I'm on a very similar situation.

Originally Portuguese, living and working in the UK for more than 5 years.

Going back to PT in 2019 and will keep working for the same employer.

I have been giving the choice to work as an independent. I also qualify for NHR as the criteria is simply not have been a tax resident in PT for the last 5 years.

Now, I have raised this with various accountants/tax advisors and I'm getting conflicting answers. Specifically if being tax-exempt in both countries is a possibility simply by obeying the following criteria:

- NHR status

- Independent income

- Income is foreign-sourced

Here is my exact confusion - if someone is king enough to explain:

(these are extracts of the legislation (NHR and UK-PT DTA) that apply to people that fall into the criteria above)

--------- NHR legislation (

PT) ---------

4* - Aos residentes não habituais em território português que obtenham, no serviços de elevado valor acrescentado, com carácter científico, artístico ou técnico, a definir em portaria do membro do Governo responsável pela área das finanças, ou provenientes da propriedade intelectual ou industrial, ou ainda da prestação de informações respeitantes a uma experiência adquirida no sector industrial, comercial ou científico, bem como das categorias E, F e G, aplica-se o método da isenção desde que, alternativamente:

a) Possam ser tributados no outro Estado contratante, em conformidade com convenção para eliminar a dupla tributação celebrada por Portugal com esse Estado;

---------

Obviously is in Portuguese (you can use the Google translator if you want) - but it basically says: Any foreign-sourced independent work (contractor/freelancer), classified high value (scientific, artistic, technical), as well as dividends and rental income are tax free in PT, if alternatively:

a)

You can be taxed in the other contractual state as per the DTA

I'm exempt if I can be taxed in the UK - as per the conformity with the DTA.

The highlighted "You can be taxed" is very important, as some of the other types of income (eg. salary) says that you are exempt in Portugal

if you are taxed in the other state and not "can be".

--------- DTA English ---------

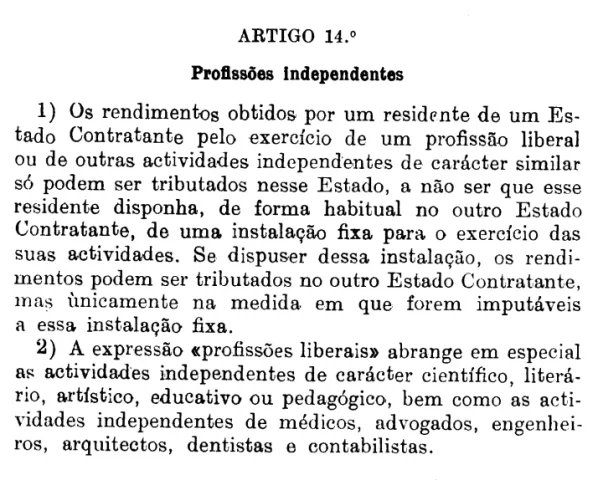

(1) Income derived by a resident of a Contracting State in respect of professional services or other independent activities of a similar character shall be taxable only in that State unless he has a fixed base regularly available to him in the other Contracting State for the purpose of performing his activities. If he has such a fixed base, the income may be taxed in the other Contracting State but only so much of it is as attributable to that fixed base. (2) The term "professional services" includes, especially independent scientific, literary, artistic, educational or teaching activities as well as the independent activities of physicians, lawyers, engineers, architects, dentists and accountants.

---------

Now, as per the DTA, I need to be taxed in Portugal, unless I have a fixed base regularly available to me in the UK, which I do. Therefore I can be taxed in the UK.

Concluding, as I can be taxed in the UK, I'm exempt from being taxed in PT under NHR. For the UK side, the UK chooses not to tax me, because I'm not a tax resident in there.

Is there a mistake in my interpretation? This way I wouldn't even need a LTD or LLP, am I wrong?