What do you mean Georgia HNWI is not acceptet for DTT? You are awarded Georgia

tax residency from Georgian side, then article 4 of DTT will further clarify in which country you will be considered tax resident in case another country will claim you are tax resident there.

The Georgian HNWI certificate is not an ordinary tax residence certificate. Not only does it look different, it explicitly states that it has been issued based on your special status. Furthermore, that this status is not based on ordinary residency.

Due to this a foeign tax administration will refuse to grant DTT benefits, if this claim is exclusively based on the presentation of such a certificate.

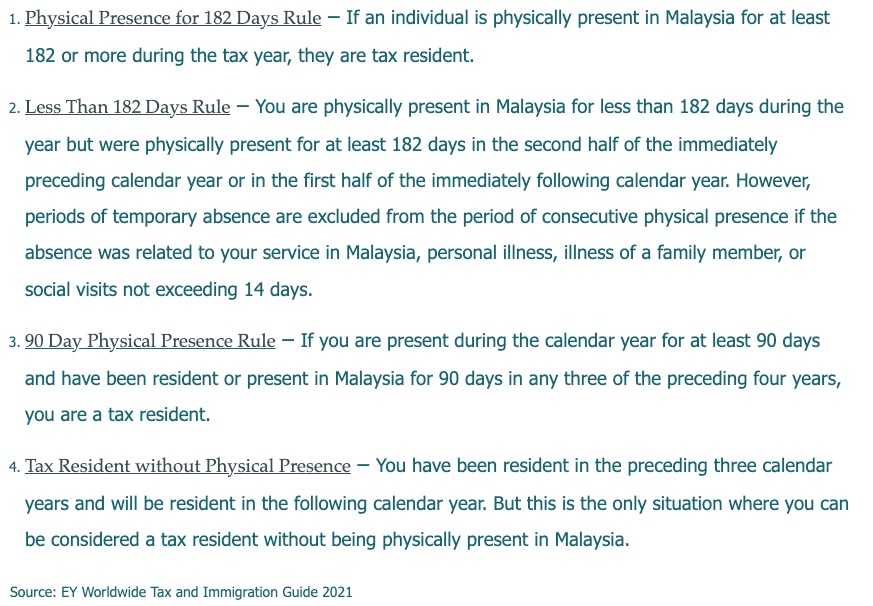

Why do you say that MM2H does not have tax implications?

Having an MM2H is not sufficient to claim tax residency. MM2H grants the right to stay in Malaysia for an extended period of time. It does not oblige you to stayed. Without tax residency MM2H has zero tax implications.

A residence permit has nothing to do with taxation!

Are those the current requrement for the SRRV?

No, SRRV SMILE doesn't exist anymore. It has been abolished in 2021 when PRA reopened.

Only SRRV CLASSIC is applicable.

Furthermore, internal procedures have been tightened massivley. Today the following applies:

If you are from a Western country that has friendly relations with the Philippines your chances are good to secure the SRRV.

If you are from an exotic country or a territory where the Philippines has certain problems with your application might need more time and the outcome is quite uncertain.

If you are from China, do not waste your time (no more SRRV for them after all the misuse).

It is expected that SRRV terms will be changed soon: More expensive, less countries, again a higher age limit (60).

All documents presented for the application process need to be translated, authenticated, notarized and apostilled.

Money needs to come directly from abroad in US-Dollar and wired by SWIFT to a transactional account (only functional for this one-time procedure) which has to be opened by you in your name in the Philippines. From there your money goes into to a Special Purpose TD in your name at the same bank.

The benefits listed on the website are not applicable in the way listed there (outdated). Specifically points 3. and 6.: No more assistance with other agencies since PRA does not have the workforce for it anymore. Health insurance now has a specfic "resident alien tariff" with lower benefits and higher premium compared to the tariff for resident citizens.

You must have visited a different Dubai (ref to item 3 above)

![taxes[1].webp](/data/attachments/4/4182-9ca5a7866dbc20f9cec593810f93ca8a.jpg?hash=03Ix604sF7)