https://taxfoundation.org/democrats-top-income-tax-rate/

---- quote start

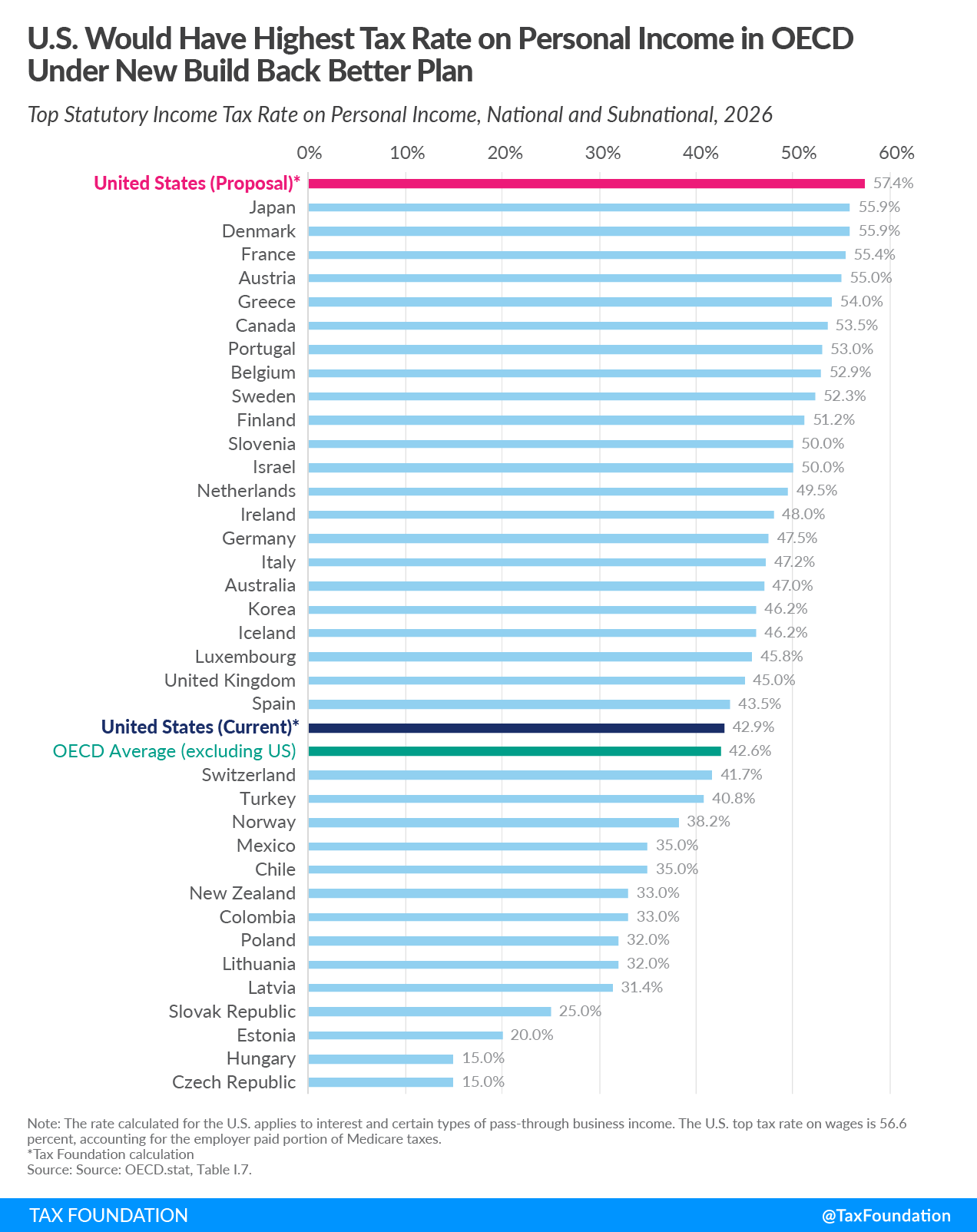

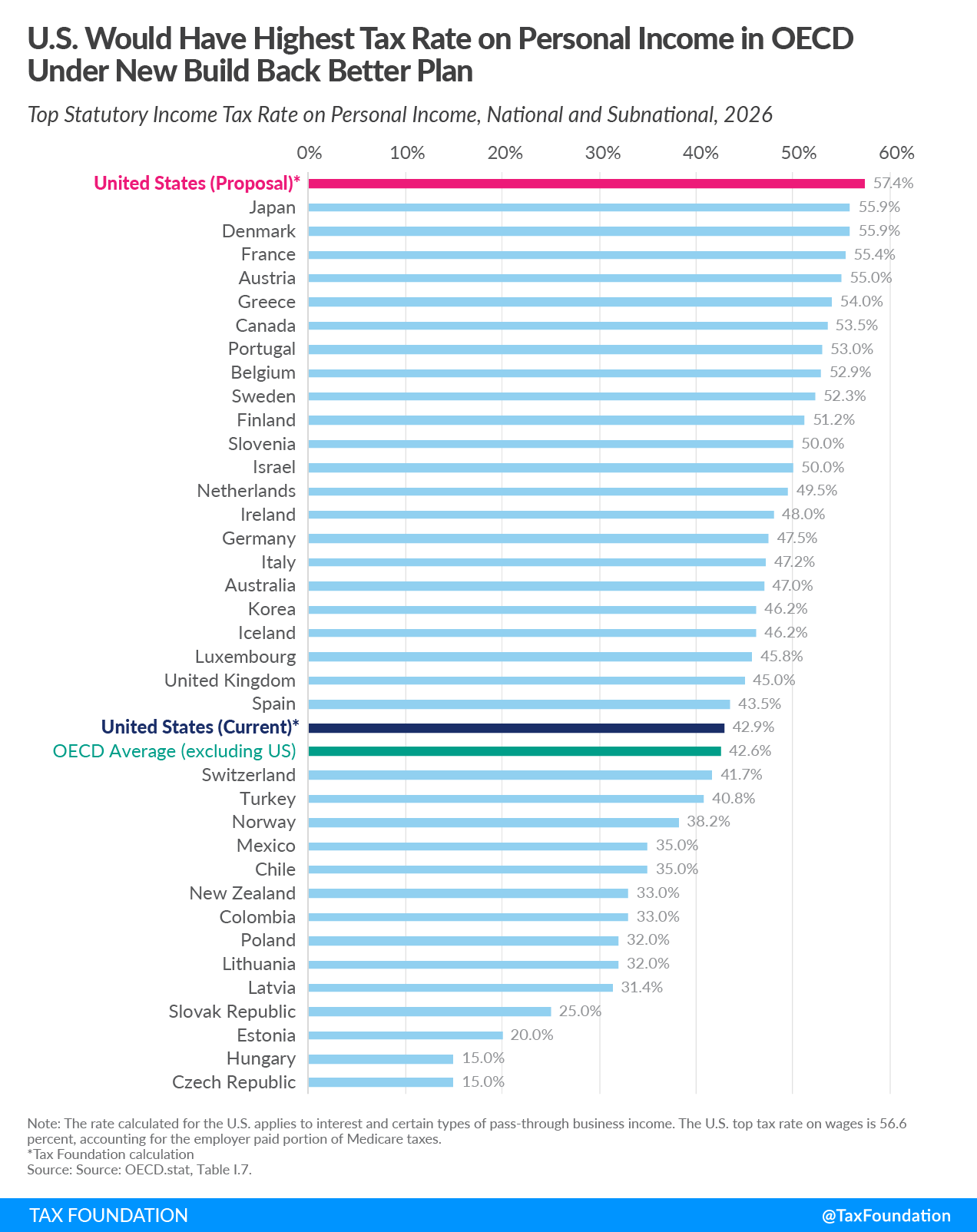

Under the latest iteration of the House Build Back Better Act (BBBA), the average top tax rate on personal income would reach 57.4 percent, giving the U.S. the highest rate in the Organisation for Economic Co-operation and Development (OECD).

High-income taxpayers would face a surcharge on modified adjusted gross income (MAGI), defined as adjusted gross income less investment interest expense. The surcharge would equal 5 percent on MAGI in excess of $10 million plus 3 percent on MAGI above $25 million, for a total surcharge of 8 percent (equivalent to about a 9.1 percent tax rate on taxable income). The plan would also redefine the tax base to which the 3.8 percent net investment income tax (NIIT) applies to include the “active” part of pass-through income—all taxable income above $400,000 (single filer) or $500,000 (joint filer) would be subject to tax of 3.8 percent due to the combination of NIIT and Medicare taxes. Under current law, the top marginal tax rate on ordinary income is scheduled to increase from 37 percent to 39.6 percent starting in 2026. Overall, the top marginal tax rate on personal income at the federal level would rise to 51.4 percent (or 52.5 percent on the basis of taxable income).

In addition to the top federal rate, individuals face taxes on personal income in most U.S. states. Considering the average top marginal state-local tax rate of 6.0 percent, the combined top tax rate on personal income would be 57.4 percent—higher than currently levied in any developed country. This assumes the deduction for state and local taxes remains capped.

Taxpayers in New York and California would face the highest tax rates, at 66.2 percent and 64.7 percent respectively, while six other states plus the District of Colombia would have top rates exceeding 60 percent. Even in states that forgo an income tax, such as Florida, taxpayers would have a top rate of 51.4 percent, which far exceeds the top rates found in most OECD countries.

As policymakers explore options to raise revenue, they should keep in mind how the U.S. compares to other countries and what the economic effects might be. Raising the top marginal tax rate on ordinary income to the highest in the OECD will damage U.S. competitiveness. It will also reduce incentives to work, save, invest, and innovate, with broad implications for the U.S. economy.

---- quote end

---- quote start

Under the latest iteration of the House Build Back Better Act (BBBA), the average top tax rate on personal income would reach 57.4 percent, giving the U.S. the highest rate in the Organisation for Economic Co-operation and Development (OECD).

High-income taxpayers would face a surcharge on modified adjusted gross income (MAGI), defined as adjusted gross income less investment interest expense. The surcharge would equal 5 percent on MAGI in excess of $10 million plus 3 percent on MAGI above $25 million, for a total surcharge of 8 percent (equivalent to about a 9.1 percent tax rate on taxable income). The plan would also redefine the tax base to which the 3.8 percent net investment income tax (NIIT) applies to include the “active” part of pass-through income—all taxable income above $400,000 (single filer) or $500,000 (joint filer) would be subject to tax of 3.8 percent due to the combination of NIIT and Medicare taxes. Under current law, the top marginal tax rate on ordinary income is scheduled to increase from 37 percent to 39.6 percent starting in 2026. Overall, the top marginal tax rate on personal income at the federal level would rise to 51.4 percent (or 52.5 percent on the basis of taxable income).

In addition to the top federal rate, individuals face taxes on personal income in most U.S. states. Considering the average top marginal state-local tax rate of 6.0 percent, the combined top tax rate on personal income would be 57.4 percent—higher than currently levied in any developed country. This assumes the deduction for state and local taxes remains capped.

Taxpayers in New York and California would face the highest tax rates, at 66.2 percent and 64.7 percent respectively, while six other states plus the District of Colombia would have top rates exceeding 60 percent. Even in states that forgo an income tax, such as Florida, taxpayers would have a top rate of 51.4 percent, which far exceeds the top rates found in most OECD countries.

As policymakers explore options to raise revenue, they should keep in mind how the U.S. compares to other countries and what the economic effects might be. Raising the top marginal tax rate on ordinary income to the highest in the OECD will damage U.S. competitiveness. It will also reduce incentives to work, save, invest, and innovate, with broad implications for the U.S. economy.

---- quote end