Hiya everyone,

I really need some advice. I'm a UK citizen living in South America. My tax residency has great tax rules so no probs there. However, tons of banks and EMIs don't accept registered businesses from here. So, I urgently need to do something as I've been using Wise (Transferwise) but they said I need a business account. So I'm thinking offshore. My priorities are easy or preferably no reporting and low tax, and not stupid costly to start.

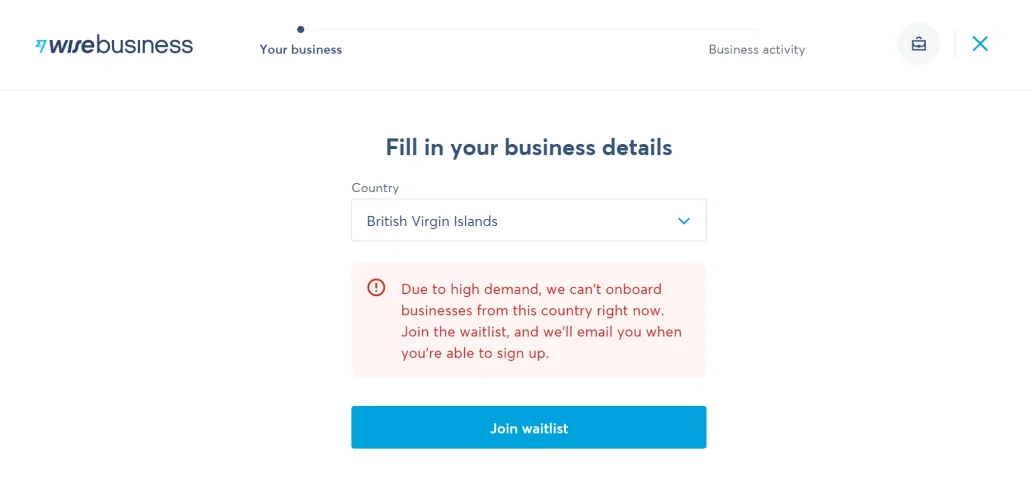

I'm currently leaning towards BVI, but I'd love to do Europe really. Any ideas folks? Thanks so much in advance

I really need some advice. I'm a UK citizen living in South America. My tax residency has great tax rules so no probs there. However, tons of banks and EMIs don't accept registered businesses from here. So, I urgently need to do something as I've been using Wise (Transferwise) but they said I need a business account. So I'm thinking offshore. My priorities are easy or preferably no reporting and low tax, and not stupid costly to start.

I'm currently leaning towards BVI, but I'd love to do Europe really. Any ideas folks? Thanks so much in advance