Anyone have experience, did a interview a few weeks ago, passed, deposited 5,000 today so the account could be opened and immediately got a email saying have to do KYC and provide a CV.

Kinda backwards, f**k knows what happens to the cash if you don't pass their checks.

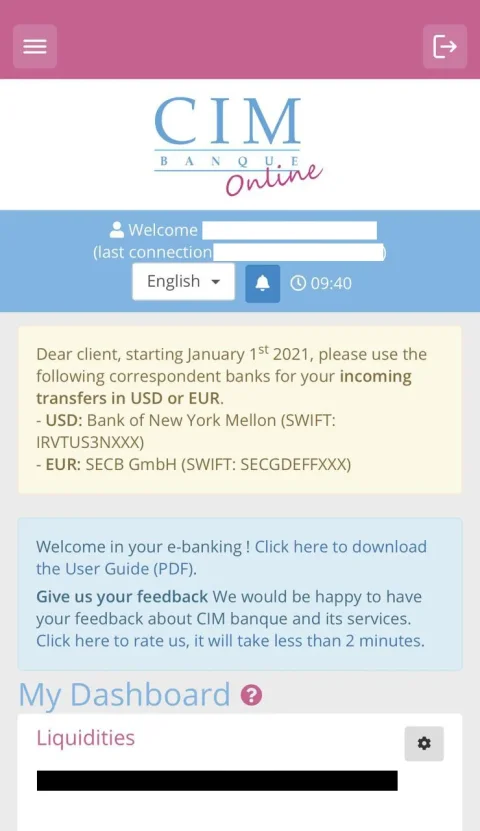

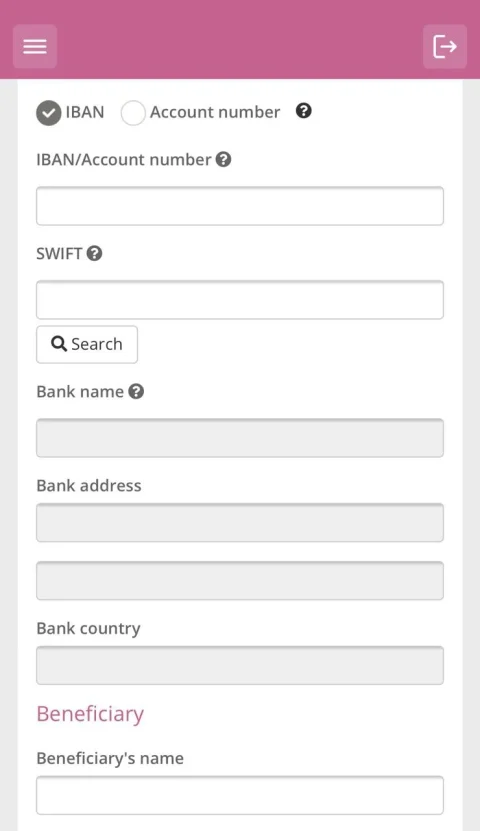

Don't worry about CIM Banque at all. They are legitimate, and our company referred many clients to CIM Banque already. Internet banking is quite smooth and modern. All kinds of fees are rather expensive, compare to other banks.

BigUnicorn is right, they are a regulated institution in Switzerland (it's not a first-class bank in Switzerland).

You will be returned your $5,000 if your application will be rejected, as quick as they receive it from you. However, I hardly saw any application that couldn't pass the opening process. The staffs are quite helpful and open to help you to archive your goal to open your bank account. It doesn't mean that you could have the account forever. CIM Banque is quite strict these days regarding incoming and outgoing payments. Be prepared to be asked for supporting documents for most of your payments.

IMO, it's the best bank if you will use it as a place to park your saving money, spending with the cards (they have pretty good card options, provided by Swiss Banker

Prepaidkarten & innovative Zahlungsmöglichkeiten | Swiss Bankers), but absolutely, not for daily operations. I would not advise it if you plan to use the account for many transactions.

Here are some screenshots of CIM Banque App as of date (well you can Google and see no similar picture, so I post them here and I'm sure it will help others who are looking at CIM Banque as an option)

Good luck with your application and I hope your own account will be opened soon!