This just hit my inbox - just in case some lovers of counterparty risk would like to make "easy money"

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Blackcatcard - interest on balance

- Thread starter void

- Start date

Looks interesting to me, however, it would require that I trust them with a big portion of my money and I don't do that. Why would I want to earn 4% in interest if this is an high risk investment where I can risk all my money!??

Blackcatcard reamins an EMI so far, not a bank, so seems like they do not fall under asset protection plan for all the balances under 100k EUR. But they call themselves a banking platform, kind of misleading

The interest was credited to my account without any problems, I had a smaller 5-digit sum parked there for a few weeks.

Trade Republic should currently also have 4% interest per year on EUR (they also recently received their banking license)

Trade Republic should currently also have 4% interest per year on EUR (they also recently received their banking license)

Good to know.The interest was credited to my account without any problems, I had a smaller 5-digit sum parked there for a few weeks.

Nevertheless, 4% interest per year on EUR is IMO not so much... (taking into account that this is not a conservative investment...)

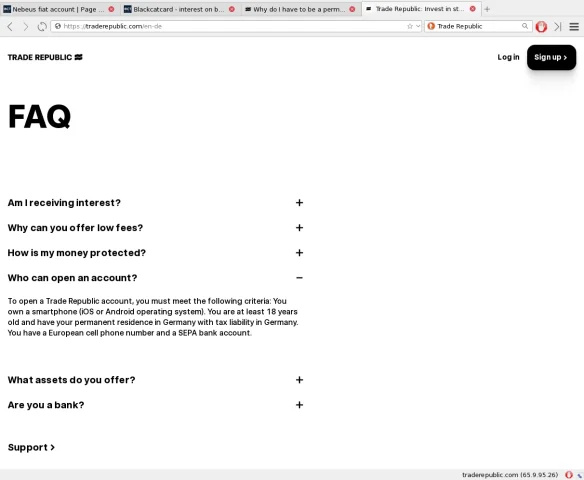

Correct; perhaps worth mentioning that they currently onboard German residents only.Trade Republic should currently also have 4% interest per year on EUR (they also recently received their banking license)

https://support.traderepublic.com/e...to-be-a-permanent-resident-to-open-an-accountCorrect; perhaps worth mentioning that they currently onboard German residents only.

"

As an investment firm, we can only accept applications from customers if they are a permanent resident in the country in which we also offer our product.

At the moment, Trade Republic is available in Germany, Austria, France, Spain, Italy, the Netherlands, Belgium, Luxembourg, Finland, Ireland, Greece, Portugal, Estonia, Latvia, Lithuania, Slovenia and Slovakia.

We are working on giving customers residing in other countries access to Trade Republic in the future."

Well, so they apparently have inconsistent information at their pages – see their FAQ, Who can open an accounthttps://support.traderepublic.com/e...to-be-a-permanent-resident-to-open-an-account

"

As an investment firm, we can only accept applications from customers if they are a permanent resident in the country in which we also offer our product.

At the moment, Trade Republic is available in Germany, Austria, France, Spain, Italy, the Netherlands, Belgium, Luxembourg, Finland, Ireland, Greece, Portugal, Estonia, Latvia, Lithuania, Slovenia and Slovakia.

We are working on giving customers residing in other countries access to Trade Republic in the future."

Attachments

Does anyone know, when they credit cashback for card purchases?

The cashback for my debit card purchases last month are still missing.

I hope the interest will be paid more reliably.

The cashback for my debit card purchases last month are still missing.

I hope the interest will be paid more reliably.

So this service is only for people living in Germany! Nice, all the rest can't use this service..Well, so they apparently have inconsistent information at their pages – see their FAQ, Who can open an account

From what I recall, also another DE neobanks started in this way, N26 included, I guess. Maybe some local habitSo this service is only for people living in Germany! Nice, all the rest can't use this service..

And seriously – the another information referenced by @bigdaddyleon names Eurozone countries (just at a glance, have not checked it thoroughly). This also makes sense.

So either one is outdated or one concerns current account openings and another one concerns investments...

Well, so they apparently have inconsistent information at their pages – see their FAQ, Who can open an account

Seems like they are only available in countries where euro (€) is the official currency.

Similar threads

- Replies

- 42

- Views

- 6,279

- Replies

- 3

- Views

- 587

- Replies

- 7

- Views

- 899

- Replies

- 15

- Views

- 1,179

- Replies

- 0

- Views

- 362

Latest Threads

-

-

-

Litigation Finance - My 26M Euros portfolio (BONUS: Free resources)

- Started by James Orwell

- Replies: 4

-

Mentor Group Gold - AD Thread! kemycard.com | Crypto Virtual Cards | Reloadable Without KYC | BIN USA

- Started by ththugues4

- Replies: 1

-

banking (fiat to crypto to fiat) for unconventional businesses (gambling, adult, and more)

- Started by Gediminas

- Replies: 2