You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Making sense on Malta WHT on dividends

- Thread starter Marzio

- Start date

From DTT:

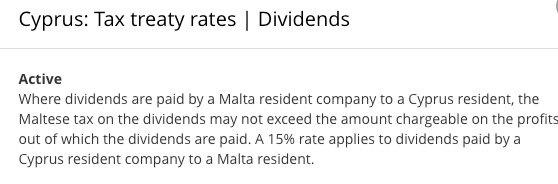

(a) where the dividends are paid by a company resident of Cyprus to a resident of Malta who is the beneficial owner thereof, the Cyprus tax so charged shall not exceed 15 per cent of the gross amount of the dividends;

(b) where the dividends are paid by a company which is a resident of Malta to a resident of Cyprus who is the beneficial owner thereof Malta tax on the gross amount of the dividends shall not exceed that chargeable on the profits out of which the dividends are paid.

Note that in general there is no withholding tax under Maltese law on dividends, interest and royalties even where a treaty allows such tax.

(a) where the dividends are paid by a company resident of Cyprus to a resident of Malta who is the beneficial owner thereof, the Cyprus tax so charged shall not exceed 15 per cent of the gross amount of the dividends;

(b) where the dividends are paid by a company which is a resident of Malta to a resident of Cyprus who is the beneficial owner thereof Malta tax on the gross amount of the dividends shall not exceed that chargeable on the profits out of which the dividends are paid.

Note that in general there is no withholding tax under Maltese law on dividends, interest and royalties even where a treaty allows such tax.

Not a Maltese lawyer, but have worked with a few.So if there are no WHT what’s the meaning of that phrase?

You need to consider wether the receiver is an individual or a legal entity, non-dom, source of income and special scheme that might apply, and when you remit the income to Malta.

Depending on the residence and domicile of the individual, liability to Maltese income tax arises -

- on a worldwide basis, or

- on a remittance basis, or

- on a territorial basis

Similar threads

- Replies

- 22

- Views

- 2,065

- Replies

- 12

- Views

- 1,301

- Replies

- 34

- Views

- 2,911

- Replies

- 7

- Views

- 640

Share:

Latest Threads

-

Selling weight loss medicines online

- Started by daggerbackstage

- Replies: 0

-

Hungary criminalizes unapproved crypto trades

- Started by toums

- Replies: 1

-

Hiding US LLC profits by electing for corporation tax treatment

- Started by Eurocash

- Replies: 8

-

-

Company formation for a specific niche without licenses

- Started by luxtravel

- Replies: 10