Offshore Company Formation comparison, what you want to know in order to get your offshore company formation work!

Forming a company offshore can benefit many business owners regardless of the size of their operations: here is an explanation of the five main benefits associated with offshore company incorporation. When it comes to the term offshore used in conjunction with company incorporation, the term offshore generally refers to any jurisdiction other than one in which the company incorporated will conduct the majority of its activities.

Usually such a jurisdiction has some degree of taxation or reporting benefit attached that makes it attractive to the company owner, and the concept of incorporating a company offshore will bring at least one of the following five benefits to a business owner: -

1) Ease of Operations depending on the jurisdiction and the type of business activity to be conducted under the company name to be incorporated, the operating restrictions, auditing and accounting requirements and standards to which the business and its employees and directors must adhere are often far less restrictive offshore than onshore.

Exceptions to this rule are financial services based companies in many jurisdictions for example, who have to comply with extra regulatory legislation for the protection of the companys clientele.

The advantage of easing operations particularly for a small or start up company is a reduction in operating costs and in the amount of time a companys directors have to dedicate to form filling and report filing.

2) Reporting Simplification this ties in with the first benefit; in the majority of offshore jurisdictions favoured for company incorporation the company activity reporting requirements are often far fewer and simpler as the business activities entered into by the company are conducted outside of the jurisdiction in which it is incorporated.

Furthermore personal information relating to the companys directors and shareholders need not be declared in all cases or the extent to which personal information is required is far less intrusive.

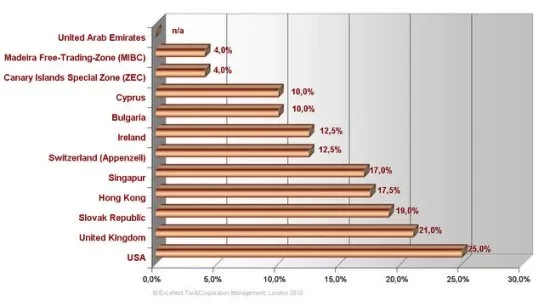

3) Taxation Reduction/Negation the reduction in taxation liability is one of the main benefits associated with investing offshore, opening an offshore bank account or incorporating a company offshore.

If you set up your company in a low or no tax jurisdiction you could potentially save yourself substantial amounts of money legally. Often the rules are that if the company incorporated in a particular jurisdiction never derives an income from the local economy it can operate tax free.

It's therefore possible to use an offshore company in an overall international business structure and ensure profits are posted in the offshore jurisdiction and so no tax is liable! Many international corporations operate in this way and actually negate their tax liability fully.

4) Asset Protection by operating a company offshore, i.e., outside the jurisdiction in which the company operates, it is sometimes possible to position assets away from the reach of any potential litigious action and also to shield business transactions from the eyes of the competition.

5) Personal Privacy Protection the level to which a director or shareholders personal information is required, held, visible or investigated offshore is likely to be far less invasive and intrusive than onshore. It is also possible to appoint nominee directors and secretaries for offshore companies in many jurisdictions thus keeping the true company owners identity shielded.

The information contained in this article cannot constitute advice. Each individuals circumstances are unique and whether or not offshore company incorporation is something that could benefit your business can only be determined with personal advice.

Forming a company offshore can benefit many business owners regardless of the size of their operations: here is an explanation of the five main benefits associated with offshore company incorporation. When it comes to the term offshore used in conjunction with company incorporation, the term offshore generally refers to any jurisdiction other than one in which the company incorporated will conduct the majority of its activities.

Usually such a jurisdiction has some degree of taxation or reporting benefit attached that makes it attractive to the company owner, and the concept of incorporating a company offshore will bring at least one of the following five benefits to a business owner: -

1) Ease of Operations depending on the jurisdiction and the type of business activity to be conducted under the company name to be incorporated, the operating restrictions, auditing and accounting requirements and standards to which the business and its employees and directors must adhere are often far less restrictive offshore than onshore.

Exceptions to this rule are financial services based companies in many jurisdictions for example, who have to comply with extra regulatory legislation for the protection of the companys clientele.

The advantage of easing operations particularly for a small or start up company is a reduction in operating costs and in the amount of time a companys directors have to dedicate to form filling and report filing.

2) Reporting Simplification this ties in with the first benefit; in the majority of offshore jurisdictions favoured for company incorporation the company activity reporting requirements are often far fewer and simpler as the business activities entered into by the company are conducted outside of the jurisdiction in which it is incorporated.

Furthermore personal information relating to the companys directors and shareholders need not be declared in all cases or the extent to which personal information is required is far less intrusive.

3) Taxation Reduction/Negation the reduction in taxation liability is one of the main benefits associated with investing offshore, opening an offshore bank account or incorporating a company offshore.

If you set up your company in a low or no tax jurisdiction you could potentially save yourself substantial amounts of money legally. Often the rules are that if the company incorporated in a particular jurisdiction never derives an income from the local economy it can operate tax free.

It's therefore possible to use an offshore company in an overall international business structure and ensure profits are posted in the offshore jurisdiction and so no tax is liable! Many international corporations operate in this way and actually negate their tax liability fully.

4) Asset Protection by operating a company offshore, i.e., outside the jurisdiction in which the company operates, it is sometimes possible to position assets away from the reach of any potential litigious action and also to shield business transactions from the eyes of the competition.

5) Personal Privacy Protection the level to which a director or shareholders personal information is required, held, visible or investigated offshore is likely to be far less invasive and intrusive than onshore. It is also possible to appoint nominee directors and secretaries for offshore companies in many jurisdictions thus keeping the true company owners identity shielded.

The information contained in this article cannot constitute advice. Each individuals circumstances are unique and whether or not offshore company incorporation is something that could benefit your business can only be determined with personal advice.

Last edited by a moderator: