Our valued sponsor

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What are you doing with your "petty" cash? Where are you hiding it?

- Thread starter Sean Restling

- Start date

Yeah tell me about it, it's become difficult to spend, difficult to deposit.. still, nice to have some though..

Buy gold as insurance. All of human history involves cycles (economic, political, wars, etc.) and we are now entering overlapping cycles of strife and uncertainly. Read "The Storm Before the Calm," by George Friedman and similar works that discuss these historical cycles for further insight.

https://www.amazon.com/Storm-Before...=1642037337&sprefix=the+storm+,aps,193&sr=8-1

https://www.amazon.com/Storm-Before...=1642037337&sprefix=the+storm+,aps,193&sr=8-1

Even though I agree with the thesis of "overlapping cycles of strife and uncertainty" I am not sure if Gold is (still) a useful insurance. Times have changed significantly: Gold is available in abundance (the universe is full of it), even on Planet Earth we mine more of it every year, almost all Gold "produced" in the past 4'000 years is still available and Gold has only very little industrial use (about 5%, hence there will never be a shortage of the yellow metal).Buy gold as insurance. All of human history involves cycles (economic, political, wars, etc.) and we are now entering overlapping cycles of strife and uncertainly. Read "The Storm Before the Calm," by George Friedman and similar works that discuss these historical cycles for further insight.

https://www.amazon.com/Storm-Before...=1642037337&sprefix=the+storm+,aps,193&sr=8-1

Then there is a general change of behaviour how value is perceived. It is sort of a tectonic shift like the switch from the horse/camel/elephant, which mankind used for thousands of years as mode of transportation, towards more convenient and efficient automotive vehicles.

I do not know what will replace Gold as a store of value but it is obvious that what mankind did during the past 4'000 years with regards to "store of value" is no longer valid. This is a pretty bleak picture for an insurance.

Diamonds: The worst idea because the entire market is controlled by a cartel. Plus the fact that you rely on a handful of dealers who will always come up with fantasy prices on both sides. Even if everything works out fine (the stones are what the certificate says and the certificate is recognized) you have to calculate an immediate and significant loss when buying today at dealer A and selling one hour later at dealer B.One could easily be cheated buying diamonds.

-------------------------------------------------------------

We all think too much about the future. What's the sense of it?

We spend only limited time on Planet Earth, permanently think about wealth accumulation/wealth preservation. What for?

If you have excess money, keep cash and enjoy your life with that cash.

Always bear in mind that in times of real crisis the government will take it all.

So, the best form of wealth preservation is to live a fun life because nobody can later take it away from you.

Last edited:

I do not know what will replace Gold as a store of value but it is obvious that what mankind did during the past 4'000 years with regards to "store of value" is no longer valid.

Gold as a store of value is no longer valid? Utterly ridiculous. Then why do central banks, directed by some of the finest minds on the planet, continue to buy and hoard gold? And in many cases, they do so at a record pace. It is because central banks realize that gold is the only real money -- and that it acts as insurance against the collapse of fiat currency, which is simply a form of credit evidenced by a note of indebtedness. Indeed, that is why they are called "banknotes." Gold is the only major form of money not issued or controlled by any central bank. As such, it will always be money . . . real money . . . and it will always be a store of value.

Following the Panic of 1907, John Pierpont Morgan was called to testify before Congress in 1912 on the subject of Wall Street manipulations and what was then called the “money trust” or banking monopoly of J. P. Morgan & Co.

In the course of his testimony, Morgan made one of the most profound and lasting remarks in the history of finance.

In reply to questions from the congressional committee staff attorney, Samuel Untermyer, the following dialogue ensued as recorded in the Congressional Record. Untermyer:

I want to ask you a few questions bearing on the subject that you have touched upon this morning, as to the control of money. The control of credit involves a control of money, does it not?

Morgan: A control of credit? No.

Untermyer: But the basis of banking is credit, is it not?

Morgan: Not always. That is an evidence of banking, but it is not the money itself. Money is gold, and nothing else.

Morgan’s observation that “Money is gold, and nothing else,” was right in two respects.

The first and most obvious is that gold is a form of money. The second and more subtle point revealed in the phrase “and nothing else,” was that other instruments purporting to be money were really forms of credit unless they were redeemable into physical gold.

Compare gold to something like Bitcoin, which originally claimed to be a form of money but then utterly failed in its original mission by never possessing any type of stable value. As any type of real money (i.e., having a stable value), it quickly became a joke.

Last edited:

Use the money for regular expenses, and keep the hard earned ones in the bank.I'm talking a few thousands euros, some tens of thousands tops.. I live in the EU neighbouring Switzerland and could deposit there but that probably wouldn't escape reporting.. What are you guys doing with it, buying art?!

Use the money for regular expenses, and keep the hard earned ones in the bank.

I know, that would be a sensible thing, but for a few reasons I prefer to spend the money in the bank and set aside the cash

As you can see in my above post I did not mention any cryptocurrency in this context.Gold as a store of value is no longer valid? Utterly ridiculous. Then why do central banks, directed by some of the finest minds on the planet, continue to buy and hoard gold? And in many cases, they do so at a record pace. It is because central banks realize that gold is the only real money -- and that it acts as insurance against the collapse of fiat currency, which is simply a form of credit evidenced by a note of indebtedness. Indeed, that is why they are called "banknotes." Gold is the only major form of money not issued or controlled by any central bank. As such, it will always be money . . . real money . . . and it will always be a store of value.

Compare gold to something like Bitcoin, which originally claimed to be a form of money but then utterly failed in its original mission by never possessing any type of stable value. As any type of real money (i.e., having a stable value), it quickly became a joke.

To be a store of value the asset should develop inline with inflation, with very low volatility. Under normal circumstances that should be achievable with bonds but global central banks have destroyed this options (-> and pushed millions of retirees into poverty).

Unfortunately, gold does not live up to its promise when it comes to volatilty: In the past ten years alone gold first saw a rise to the moon, just to collapse by 50%, and now being up half-way to its former high it first reached about ten years ago. Not to speak of the catastrophic performance of gold during the 1980's and 1990's. That alone makes it a rather risky investment and not exactly a store of value.

You are absolutely correct that there are central banks who continue purchasing gold and hoarding it in large quantities: Kazakhstan, Russia, Kyrgyzstan, Turkey, Qatar, China, Poland, Hungary .... . It should be obvious that this is much more politically motivated than anything else.

John Pierpont Morgan testified before Congress in 1912. That was 110 years ago. Back then gold was indeed real money and he could not have said anything else. The Dollar was pegged to gold (or vice versa, however you want to read it) and that's what was called the Gold Standard. Back then the Dollar was a young currency, the Federal Reserve -as we know it today- not even founded. Moreover, gold was still the dominant "currency" throughout the world - banknotes (printed money) had just been invented.

Having said that, I am sure you admit that citing J.P. Morgan in the context of our search for a "store of value" is not suitable anymore. Times have changed too much in the past 110 years.

I do not admit that at all. In fact, gold is still the only universal store of value. Even the USD is a distant second. Nothing that you have said proves otherwise. Gold is insurance because it acts conversely to whatever currency you hold. For example, if the value of the USD declines then gold usually goes up and vice versa. Regarding the volatility that you mentioned, gold's volatility simply mirrors the volatility of the underlying currency.Having said that, I am sure you admit that citing J.P. Morgan in the context of our search for a "store of value" is not suitable anymore. Times have changed too much in the past 110 years.

If you hold gold, then you have a hedge against a currency decline -- or even a collapse. Nothing else provides a universal hedge against the collapse of any particular currency. Gold works as insurance in almost every country on the planet.

As you can see in my above post I did not mention any cryptocurrency in this context.

To be a store of value the asset should develop inline with inflation, with very low volatility.

I suppose there are different definitions of store of value than. If you look at Michal Saylors definition, that guy that pushed Bitcoin at the end of 2020 to a new high, I would agree that Bitcoin is at least some kind of a store of value (not all cryptocurrencies though). And if your time horizon is at least 4 years you most likely end up outperforming inflation.

What you describe is the ideal scenario and the way gold should react in times of crisis. And it still does react that way when we take TRY, ARS, RUB, VEF/VES, EGP and the like. However, the aforementioned currencies are not the benchmark and when taking Gold against CHF or USD it did not live up to its expectations during the past 40 years stability-wise.I do not admit that at all. In fact, gold is still the only universal store of value. Even the USD is a distant second. Nothing that you have said proves otherwise. Gold is insurance because it acts conversely to whatever currency you hold. For example, if the value of the USD declines then gold usually goes up and vice versa. Regarding the volatility that you mentioned, gold's volatility simply mirrors the volatility of the underlying currency.

If you hold gold, then you have a hedge against a currency decline -- or even a collapse. Nothing else provides a universal hedge against the collapse of any particular currency. Gold works as insurance in almost every country on the planet.

Note: I am looking for a reliable store of value and do not see that with Gold. Just to clarify, neither do I see CHF or USD as a store of value because central banks destroyed the "bond-option" (see my above post).

I agree that you might be able to outperform inflation but the same can be said about certain stocks and other financial instruments.I suppose there are different definitions of store of value than. If you look at Michal Saylors definition, that guy that pushed Bitcoin at the end of 2020 to a new high, I would agree that Bitcoin is at least some kind of a store of value (not all cryptocurrencies though). And if your time horizon is at least 4 years you most likely end up outperforming inflation.

My discussion with @Golden Fleece is much more about a reliable store of value and stability. Unfortunately, BTC is too volatile to fit into this. Perhaps this changes one day but as long as the value of BTC goes up and down by 50% in a matter of weeks it is very far away from being a store of value.

Last edited:

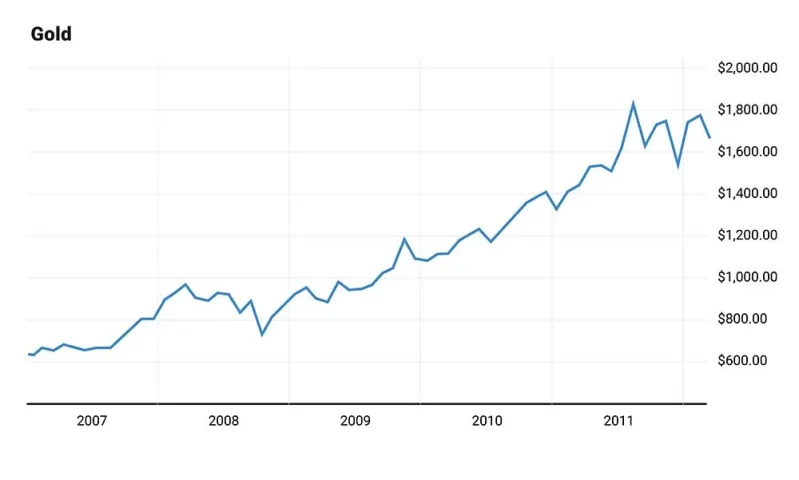

The problem is that you refuse to cite any actual facts for your unsupported thesis -- and, in fact, the actual evidence is contrary to all your assertions. Gold has indeed risen in USD during times of crises during the past forty years, most recently in the wake of the worldwide financial crisis after 2008.What you describe is the ideal scenario and the way gold should react in times of crisis. And it still does react that way when we take TRY, ARS, RUB, VEF/VES, EGP and the like. However, the aforementioned currencies are not the benchmark and when taking Gold against CHF or USD it did not live up to its expectations during the past 40 years stability-wise.

After the initial liquidation period in late-2008 (when investors de-leveraged out of all assets, including gold, and fled to the perceived safety of the USD), gold rose steadily after the crisis.

Attachments

Last edited:

I fully understand that you love gold. Nothing is wrong with that.The problem is that you refuse to cite any actual facts for your unsupported thesis -- and, in fact, the actual evidence is contrary to all your assertions. Gold has indeed risen in USD during times of crises during the past forty years, most recently in the wake of the worldwide financial crisis after 2008.

After the initial liquidation period in late-2008 (when investors de-leveraged out of all assets, including gold, and fled to the perceived safety of the USD), gold rose steadily after the crisis.

However, justifying your thesis by posting a 4-year chart while we are talking about a "store of value" doesn't make your arguments any more credible. What you now do is as serious as somebody posting a BTC chart over the same period of time (well, it would have to start one to two years later but the time frame can be drawn out for the same period) and claiming that BTC is a "store of value"

.

.Btw., why does your chart stop at the point when gold started crashing?

No, I brought up the topic of gold as "insurance" (see my first post, which is post #4), which it most certainly is (as proven by that chart). Insurance and a store of value are two different but interrelated issues. And no, I do not love gold. I hold a very minimal amount of gold, compared to my other assets. But as a prudent person, you should always have insurance, whether or not you feel that you need it. That was my point.I fully understand that you love gold. Nothing is wrong with that.

However, justifying your thesis by posting a 4-year chart while we are talking about a "store of value" doesn't make your arguments any more credible.

So, I proved that gold worked both as insurance (and a store of value, which is an issue that you raised, not me) in the wake of the 2008 financial crisis. And if you use gold as insurance against a crisis, and as a store of value during a crisis, then why would you need to see the part of the gold chart after the crisis is over? Of course gold will decline in price after a crisis is over. So, none of what you say makes any sense.

Last edited:

price in the past 20y.... currently at almost ATH...

It could easily loose 20-35% in next year or two...

so I would not touch it at this point...

about your initial question - you could just keep it in cash...

It could easily loose 20-35% in next year or two...

so I would not touch it at this point...

about your initial question - you could just keep it in cash...

about your initial question - you could just keep it in cash...

Yes that's what I'm doing, and this thread proved there aren't that many good alternatives..

Latest Threads

-

Germany's SPD unveils plan to boost investment with 'Made in Germany' premium

- Started by Martin Everson

- Replies: 3

-

-

-

-

Offshore company (in or out of EU) with EU residency only

- Started by Delta

- Replies: 5