I think it works out to $9k/yr in fees and taxesDo you know how much does this cost?

What would be the minimum wage you have to assign yourself?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax residency with no or little or mimimum stay, ability to get tax certificate, No CFC Rules, territorial tax or taxfree

- Thread starter piratechain

- Start date

I think it works out to $9k/yr in fees and taxes

Thai Elite avg at 3.5k year. Its upfront tho and this one is not.

I mean not a bad option if you just want to test the ground and see if you like it. You get access to public healthcare too for what I saw.

Their business model is not to sell visas, but to actually run a nomad-friendly agency. They are a proper agency with an office in Bangkok.

If I remember correctly, they simply take a cut of your revenue. More if they found the client, less if you bring your own client. Not sure if there are any fixed fees on top.

They are very nomad friendly and don't expect you to sit in their office or anything, from what I've heard.

If I remember correctly, they simply take a cut of your revenue. More if they found the client, less if you bring your own client. Not sure if there are any fixed fees on top.

They are very nomad friendly and don't expect you to sit in their office or anything, from what I've heard.

OK so for a citizen of a draconian commonwealth country (not USA or EU):

- Get residency and 'employment' in Thailand via EOR provider like iglu or others.

- Within a month or two get tax certificate in Thailand and paper trail of having employment, residency and paid income tax in Thailand should be well on its way.

Whether you spend a few months or more than 183 days in Thailand, you could otherwise fairly and reasonably state you are resident of Thailand at this point and have a good trail of facts/paperwork to back you up.

Assuming you then spend no excessive amount of time in other territories......

- Open new corporation in non black/greylisted country that has CFC rules and dual tax treaty with Thailand and most other countries, let's say Germany. Declare/set it as a non-resident company in Germany, by stating that it is resident in Thailand (Show any Thai residence related documentation during the company setup).

- Open new trading account with IBKR in name of new German company (Whether they would open it with their Singapore or Swiss branch who knows but probably doesn't matter).

- Trade US instruments through IBKR from Thailand (Profits from active trading, not collection of dividends on long term passive investments).

- German company pays no tax to German authorities when you do the annual filing and whatnot in Germany because the profits were earned outside Germany.

- Thailand authorities not interested in collecting tax on German company due to no CFC rules, and would not seek permanent establishment of German operation or collection of German profits within Thailand.

- Pay dividends to yourself from German company tax free from time to time. Probably doesn't matter where paid to, as long as it is not paid into a Thai based bank account.

I know that perhaps this question is moot from the Thailand perspective because ultimately you could just skip the whole company idea and open a personal account with IBKR Singapore and trade in your personal name and so long as you don't bring any profits back to Thailand within the same calendar year you would not pay personal income tax on them in Thailand. However a lot of the time a corporate account with IBKR will afford you things like greater level of margin. Also in future I will probably travel or be in other countries of the world, so to have the trading under a company name in a country I have no interest in living in may help protect me a little instead of any personal level tax implication that any authority may wish to impose on me from time to time.

With this concept you could choose from very many countries of the world for the company setup, probably even USA, as long as that country doesn't tax foreign earnings of non-resident companies and you are probably not interested in ever living there. It would also help quell any concerns with any draconian authorities of the world you may be citizen of to not care or scrutinise you too much, even if you go for the full disclosure route, because you are a beneficial owner of a company in a "normal" country with a tax treaty, not one of those stinky black/greylisted tax haven countries.

Have I understood this correctly for a working concept or am I missing something critical and headed directly to jail?

- Get residency and 'employment' in Thailand via EOR provider like iglu or others.

- Within a month or two get tax certificate in Thailand and paper trail of having employment, residency and paid income tax in Thailand should be well on its way.

Whether you spend a few months or more than 183 days in Thailand, you could otherwise fairly and reasonably state you are resident of Thailand at this point and have a good trail of facts/paperwork to back you up.

Assuming you then spend no excessive amount of time in other territories......

- Open new corporation in non black/greylisted country that has CFC rules and dual tax treaty with Thailand and most other countries, let's say Germany. Declare/set it as a non-resident company in Germany, by stating that it is resident in Thailand (Show any Thai residence related documentation during the company setup).

- Open new trading account with IBKR in name of new German company (Whether they would open it with their Singapore or Swiss branch who knows but probably doesn't matter).

- Trade US instruments through IBKR from Thailand (Profits from active trading, not collection of dividends on long term passive investments).

- German company pays no tax to German authorities when you do the annual filing and whatnot in Germany because the profits were earned outside Germany.

- Thailand authorities not interested in collecting tax on German company due to no CFC rules, and would not seek permanent establishment of German operation or collection of German profits within Thailand.

- Pay dividends to yourself from German company tax free from time to time. Probably doesn't matter where paid to, as long as it is not paid into a Thai based bank account.

I know that perhaps this question is moot from the Thailand perspective because ultimately you could just skip the whole company idea and open a personal account with IBKR Singapore and trade in your personal name and so long as you don't bring any profits back to Thailand within the same calendar year you would not pay personal income tax on them in Thailand. However a lot of the time a corporate account with IBKR will afford you things like greater level of margin. Also in future I will probably travel or be in other countries of the world, so to have the trading under a company name in a country I have no interest in living in may help protect me a little instead of any personal level tax implication that any authority may wish to impose on me from time to time.

With this concept you could choose from very many countries of the world for the company setup, probably even USA, as long as that country doesn't tax foreign earnings of non-resident companies and you are probably not interested in ever living there. It would also help quell any concerns with any draconian authorities of the world you may be citizen of to not care or scrutinise you too much, even if you go for the full disclosure route, because you are a beneficial owner of a company in a "normal" country with a tax treaty, not one of those stinky black/greylisted tax haven countries.

Have I understood this correctly for a working concept or am I missing something critical and headed directly to jail?

OK so for a citizen of a draconian commonwealth country (not USA or EU):

- Get residency and 'employment' in Thailand via EOR provider like iglu or others.

- Within a month or two get tax certificate in Thailand and paper trail of having employment, residency and paid income tax in Thailand should be well on its way.

Whether you spend a few months or more than 183 days in Thailand, you could otherwise fairly and reasonably state you are resident of Thailand at this point and have a good trail of facts/paperwork to back you up.

Assuming you then spend no excessive amount of time in other territories......

- Open new corporation in non black/greylisted country that has CFC rules and dual tax treaty with Thailand and most other countries, let's say Germany. Declare/set it as a non-resident company in Germany, by stating that it is resident in Thailand (Show any Thai residence related documentation during the company setup).

- Open new trading account with IBKR in name of new German company (Whether they would open it with their Singapore or Swiss branch who knows but probably doesn't matter).

- Trade US instruments through IBKR from Thailand (Profits from active trading, not collection of dividends on long term passive investments).

- German company pays no tax to German authorities when you do the annual filing and whatnot in Germany because the profits were earned outside Germany.

- Thailand authorities not interested in collecting tax on German company due to no CFC rules, and would not seek permanent establishment of German operation or collection of German profits within Thailand.

- Pay dividends to yourself from German company tax free from time to time. Probably doesn't matter where paid to, as long as it is not paid into a Thai based bank account.

I know that perhaps this question is moot from the Thailand perspective because ultimately you could just skip the whole company idea and open a personal account with IBKR Singapore and trade in your personal name and so long as you don't bring any profits back to Thailand within the same calendar year you would not pay personal income tax on them in Thailand. However a lot of the time a corporate account with IBKR will afford you things like greater level of margin. Also in future I will probably travel or be in other countries of the world, so to have the trading under a company name in a country I have no interest in living in may help protect me a little instead of any personal level tax implication that any authority may wish to impose on me from time to time.

With this concept you could choose from very many countries of the world for the company setup, probably even USA, as long as that country doesn't tax foreign earnings of non-resident companies and you are probably not interested in ever living there. It would also help quell any concerns with any draconian authorities of the world you may be citizen of to not care or scrutinise you too much, even if you go for the full disclosure route, because you are a beneficial owner of a company in a "normal" country with a tax treaty, not one of those stinky black/greylisted tax haven countries.

Have I understood this correctly for a working concept or am I missing something critical and headed directly to jail?

Your understanding is almost correct but you're overcomplicating things and throwing money away with an EOR if your business will be outside of Thailand.

You can easily get a tax ID in Thailand, remit a symbolic amount of income and pay a few thousand baht of tax on it. Done.

This part is incorrect:

"Whether you spend a few months or more than 183 days in Thailand, you could otherwise fairly and reasonably state you are resident of Thailand at this point and have a good trail of facts/paperwork to back you up."

That's not how it works, and spending a few months in Thailand will not cut it if you're challenged by the tax authority of a developed country. Better to spend 180+ days in Thailand to be safe.

Declare/set it as a non-resident company in Germany, by stating that it is resident in Thailand (Show any Thai residence related documentation during the company setup).

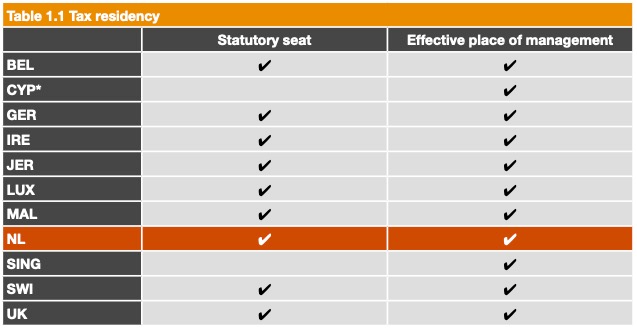

The only country where a company is not considered tax resident by means of incorporation is Singapore (Cyprus joined the list in 2023, this chart is from 2022)

All the others countries considers tax resident a company incoporated within the country.

This means that for the incorporation country, to declare your company treaty non resident you need to provide a Tax ID from the Contracting State otherwise the company will always be considered tax resident in the incorporation country.

Thailand authorities not interested in collecting tax on German company due to no CFC rules, and would not seek permanent establishment of German operation or collection of German profits within Thailand.

Thailand tax authorities will be veeery interested in taxing your treaty non resident Germany company because it became a Thai tax resident company.

skip the whole company idea and open a personal account with IBKR Singapore and trade in your personal name and so long as you don't bring any profits back to Thailand within the same calendar year you would not pay personal income tax on them in Thailand.

The most realistinc thing i've read in your post.

You can easily get a tax ID in Thailand, remit a symbolic amount of income and pay a few thousand baht of tax on it. Done.

Remit a symbolic amount of income too/from where?

88mdok said:

skip the whole company idea and open a personal account with IBKR Singapore and trade in your personal name and so long as you don't bring any profits back to Thailand within the same calendar year you would not pay personal income tax on them in Thailand.

The most realistinc thing i've read in your post.

Is it safe/reasonable to have a Singapore based personal bank account to receive trading profits from the personal account at IBKR Singapore? Or would this trigger some kind of "receiving profits into Singapore account where profits are taxable" issue? Maybe its best to have say, a Vietnam based account to receive profits from IBKR Singapore?

Last edited:

Couldn't it be said that the income is Singapore sourced because even though global/US instruments are traded it may ultimately be deemed that the trades are otherwise settled/concluded by Interactive Brokers Singapore company?As long as you aren't a SG tax resident and income isn't SG sourced i don't see why you should be taxed.

Or is the concept of "sourced" more related to where the work by the client was performed (Thailand/Globally from time to time).

OK Great thank you for helping me to understand.The concept of "sourced" is related to where the work that generated the income was performed.

Remit a symbolic amount of income too/from where?

Thailand taxes foreign income that is remitted into Thailand the year it is earned, as long as the person spends 180+ days in Thailand.

So you can remit any foreign income that you make (company's profits, personal salary, rental income, capital gains, dividend income, etc.) into Thailand and pay tax on it. This is useful if you need a tax certificate.

How have you found the Thai elite Visa/Membership?Because Ive got one. Most agents will get you one during the onboarding process.

Have you used any of the member services available to you yet?

Would you go this route again if you were able to do it all over again?

Any tips on a good property agent on your property buying hunt?

Easy, it took some time to go through the background check but overall it was great.How have you found the Thai elite Visa/Membership?

NoHave you used any of the member services available to you yet?

YesWould you go this route again if you were able to do it all over again?

If you want to buy in TH theres only a few places where cashflow is positive, namely Phuket, Pattaya and Samui.Any tips on a good property agent on your property buying hunt?

Hi! I found your thought very interesting but I am new to this kind of setups. Could you please explain how you make/transfer your profits from this scheme through IBKR?- Open new trading account with IBKR in name of new German company (Whether they would open it with their Singapore or Swiss branch who knows but probably doesn't matter).

- Trade US instruments through IBKR from Thailand (Profits from active trading, not collection of dividends on long term passive investments).

That's the dumbest idea I've read about in a long time. You risk issues in all involved jurisdictions.

That's what I thought when I read it. But now I am confused what's it's all about. Maybe you can clear the path for me? Couple of sentences how would you actThat's the dumbest idea I've read about in a long time. You risk issues in all involved jurisdictions.

You would be telling the German tax authority that the company should be taxed like a Thai company because it is managed from Thailand.

At the same time, you're telling the Thai tax authority that it shouldn't be treated like a Thai company because it is registered outside of Thailand.

What?

The whole idea relies on the fact that the Thai tax authority will never actually question this or talk to their German counterpart.

What will you do when the German tax authority asks for documentation from their Thai colleagues that the company is considered tax resident in Thailand?

And if it is considered tax resident in Thailand, why not just use a Thai company? Are we even sure that Thailand taxes "foreign" profits of domestic companies? Maybe it would be sufficient to just use a non-Thai broker and not bring the money into Thailand?

At the same time, you're telling the Thai tax authority that it shouldn't be treated like a Thai company because it is registered outside of Thailand.

What?

The whole idea relies on the fact that the Thai tax authority will never actually question this or talk to their German counterpart.

What will you do when the German tax authority asks for documentation from their Thai colleagues that the company is considered tax resident in Thailand?

And if it is considered tax resident in Thailand, why not just use a Thai company? Are we even sure that Thailand taxes "foreign" profits of domestic companies? Maybe it would be sufficient to just use a non-Thai broker and not bring the money into Thailand?

You have a point, maybe the whole idea relies on that no one will never ask, because no crs... It is goofy risky. But I am more interested in what you mentioned too.You would be telling the German tax authority that the company should be taxed like a Thai company because it is managed from Thailand.

At the same time, you're telling the Thai tax authority that it shouldn't be treated like a Thai company because it is registered outside of Thailand.

What?

The whole idea relies on the fact that the Thai tax authority will never actually question this or talk to their German counterpart.

What will you do when the German tax authority asks for documentation from their Thai colleagues that the company is considered tax resident in Thailand?

And if it is considered tax resident in Thailand, why not just use a Thai company? Are we even sure that Thailand taxes "foreign" profits of domestic companies? Maybe it would be sufficient to just use a non-Thai broker and not bring the money into Thailand?

What is about using brokers and trading instruments? How you make your profit from it, just on trading? Like you can lose quite enough of your profits by just trading... as i see it. I am noob, how it works?

Yeah, that as well. The part about how to consistently be profitable trading was missing from the post as well. ;-)

Share:

Latest Threads

-

Where to get a free USA TEXTING/CALL NUMBER ?

- Started by JAKINSMITH

- Replies: 3

-

-

Need Assistance Opening UK Bank Account or EMI for UK Ltd Company For Non-Resident Directors

- Started by heavyhitter2020

- Replies: 8

-

Does small US LLC company selling B2C to EU customers have to add VAT?

- Started by vgahdmi123

- Replies: 1

-

Thailand approves five-year crypto tax exemption

- Started by Mercury

- Replies: 4