Hey guys

Just trying to get a handle on the new CT regs in the UAE and thought I'd bounce my situation off you all to ensure I'm on track.

Here's my deal:

Here is my understanding:

Just do not want to get fined or flagged for something as stupid as not registering.

TL;DR:

Any info will be highly appreciated.

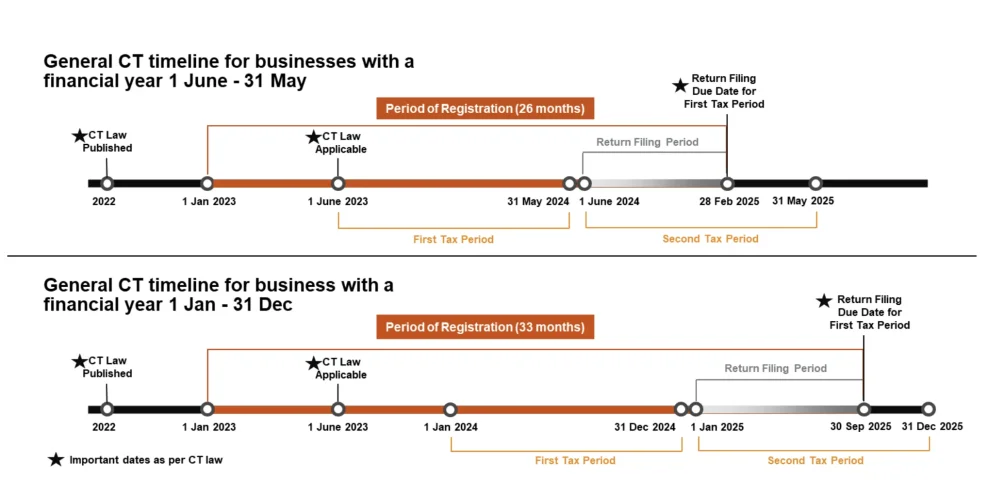

I've addeda screenshot of what I have found on the UAE FTA website.

Just trying to get a handle on the new CT regs in the UAE and thought I'd bounce my situation off you all to ensure I'm on track.

Here's my deal:

- I own a FZCO incorporated with IFZA since 1 March 2022.

- Marketing, Consultancy, Internet Content licenses.

- Keeping profits just shy of 375K AED for now, and have not registed with VAT or Tax since I am not above the threshold.

Here is my understanding:

- We've got until 31 December 2024 to register for Corporate Tax.

- Post-registration, our first tax return, and any payment is due by 30 September 2025.

Just do not want to get fined or flagged for something as stupid as not registering.

TL;DR:

- Company in IFZA Dubai freezone, started 1 March 2022.

- Register for Corporate Tax by 31 Dec 2024.

- File and pay taxes by 30 Sep 2025.

Any info will be highly appreciated.

I've addeda screenshot of what I have found on the UAE FTA website.