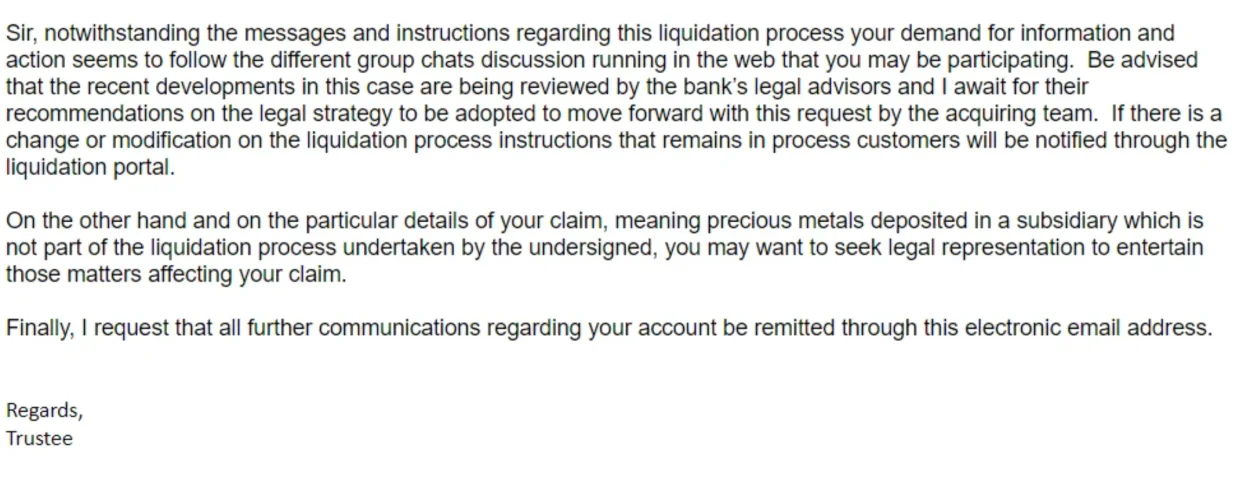

Yes, but he did not write that he rejected it out of hand. That's a bd sign. He should demand the Qenta return all the assets. The worst part is that he wrote that he does not consider the $50 million in gold or silver to be part of the banks assets that he is administering under the liquidation. So he does not care what happens to the gold and silver, and recommended the customer hire a lawyer take it up with Qenta. But if the receiver agree to accept Qenta's terms, Qenta owes customers nothing. The bank retains the full liability for $50 million in gold and silver, but it will only have $25 million in cash to satisfy that liability. Qenta gets to keep that other $25 million free and clear of any liabilities to the bank's customers.