Dubai is a monarchy that operates under Sharia law. The government is seen as being always right, and the courts are often seen as being biased in favor of the government or local businesses. This makes it difficult for businesses to get a fair hearing if they are involved in a dispute with the government or a local business.

As a result, many businesses prefer to operate in countries with more democratic systems and fair justice systems. For example, Singapore has a 17% corporate tax rate, but businesses are willing to pay this rate because they know that they will receive a fair hearing if they ever have a dispute with the government.

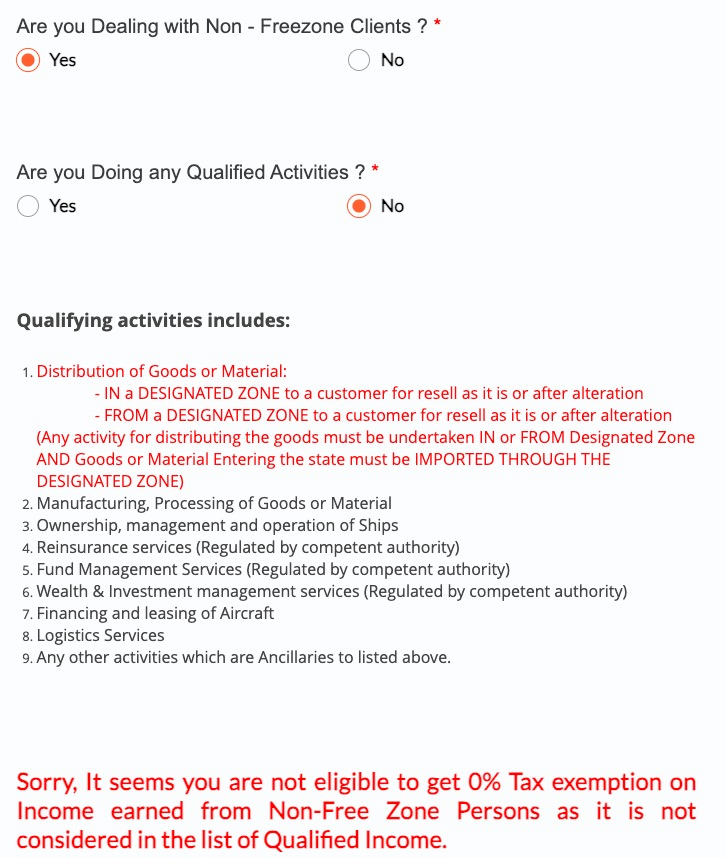

Dubai's tax-free status was one of its main attractions for businesses, but this status has now been revoked. As a result, businesses are now looking to other countries to set up their operations. Dubai is now seen as being nothing more than an over-glorified tourist destination with everything artificial under the sun.

https://www.turnerlittle.com/offsho...u-should-move-your-company-away-from-the-uae/worth reading Master piece written before many months