Greetings

I'm a Danish citizen who does crypto consulting and crypto investing/trading.

I want to create an LLC in a foreign country and trade crypto primarily, but the option to also trade/invest into gold, silver and stocks is welcome.

I am doing this because the survelliance and draconian laws in my home country are increasing at a rapid rate.

So far the Government is crypto friendly, but I expect that to change.

I've done some research and I am currently talking with these guys in Georgia: Company Formation Georgia » Register Your Business in Georgia.

They say that it will cost me around 700 euro for an LLC company if I visit the country and 850 to get an LLC by e-mail correspondence where I don't have to travel there.

I can't help but think: What is the catch?

Also, does any of you have experience talking with the service I linked too?

They are also owners of:

http://www.georgialegalservice.ge

BRG - Register Business in Georgia

Also, can I ask, is it normal to feel affraid of this whole situation? My home country is still crypto friendly, so I am not in any trouble ( yet ) but I know that will change.

I feel very nervous traveling to an other part of the planet.

I just want to make sure that I visit a country where I can open an LLC company and trade/invest into the previously mentioned things without any trouble and the whole process must not take more than 7-10 days.

I don't mind paying 10-13% taxes but absolutely no more than that.

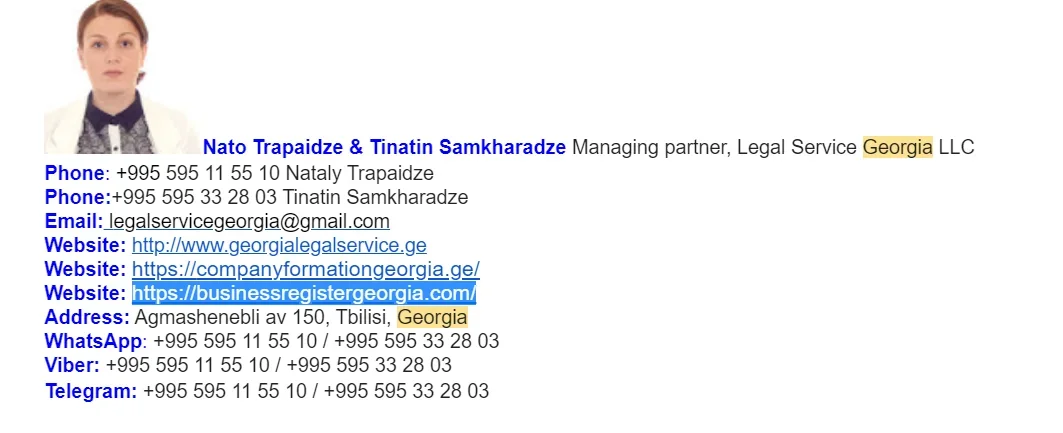

I have attached the contact info of the firm.

This is my first time doing this, so any advice is really appreciated.

Thank you in advance and bless you all!

I'm a Danish citizen who does crypto consulting and crypto investing/trading.

I want to create an LLC in a foreign country and trade crypto primarily, but the option to also trade/invest into gold, silver and stocks is welcome.

I am doing this because the survelliance and draconian laws in my home country are increasing at a rapid rate.

So far the Government is crypto friendly, but I expect that to change.

I've done some research and I am currently talking with these guys in Georgia: Company Formation Georgia » Register Your Business in Georgia.

They say that it will cost me around 700 euro for an LLC company if I visit the country and 850 to get an LLC by e-mail correspondence where I don't have to travel there.

I can't help but think: What is the catch?

Also, does any of you have experience talking with the service I linked too?

They are also owners of:

http://www.georgialegalservice.ge

BRG - Register Business in Georgia

Also, can I ask, is it normal to feel affraid of this whole situation? My home country is still crypto friendly, so I am not in any trouble ( yet ) but I know that will change.

I feel very nervous traveling to an other part of the planet.

I just want to make sure that I visit a country where I can open an LLC company and trade/invest into the previously mentioned things without any trouble and the whole process must not take more than 7-10 days.

I don't mind paying 10-13% taxes but absolutely no more than that.

I have attached the contact info of the firm.

This is my first time doing this, so any advice is really appreciated.

Thank you in advance and bless you all!