything.

But that's specific to those countries and it usually has nothing to do with your citizenship - but rather with how long you have lived in that country.

Exactly, when i said "you are taxed in your home country because of your citizenship" I wasn't thinking about people who have a passport from a country that they never lived in like in your example.

I was thinking about all the people who have one passport from the country they lived in until they moved.

I was thinking about all the people who have one passport from the country they lived in until they moved.

And even there are plenty of countries that - as of now - are fine with you leaving to live on a sailboat in international waters for the rest of your life. They wouldn't come after you, and there is established case law for that.

Unless you come back after 2 years - then they might say "Hey, you were just on vacation for those 2 years".

But of course there are other countries that want to see proof of new ties somewhere else before they let you go. But for most countries, showing a rental agreement should actually be enough, few countries would demand a tax residency certificate. But as usual, you have to check the rules for the specific country and the relevant case law.

And even there are plenty of countries that - as of now - are fine with you leaving to live on a sailboat in international waters for the rest of your life.

Just of curiosity, can you name a few because the more i think about France, Spain, Germany, Italy, Belgium and all the usual high tax countries, the less i'm convinced that they will let you go with your sailboat.

The only hight tax country i could think of is "maybe" Canada.

UK, and Ireland would. You have to give them an address abroad somewhere, but what matters is the time (not) spent in Ireland / UK, not the address abroad. Same thing with Estonia. And for Sweden/Denmark/Finland, it's similar - just give them an address somewhere - , but they have tougher rules on severing the connection. Probably most of Eastern Europe is like this.Just of curiosity, can you name a few because the more i think about France, Spain, Germany, Italy, Belgium and all the usual high tax countries, the less i'm convinced that they will let you go with your sailboat.

The only hight tax country i could think of is "maybe" Canada.

For Italy, well, you have to register with AIRE somewhere which includes show proof of residency at an Italian embassy - but then you can live on a sailboat.

I believe Germany also falls in that category. I've never heard of them asking for an address when you leave. But as usual, most countries may ask questions if you return after a few years.

Scandinavia may be stricter, there was a thread a while ago from someone where I did some research (not sure exactly which country it was). They still consider you tax resident for up to 3-4 years after you leave, unless you move to a country with a tax treaty which would allow you to sever the ties earlier.

But that's exactly what I mean - you have to study the rules for each individual country.

First of all, there is no general "then you pay tax in your home country!!!" rule. It simply doesn't exist.

But countries with vague tax residency criteria such as "habitual abode" may of course cause trouble if you're only gone for a short while and not permanently.

So I'm not saying "just leave, no tax, ever!", but the opposite isn't true either. You have to check the rules for every country.

In the same way, people could be American citizens without ever having lived there, and they would be considered tax residents by the US regardless.

Scandinavia may be stricter, there was a thread a while ago from someone where I did some research (not sure exactly which country it was). They still consider you tax resident for up to 3-4 years after you leave, unless you move to a country with a tax treaty which would allow you to sever the ties earlier.

But that's exactly what I mean - you have to study the rules for each individual country.

First of all, there is no general "then you pay tax in your home country!!!" rule. It simply doesn't exist.

But countries with vague tax residency criteria such as "habitual abode" may of course cause trouble if you're only gone for a short while and not permanently.

So I'm not saying "just leave, no tax, ever!", but the opposite isn't true either. You have to check the rules for every country.

In the same way, people could be American citizens without ever having lived there, and they would be considered tax residents by the US regardless.

Scandinavia may be stricter, there was a thread a while ago from someone where I did some research (not sure exactly which country it was). They still consider you tax resident for up to 3-4 years after you leave, unless you move to a country with a tax treaty which would allow you to sever the ties earlier.

That must have been Norway, they have this 3 calendar year rule after you leave.

"If you have lived in Norway for less than ten years before the income year in which you take up permanent residency abroad, your tax residence in Norway will cease in the income year in which all three of these conditions are met.

If you have lived in Norway for a total of ten years or more before the income year in which you take up permanent residency abroad, your tax residence in Norway cannot cease until after the end of the third income year after the year in which you took up permanent residency abroad."

From: Tax liability in Norway

The other Nordic/Scandinavian countries arent this strict.

Finland also has a rule similar to that. Denmark (including Faroe Islands and Greenland), Sweden, and Iceland are more relaxed: tax residence end when you leave.

Nordic countries in general are strict, though. Absolutely do not mess with them. They have some of the sharpest, most efficient tax authorities in the world, which are revered by their peers. However, they are also very predictable with generally clear tax laws. You don't have nearly the same amount of uncertainty and vagueness as in many other jurisdictions.

Nordic countries in general are strict, though. Absolutely do not mess with them. They have some of the sharpest, most efficient tax authorities in the world, which are revered by their peers. However, they are also very predictable with generally clear tax laws. You don't have nearly the same amount of uncertainty and vagueness as in many other jurisdictions.

Share:

Latest Threads

-

Selling weight loss medicines online

- Started by daggerbackstage

- Replies: 0

-

Hungary criminalizes unapproved crypto trades

- Started by toums

- Replies: 1

-

Hiding US LLC profits by electing for corporation tax treatment

- Started by Eurocash

- Replies: 8

-

-

Company formation for a specific niche without licenses

- Started by luxtravel

- Replies: 10