https://taxsummaries.pwc.com/italy/individual/residence

"An anti-abuse rule provides that Italian citizens who transfer residence to countries considered as ‘tax havens’ (these are determined through a Decree of the Ministry of Finance), are deemed to be resident in Italy even if they are no longer registered in the Records of the Italian Resident Population, unless otherwise proven by the individuals."

https://www.swissinfo.ch/eng/politics/italy-takes-switzerland-off-list-of-tax-havens/48450366

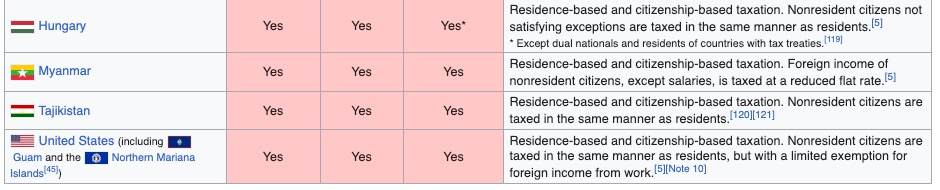

Anyone who knows other EU countries that have citizenship based taxation when moving to tax havens?

"An anti-abuse rule provides that Italian citizens who transfer residence to countries considered as ‘tax havens’ (these are determined through a Decree of the Ministry of Finance), are deemed to be resident in Italy even if they are no longer registered in the Records of the Italian Resident Population, unless otherwise proven by the individuals."

https://www.swissinfo.ch/eng/politics/italy-takes-switzerland-off-list-of-tax-havens/48450366

Anyone who knows other EU countries that have citizenship based taxation when moving to tax havens?