This means that I will be taxed in US as person? From some research I did I understood that in this case I will only have to pay the Federal tax only if I register my LLC in Delaware?So would the UK Ltd, wouldn't it?

Delaware, Nevada, Wyoming, Florida... LLCs are disregarded entities for the IRS, which means the company is not taxed, its owners are. If you operate outside the US, it matters little where you form the LLC, except perhaps for, I assume for you less relevant aspects, as formation/maintenance costs or "anonymity" (the IRS and your corporate bank will need to know who is behind the company in any case)

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Freelancer working from Greece via his own UK LTD. Tax Planning options

- Thread starter archer

- Start date

I assume you are not a US tax resident. If that is the case, you will only be liable for US tax if you are ETBUS. Check this out as starting pointThis means that I will be taxed in US as person? From some research I did I understood that in this case I will only have to pay the Federal tax only if I register my LLC in Delaware?

https://globalisationguide.org/us-llc-non-resident/

Could you elaborate?Not necessarely like UK LLP

At the moment there are no challenges by local agency. With that being said paying 19% and tax evade vs paying 22% and not tax evade doesn't sound very wise to me. Especially, when you will have local clients

At the moment there are no challenges by local agency. With that being said paying 19% and tax evade vs paying 22% and not tax evade doesn't sound very wise to me. Especially, when you will have local clients

Agree. And the CIT rate in the UK is going up to 25% in a couple of weeks, so even worse.

When you say "At the moment there are no challenges by local agency" are you talking about the general situation in Greece of about @archer's case in particular?

Generally in Greece.Agree. And the CIT rate in the UK is going up to 25% in a couple of weeks, so even worse.

When you say "At the moment there are no challenges by local agency" are you talking about the general situation in Greece of about @archer's case in particular?

As long as you have something reasonable though (within EU) with CIT above 11%.Generally in Greece.

It's not 22% in Greece for the full amount. My total income will put a significant portion at a tax rate of 28%, 36% and even at 44%At the moment there are no challenges by local agency. With that being said paying 19% and tax evade vs paying 22% and not tax evade doesn't sound very wise to me. Especially, when you will have local clients

For income below 50K, it will remain at 19%Agree. And the CIT rate in the UK is going up to 25% in a couple of weeks, so even worse.

When you say "At the moment there are no challenges by local agency" are you talking about the general situation in Greece of about @archer's case in particular?

You can open an LLC, "ΙΚΕ", with an effective taxation of 22%. The table above refers to self-employed people and is only worth it if you make less than 50k annually.It's not 22% in Greece for the full amount. My total income will put a significant portion at a tax rate of 28%, 36% and even at 44%

View attachment 4584

For income below 50K, it will remain at 19%

View attachment 4585

Seems like the first thing you need to do is understand your options within the country and then look to incorporate abroad.You can open an LLC, "ΙΚΕ", with an effective taxation of 22%. The table above refers to self-employed people and is only worth it if you make less than 50k annually.

Bringing the money back in the country will probably give you trouble if you have an LLC in the US.Really? I heard there have been quite some challenges lately, especially for companies in Cyprus.

What about LLCs in the US?

Ah, ok, so 19% then.It's not 22% in Greece for the full amount. My total income will put a significant portion at a tax rate of 28%, 36% and even at 44%

View attachment 4584

For income below 50K, it will remain at 19%

View attachment 4585

If you create a company in Greece you will pay 22% CIT plus the 5% in dividends, same procedure as you were describing in your initial post for the UK LTd.

You can also pay yourself from the company as a freelance (or a director) up to 30K+ to benefit from the lower tax rates that you show and get the rest as dividends from the company. All completely legal. Do the math, the breakeven will probably be above 30K. You'll have to take into account other levies and costs (Social Security, company setup and maintenance, etc) that I am not familiar with.

Bringing the money back in the country will probably give you trouble if you have an LLC in the US.

Leaving it outside of the country will likely give you more trouble, I guess. At least if you bring it back and declare it as dividends they cannot say you were hiding it.

What do you think about an LLP in the UK (also tax transparent there)?

Last edited:

Dividends will be taxed in the rate of 15% since there is not an agreement with Delaware for example. Another issue is that cfc will kick in for such an entity. Most people open their companies in Cyprus, Bulgaria and Estonia if not Greece so I am not sure what would happen in case of the Uk ltd. I am sure that at least the director has to be in the UK though.Ah, ok, so 19% then.

If you create a company in Greece you will pay 22% CIT plus the 5% in dividends, same procedure as you were describing in your initial post for the UK LTd.

You can also pay yourself from the company as a freelance (or a director) up to 30K+ to benefit from the lower tax rates that you show and get the rest as dividends from the company. All completely legal. Do the math, the breakeven will probably be above 30K. You'll have to take into account other levies and costs (Social Security, company setup and maintenance, etc) that I am not familiar with.

Leaving it outside of the country will likely give you more trouble, I guess. At least if you bring it back and declare it as dividends they cannot say you were hiding it.

What do you think about an LLP in the UK (also tax transparent there)?

Why would the dividends be charged at 15% if the statuary tax rate on dividends in Greece is 5%? If there is a tax treaty with the other jurisdiction, the effective rate in GR might be lower than 5% if you paid already tax abroad but I do not see how it could ever be higher. Can you point me to legislation that speaks about this?

Plus, as far as I know, the DTT between Greece in the US does not exclude any state.

As for CFC, it only applies in Greece to passive income so it should not be an issue if the LLC income is active. What would kick in potentially, with the same result, is Permanent Establishment or even GAAR

Plus, as far as I know, the DTT between Greece in the US does not exclude any state.

As for CFC, it only applies in Greece to passive income so it should not be an issue if the LLC income is active. What would kick in potentially, with the same result, is Permanent Establishment or even GAAR

Hi all, thanks for the helpful answers to this thread so far. I have 2 other questions related with my setup above:

1. Shall I pay dividends tax in UK or in Greece? I couldn't find a clear answer on that online. Actually I heard both the answers from different people

2. I want to invoice my UK-LTD with my Greek personal company which is actually MY REAL NAME (no company name for personal companies). Ideally, I want to invoice 12-15K EUR from a total of 50K of income. Will this be a red flag for any of the 2 tax authorities? (UK and Greek) If yes, would some lower amount be un-noticed?

What is your experience with this? Sorry if some questions sound naive for some of you that may have many years of experience in the business but for me it's my first years and still have some basic questions

Thanks

1. Shall I pay dividends tax in UK or in Greece? I couldn't find a clear answer on that online. Actually I heard both the answers from different people

2. I want to invoice my UK-LTD with my Greek personal company which is actually MY REAL NAME (no company name for personal companies). Ideally, I want to invoice 12-15K EUR from a total of 50K of income. Will this be a red flag for any of the 2 tax authorities? (UK and Greek) If yes, would some lower amount be un-noticed?

What is your experience with this? Sorry if some questions sound naive for some of you that may have many years of experience in the business but for me it's my first years and still have some basic questions

Thanks

I have no answer to the above, you should consult with an accountant an a lawyer. Honestly, you can just open one "etterorithmi etairia" pay 22% tax without paying any dividend tax since you own all the money. This will be **CHEAPER** than incorporating in the UK.Hi all, thanks for the helpful answers to this thread so far. I have 2 other questions related with my setup above:

1. Shall I pay dividends tax in UK or in Greece? I couldn't find a clear answer on that online. Actually I heard both the answers from different people

2. I want to invoice my UK-LTD with my Greek personal company which is actually MY REAL NAME (no company name for personal companies). Ideally, I want to invoice 12-15K EUR from a total of 50K of income. Will this be a red flag for any of the 2 tax authorities? (UK and Greek) If yes, would some lower amount be un-noticed?

What is your experience with this? Sorry if some questions sound naive for some of you that may have many years of experience in the business but for me it's my first years and still have some basic questions

Thanks

Interesting. Why would he have to pay no dividend tax? How would that work?I have no answer to the above, you should consult with an accountant an a lawyer. Honestly, you can just open one "etterorithmi etairia" pay 22% tax without paying any dividend tax since you own all the money. This will be **CHEAPER** than incorporating in the UK.

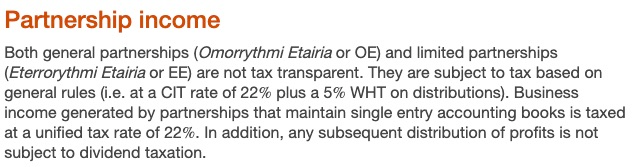

This is true for OE, EE and personal companies. However OE and EE require a partner, you cannot have them alone. However with 22% tax rate and no dividend tax, they really look as the best option, even compared with many other countriesInteresting. Why would he have to pay no dividend tax? How would that work?

https://www.startyouup.gr/el/a/106-forologia-epixeirhsewn

This is true for OE, EE and personal companies. However OE and EE require a partner, you cannot have them alone. However with 22% tax rate and no dividend tax, they really look as the best option, even compared with many other countries

View attachment 4591

https://www.startyouup.gr/el/a/106-forologia-epixeirhsewn

I don't see a lot of logic as to why dividends from an Ltd would be taxed and distributions from a partnership wouldn't after having paid the same CIT. But if it does work like that, it certainly seems like the best option, potentially combined with obtaining part of the income as a freelance to also benefit from those lower rates.

@hungryPanda

Imagine you have a US LLC, disburse its profit to yourself and declare it as dividends before the GR tax authority, paying 5% tax

The GR TA then looks into it and decides the US LLC is a tax resident in GR. What do you think would happen? You pay the additional 22% CIT on that income and that is it? Would there be penalties?

Assuming you accept the ruling and do not take them to court (or do but fail).

Thanks

Last edited:

Getting a partner is simple, you just give someone you trust 0.1% of the company. It also has much lower expenses compared to IKE.This is true for OE, EE and personal companies. However OE and EE require a partner, you cannot have them alone. However with 22% tax rate and no dividend tax, they really look as the best option, even compared with many other countries

View attachment 4591

https://www.startyouup.gr/el/a/106-forologia-epixeirhsewn

These type of companies do have liability in contrast to an llc and this is why there is no need for dividends. I am really not able to answer the US LLC question. I just share some of the things that I learned from personal research. II don't see a lot of logic as to why dividends from an Ltd would be taxed and distributions from a partnership wouldn't after having paid the same CIT. But if it does work like that, it certainly seems like the best option, potentially combined with obtaining part of the income as a freelance to also benefit from those lower rates.

@hungryPanda

Imagine you have a US LLC, disburse its profit to yourself and declare it as dividends before the GR tax authority, paying 5% tax

The GR TA then looks into it and decides the US LLC is a tax resident in GR. What do you think would happen? You pay the additional 22% CIT on that income and that is it? Would there be penalties?

Assuming you accept the ruling and do not take them to court (or do but fail).

Thanks

Last edited:

I don't see a lot of logic as to why dividends from an Ltd would be taxed and distributions from a partnership wouldn't after having paid the same CIT. But if it does work like that, it certainly seems like the best option, potentially combined with obtaining part of the income as a freelance to also benefit from those lower rates.

https://taxsummaries.pwc.com/greece/corporate/income-determination

Yeah, I'd seen that. Just saying I don't quite get why the partnerships get that preferential treatment vs LTDs. Guess it's to compensate for the unlimited liability, as @hungryPanda pointed out.

@MarzioNot necessarely like UK LLP

I had asked you to elaborate on this, maybe you missed it. It'd be great if you can

Thanks

Last edited:

Latest Threads

-

-

Litigation Finance - My 26M Euros portfolio (BONUS: Free resources)

- Started by James Orwell

- Replies: 3

-

Mentor Group Gold - AD Thread! kemycard.com | Crypto Virtual Cards | Reloadable Without KYC | BIN USA

- Started by ththugues4

- Replies: 1

-

banking (fiat to crypto to fiat) for unconventional businesses (gambling, adult, and more)

- Started by Gediminas

- Replies: 2

-

Wise to move primary listing to the U.S. in blow to London stock exchange

- Started by Martin Everson

- Replies: 1