They are run by morons on top of all what has been written here. The better staff left years ago.Some are saying that they were sunk because they, like DB, dared to go do business in the US. Anyone can confirm?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Suisse going bankrupt?

- Thread starter GeneralGogol

- Start date

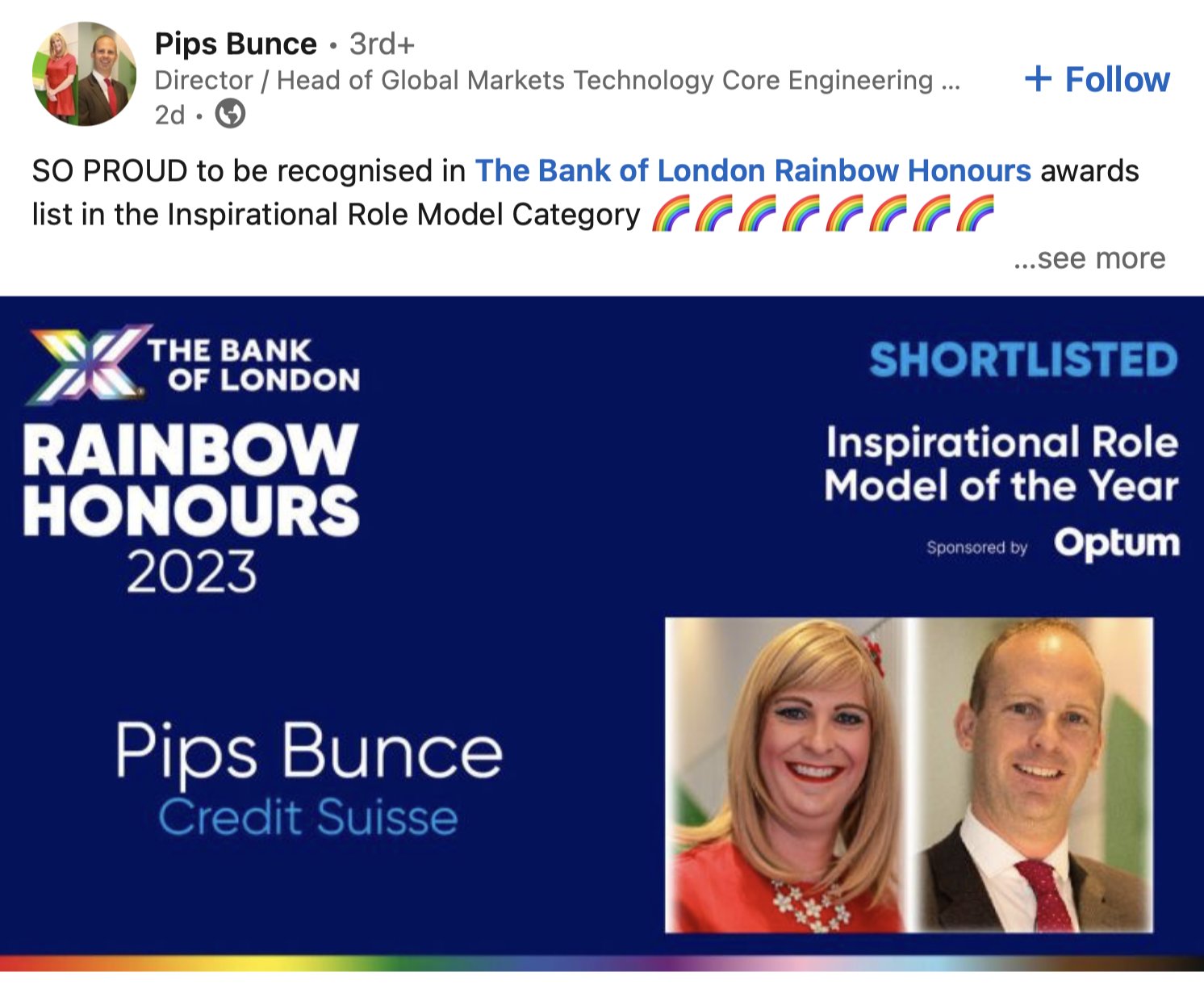

How did it happen? they've got top notch management, plenty of awards!

head of global markets (the second one lol)

TOP FEMALE EXECUTIVE 2018

INSPIRATIONAL ROLE MODEL OF THE YEAR 2023

head of global markets (the second one lol)

TOP FEMALE EXECUTIVE 2018

INSPIRATIONAL ROLE MODEL OF THE YEAR 2023

UBS in talks to acquire Credit Suisse

https://www.ft.com/content/17892f24-4ca0-417f-9093-289b019a0852

https://www.ft.com/content/17892f24-4ca0-417f-9093-289b019a0852

What would happen to the euro deposits at Medirect if CS goes bankrupt? Can Medirect simply choose another routing, or would the money be trapped for the time being, as with EPB?

I did not get your answer. But thanks a lot for your reply.This being said if you look at some banks they hold multiple correspondence banks for each currency for this very reason i.e BOG has 5 USD correspondence bank accounts and 7 EUR correspondence bank accounts. I guess Medirect has a sweet heart deal with CS or maybe has backup banks but does not publish them as they are not in regular use.

Lets say, say someone have an account at Medirect and the incoming funds were routed via CS.

Can Medirect send these fund out via their direct connection to ECB? Or is it mandatory to send them the same route as the funds were received (via CS in this case)?

If they have enough liquidity in ECB or somewhere else, yes, they can pay it out via that channel. Banks are free to use whichever correspondent is best.Lets say, say someone have an account at Medirect and the incoming funds were routed via CS.

Can Medirect send these fund out via their direct connection to ECB? Or is it mandatory to send them the same route as the funds were received (via CS in this case)?

However, if they don't have liquidity, they may not be able to process the transaction, at least not without some financial aid or until they have received enough incoming funds on the account.

Lets say, say someone have an account at Medirect and the incoming funds were routed via CS.

Can Medirect send these fund out via their direct connection to ECB?

Routed via CS?? The funds are held with CS in Medirects Nostro accounts they hold within CS for each currency. So no.

How can they send out funds stuck in their Nostro accounts at CS. Thats like saying can EPB send funds stuck in their Nostro acconts at Banco Novo to another correspondence account - they can't as funds are stuck lol.

Or is it mandatory to send them the same route as the funds were received (via CS in this case)?

No. But one would need to transfer the funds from their Nostro account at CS to their Nostro account at the ECB. How can that happen if CS stopped functioning? Medirect would simply be stuck as would every bank on planet using CS.

The reason as a bank you should maintain multiple correspondence accounts (i.e Nostro Accounts) like BOG does is to spread your risk around. Don't keep all your eggs in one basket. The same reason I keep multiple personal accounts everywhere.

The fate of Credit Suisse could be decided in the next 36 hours

https://www.msn.com/en-us/money/per...ill-ubs-step-up-with-a-rescue-bid/ar-AA18MXYMSince when the Swiss work on weekends?The fate of Credit Suisse could be decided in the next 36 hours

https://www.msn.com/en-us/money/per...ill-ubs-step-up-with-a-rescue-bid/ar-AA18MXYM

Since when the Swiss work on weekends?

Your absolutely right. Not even the Swiss Air-force work outside office hours.

The Swiss air force: armed and dangerous, but only in office hours

https://www.theguardian.com/world/s...rce-ethiopian-airlines-hijacking-office-hoursCredit Suisse's Days Are Numbered

https://www.thestreet.com/banking/credit-suisses-days-are-numbered----- Quote start

The Swiss government has urged UBS to acquire Credit Suisse (CSGKF) , in an attempt to end the crisis of confidence around the bank, which has been rocked by numerous scandals over the past few years. The government, which provided Credit Suisse a 50 billion Swiss Franc loan (almost $54 billion) to shore up its liquidity this week, is not in a position to intervene further, fearing public backlash in using taxpayer money to bail out the bank.

---- Quote end

I thought the public outrage and pre-existing plan FINMA had on how to handle this exact situation would kick in. But in end the Swiss bottled it and bailed them out. Lol....wonder what will happen to all those bankers compensated in CS Shares including former CEO's

.

.The house is on fire when the bureaucrats work on a sat evening.Your absolutely right. Not even the Swiss Air-force work outside office hours.

The Swiss air force: armed and dangerous, but only in office hours

https://www.theguardian.com/world/s...rce-ethiopian-airlines-hijacking-office-hours

Credit Suisse's Days Are Numbered

https://www.thestreet.com/banking/credit-suisses-days-are-numbered

----- Quote start

The Swiss government has urged UBS to acquire Credit Suisse (CSGKF) , in an attempt to end the crisis of confidence around the bank, which has been rocked by numerous scandals over the past few years. The government, which provided Credit Suisse a 50 billion Swiss Franc loan (almost $54 billion) to shore up its liquidity this week, is not in a position to intervene further, fearing public backlash in using taxpayer money to bail out the bank.

---- Quote end

I thought the public outrage and pre-existing plan FINMA had on how to handle this exact situation would kick in. But in end the Swiss bottled it and bailed them out. Lol....wonder what will happen to all those bankers compensated in CS Shares including former CEO's.

Credit Suisse Ratings and reports

https://www.credit-suisse.com/about...ns/debt-investors/ratings-credit-reports.html

That was 90 days ago. Why isn't their rating now Ba1/BB+/BB+ i.e Non-Investment Grade speculative by the three agencies (Moodys/S&P/Fitch) or in fact much lower.

Anyway CS learning that karma is real looking back on their history.

aaaand for $3.25 billion it's sold to UBS!

And SNB will burn another $100 billion for it. Central banks' printers in full BRRRRRR mode worldwide.

And SNB will burn another $100 billion for it. Central banks' printers in full BRRRRRR mode worldwide.

What a steal, that bank was.aaaand for $3.25 billion it's sold to UBS!

And SNB will burn another $100 billion for it. Central banks' printers in full BRRRRRR mode worldwide.

They apparently amend laws to avoid a shareholder vote.

Bitcoin never felt safer

Lol....I can't stop laughing

. The Swiss tax payer is asked to cover up to $9bn of potential losses for problems a private and twice convicted criminal enterprise called CS caused to itself

. The Swiss tax payer is asked to cover up to $9bn of potential losses for problems a private and twice convicted criminal enterprise called CS caused to itself

.

.

----- quote start

The terms of the deal will see Credit Suisse shareholders receive 1 UBS share for every 22.48 Credit Suisse shares they hold.

“This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue. We have structured a transaction which will preserve the value left in the business while limiting our downside exposure,” said UBS Chairman Colm Kelleher in a statement.

The combined bank will have $5 trillion of invested assets, according to UBS.

The Swiss National Bank pledged a loan of up to 100 billion Swiss francs ($108 billion) to support the takeover. The Swiss government also granted a guarantee to assume losses up to 9 billion Swiss francs from certain assets over a preset threshold “in order to reduce any risks for UBS,” said a separate government statement.

“This is a commercial solution and not a bailout,” said Karin Keller-Sutter, the Swiss finance minister, in a press conference Sunday.

----- quote end

----- quote start

The terms of the deal will see Credit Suisse shareholders receive 1 UBS share for every 22.48 Credit Suisse shares they hold.

“This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue. We have structured a transaction which will preserve the value left in the business while limiting our downside exposure,” said UBS Chairman Colm Kelleher in a statement.

The combined bank will have $5 trillion of invested assets, according to UBS.

The Swiss National Bank pledged a loan of up to 100 billion Swiss francs ($108 billion) to support the takeover. The Swiss government also granted a guarantee to assume losses up to 9 billion Swiss francs from certain assets over a preset threshold “in order to reduce any risks for UBS,” said a separate government statement.

“This is a commercial solution and not a bailout,” said Karin Keller-Sutter, the Swiss finance minister, in a press conference Sunday.

----- quote end

Yah indeed thats beyond comical.Lol....I can't stop laughing. The Swiss tax payer is asked to cover up to $9bn of potential losses for problems a private and twice convicted criminal enterprise called CS caused to itself .

.

----- quote start

The terms of the deal will see Credit Suisse shareholders receive 1 UBS share for every 22.48 Credit Suisse shares they hold.

“This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue. We have structured a transaction which will preserve the value left in the business while limiting our downside exposure,” said UBS Chairman Colm Kelleher in a statement.

The combined bank will have $5 trillion of invested assets, according to UBS.

The Swiss National Bank pledged a loan of up to 100 billion Swiss francs ($108 billion) to support the takeover. The Swiss government also granted a guarantee to assume losses up to 9 billion Swiss francs from certain assets over a preset threshold “in order to reduce any risks for UBS,” said a separate government statement.

“This is a commercial solution and not a bailout,” said Karin Keller-Sutter, the Swiss finance minister, in a press conference Sunday.

----- quote end

Also things to laugh about - shareholder rights apparently do not count like in a banana republic. I can rather go back and buy stocks in Africa. At least they are cheap af there.

They provide 100bn liquidity and go back to printing. So they also pay with debased chf.

Also things to laugh about - shareholder rights apparently do not count like in a banana republic.

You raise an important point. Deal was done by bypassing a shareholder vote. So where is rule of law in Switzerland when self inflicted crisis's like this happen? The government had plenty of time to prepare and even had a too big to fail plan in place which they didnt follow. Credit Suisse has had problems for years even this thread goes back nearly 6 months...lol.

Anyway this all reminds me of when Swiss government broke their own banking secrecy laws to hand over the names of 4,450 American UBS account holders to US after US threatened to revoke its US banking license. I can't take the Swiss seriously any more and the reputation it had as a sound trusted financial centre is truly over. When push came to shove Finma and government have shown Switzerland to be a very weak financial centre for stability, protection and rule of law sadly. Also investors in Credit Suisse would have been far better off investing in Dogecoin or Shiba Inu....just saying lol.

Credit Suisse: Bank rescue damages Switzerland's reputation for stability

https://www.bbc.com/news/business-65009996P.S RIP Credit Suisse, so long, and glad I ended my relationship years ago.

All this is true but not surprising. All banks worldwide are zombies in advanced decomposition process. Saving them using freshly printed fiat is pointless.You raise an important point. Deal was done by bypassing a shareholder vote. So where is rule of law in Switzerland when self inflicted crisis's like this happen? The government had plenty of time to prepare and even had a too big to fail plan in place which they didnt follow. Credit Suisse has had problems for years even this thread goes back nearly 6 months...lol.

Anyway this all reminds me of when Swiss government broke their own banking secrecy laws to hand over the names of 4,450 American UBS account holders to US after US threatened to revoke its US banking license. I can't take the Swiss seriously any more and the reputation it had as a sound trusted financial centre is truly over. When push came to shove Finma and government have shown Switzerland to be a very weak financial centre for stability, protection and rule of law sadly. Also investors in Credit Suisse would have been far better off investing in Dogecoin or Shiba Inu....just saying lol.

Credit Suisse: Bank rescue damages Switzerland's reputation for stability

https://www.bbc.com/news/business-65009996

P.S RIP Credit Suisse, so long, and glad I ended my relationship years ago.

Seriously concerning.You raise an important point. Deal was done by bypassing a shareholder vote. So where is rule of law in Switzerland when self inflicted crisis's like this happen? The government had plenty of time to prepare and even had a too big to fail plan in place which they didnt follow. Credit Suisse has had problems for years even this thread goes back nearly 6 months...lol.

Good point. By its laws, leaking bank client data is highly punished with jail time. Much more than not paying tax etc. So every small schmuck working at a bank there needs to take care of this.Anyway this all reminds me of when Swiss government broke their own banking secrecy laws to hand over the names of 4,450 American UBS account holders to US after US threatened to revoke its US banking license. I can't take the Swiss seriously any more and the reputation it had as a sound trusted financial centre is truly over. When push came to shove Finma and government have shown Switzerland to be a very weak financial centre for stability, protection and rule of law sadly. Also investors in Credit Suisse would have been far better off investing in Dogecoin or Shiba Inu....just saying lol.

But as you said, apparently, it doesn't count in an emergency.

Good call.Credit Suisse: Bank rescue damages Switzerland's reputation for stability

https://www.bbc.com/news/business-65009996

P.S RIP Credit Suisse, so long, and glad I ended my relationship years ago.

Latest Threads

-

-

-

Litigation Finance - My 26M Euros portfolio (BONUS: Free resources)

- Started by James Orwell

- Replies: 3

-

Mentor Group Gold - AD Thread! kemycard.com | Crypto Virtual Cards | Reloadable Without KYC | BIN USA

- Started by ththugues4

- Replies: 1

-

banking (fiat to crypto to fiat) for unconventional businesses (gambling, adult, and more)

- Started by Gediminas

- Replies: 2