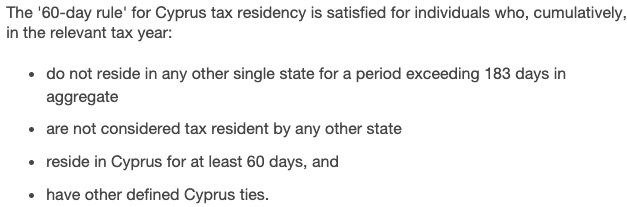

They have a DTT, so what you say is pretty much nonsense. In whatever country I have stronger connections with gets the right of taxation.If you spend <183 days per year in Cyprus, then you will only be considered tax resident in Cyprus even under domestic rules if no other country claims you as tax resident.

So as soon as Spain says you're tax resident there (for whatever reason), having residency in Cyprus wouldn't help you.

Renting some airbnb for 4 months in spain meanwhile having a fully equipped home in cyprus clears the case.

Please read properly before answering such nonsense.