HOWEVER, you wrote in your first post that you would continue living in your current country of resident for 7 months every year. So your solution will not be legal.I do not think it is illegal to relocate to a country that has fewer taxes than yours, that's how all the people which transfer residency in UAE are currently doing.

Also, the fact that you relocate to a non-tax heaven is better seen.

If this was an issue then all the guys which transferred to UAE now would have troubles.

Also, company profit goes to 0 because I haven't renewed the licensing agreement with it, I think it is quite standard, I am not hiding money anywhere, simply my home country company does not have the licenses anymore to use the app for economic purposes.

In Europe, there is the freedom to relocate anywhere (in any EU country) so I do not really know how this can be seen as an issue.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Portugal NHR + Luxemburg company

- Thread starter OffshorePhantom

- Start date

This was only to show that theoretically, it is very hard to find out if I am in my home country or in particular.HOWEVER, you wrote in your first post that you would continue living in your current country of resident for 7 months every year. So your solution will not be legal.

What I wanted to say in the first post is if it is easy or not to find out the real country of residence if you remain in the Schengen area (no tax heaven) because in my opinion is not that easy for the tax-man if you do not have any tides to your home country and rent an apartment in Portugal.

What I want to know is if my solution is legal considering I will move to Portugal, clearly if I stay in my home country while declaring being resident in Portugal I know that it is not technically legal.

The problem highlighted was if moving to another country just to pay fewer taxes and bring the revenue of a company from a few million to nearly zero was legal and it seems that if done properly it is.

@hireblade89 Hi! Did you manage to succeed with your proposed structure? I recently came to a similar structure with ebook profit from selling through an Estonian company and paying royalties to a Spanish resident. I'm interested in whether there are some real caveats. I'd appreciate any advice.

if I were you, I would avoid portugal NHR, too many loopholes for the tax authorities to come after you when their coffers get empty. I would take up tax residency in cyprus, live 3 months and or in ireland as a non dom from personal tax perspective and I will form my company in malta and visit portugal for 5 months and leave it at that.

I will form my company in malta

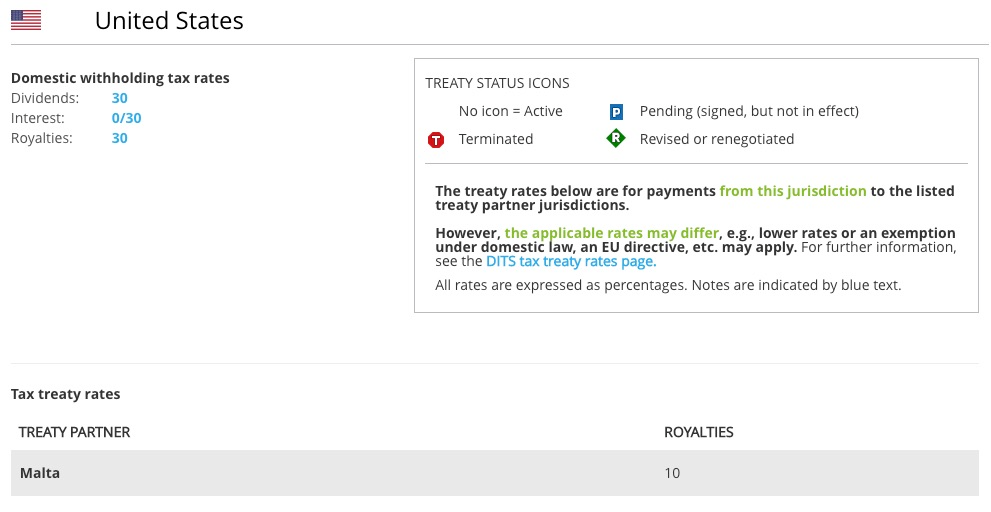

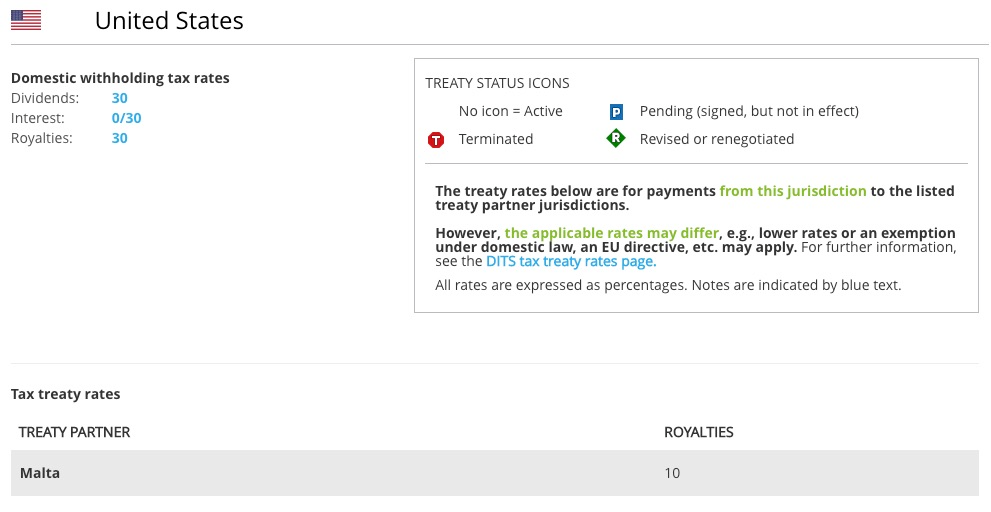

There's a 10% US WHT on Maltese companies.

I dont know what you mean by that? I was referring to a us or non -us individual living in ireland instead of portugal. Keep your money out of ireland and you are good or moving to cyprus and living there for 3 months and being a ta resident for the whole year and claiming non domicile. If one is a us citizen then they can claim non resident income exclusion which is more than 100k USD a year per person .There's a 10% US WHT on Maltese companies.

I am considering speaking to a good tax attorney in portugal who can help with structuring for NHR or else I am seriously considering ireland to move my tax residency and family and claim non domicile status. As one wise entrepreneur told me, keep your money in switzerland and company in cyprus and then go and live whereever you want.

how about having a maltese operating company which is fully owned by a cyprus holding company? I spoke to a tax attorney in holland, they allow participation exxemption as well which not many people are speaking of, it comes to 5% CIT which is not bad considering you are working with grade A jurisdiction.There's a 10% US WHT on Maltese companies.

Last edited:

I dont know what you mean by that?

In this particular thread we are talking about receiving royalties from US.

You said "i will form my company in Malta" so i said that if you receive royalties from US to Malta there will be a 10% whithholding tax.

Yes, the trick was finding a country where the withholding tax regarding royalties from USA is 0% like Luxembourg, Ireland, Switzerland, Cyprus and others.In this particular thread we are talking about receiving royalties from US.

You said "i will form my company in Malta" so i said that if you receive royalties from US to Malta there will be a 10% whithholding tax.

Problem is that I do not trust a lot the NHR system because Portugal is changing the rules frequently, for example with Crypto, and if they see a good volume they may easily go after you, especially with a socialist government.

sorry I am new, maybe your best option is moving to puerto rico. pay 4% corporate tax and 0% capital gains and move that money to europe.Yes, the trick was finding a country where the withholding tax regarding royalties from USA is 0% like Luxembourg, Ireland, Switzerland, Cyprus and others.

Problem is that I do not trust a lot the NHR system because Portugal is changing the rules frequently, for example with Crypto, and if they see a good volume they may easily go after you, especially with a socialist government.

if wht from USA to ireland or cyprus is 0 then maybe you should consider cyprus first and then ireland. Cyprus you can be a tax resident by just spending 3 months a year plus cyprus is way cheaper than ireland. The advantage of ireland is maybe its slightly closer but its very very cold country.sorry I am new, maybe your best option is moving to puerto rico. pay 4% corporate tax and 0% capital gains and move that money to europe.

I am not a US citizen so no need to move to Puerto Rico, there are lot of other possibilities abroad. To avoid the US WTH tax you have to create a company in a country which does not have any WTH on royalties with US like the ones mentioned above and then move those profits to yourself while relocating yourself in a country that does not tax royalties or dividends.sorry I am new, maybe your best option is moving to puerto rico. pay 4% corporate tax and 0% capital gains and move that money to europe.

For example something which might work is having a company in Cyprus (not managed by you) that collects US payments (WTH 0% with US) and then create a royalty contract between your Cyprus company and yourself to shift the profits. You need to relocate in this case to a country that does not tax royalties or dividends for example UAE (with which there is a 0% WTH on royalties and dividends between Cyprus & UAE).

maybe you should research on guilty tax law in USA and UBO (ULTIMATE BENEFICIAL OWNER) law in UAE. I have lived in UAE for 7 years, excellent for holidays only. I would live somewhere in europe or look at malaysia or thailand where your money would go much further.I am not a US citizen so no need to move to Puerto Rico, there are lot of other possibilities abroad. To avoid the US WTH tax you have to create a company in a country which does not have any WTH on royalties with US like the ones mentioned above and then move those profits to yourself while relocating yourself in a country that does not tax royalties or dividends.

For example something which might work is having a company in Cyprus (not managed by you) that collects US payments (WTH 0% with US) and then create a royalty contract between your Cyprus company and yourself to shift the profits. You need to relocate in this case to a country that does not tax royalties or dividends for example UAE (with which there is a 0% WTH on royalties and dividends between Cyprus & UAE).

For example something which might work is having a company in Cyprus (not managed by you) that collects US payments (WTH 0% with US) and then create a royalty contract between your Cyprus company and yourself to shift the profits

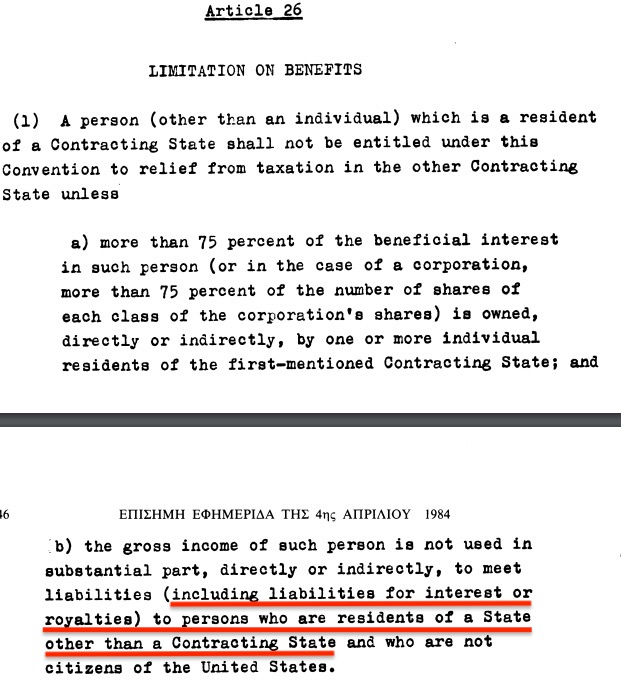

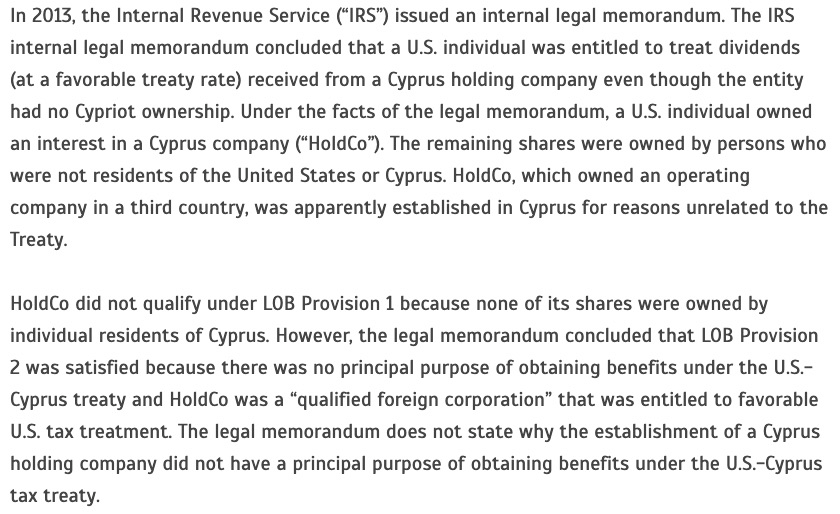

This would not work due to LOB article in the Cyprus - US DTT

Guilty tax is for US resident or citizen. Yeah I agree with you, but you can stay in UAE sometime and then spend most of other time in Thailand, Malaysia or other countries in Europe without staying too much to avoid triggering any tax liabilities there.maybe you should research on guilty tax law in USA and UBO (ULTIMATE BENEFICIAL OWNER) law in UAE. I have lived in UAE for 7 years, excellent for holidays only. I would live somewhere in europe or look at malaysia or thailand where your money would go much further.

Then a company in Georgia that has no LOB on the tax treaty might work. I don't know if other countries have no LOB with the US in their tax treaty.This would not work due to LOB article in the Cyprus - US DTT

Also, I really don't know how they will be able to enforce this since when you give Google (or others) your Cyprus company details they will automatically apply the treaty and no one will see that you then shift the profit with royalties contracts between Cyprus and UAE for example, especially on the US side.

Also, I really don't know how they will be able to enforce this since when you give Google (or others) your Cyprus company details they will automatically apply the treaty and no one will see that you then shift the profit with royalties contracts between Cyprus and UAE for example, especially on the US side.

They will obviously get the help of the administration of the treaty country.

In any country where there's a LOB the tax administration of the contracting party will verify if indeed the company qualify for the favourable rate.

Otherwise how do you think IRS came to know about this scenario?

Probably the IRS has discovered and gone after this because there was a US individual involved, otherwise they wouldn't have bothered that much, but I might be wrong.They will obviously get the help of the administration of the treaty country.

In any country where there's a LOB the tax administration of the contracting party will verify if indeed the company qualify for the favourable rate.

Otherwise how do you think IRS came to know about this scenario?

Georgia, which has no LOB might work in this scenario. Do you know any other countries which have a tax treaty with US and no LOB?

Do you know any other countries which have a tax treaty with US and no LOB?

Not having a LOB article will not save you from having the company to perform some form of activity because even if Georgia doesn't have a LOB you will have to justify the profit shifing with some work performed by the company.

Also isn't enough to find a country with a treaaty with US and potentially no LOB, that country also has to have a DTT with the country where you would want to shift profits.

First you decide where you want to shift profits to and then look which countries that have a US tax treaty and potentially no LOB, allows you to do that.

For the sake of conversation while we are speaking of Georgia, there is no US WHT on royalties and no LOB but there is a 5% WHT on royalties paid to Portugal for example otherwise there's a 0% WHT royalties paid to UAE.

This is not an issue if you personally own a software and the Georgian company is using it under a license agreement you have signed with them, this is done also by lots of big groups that shift profits using royalties on trademarks, clearly there need to be some substance in the Georgian company.Not having a LOB article will not save you from having the company to perform some form of activity because even if Georgia doesn't have a LOB you will have to justify the profit shifing with some work performed by the company.

This is not an issue if you personally own a software and the Georgian company is using it under a license agreement you have signed with them, this is done also by lots of big groups that shift profits using royalties on trademarks, clearly there need to be some substance in the Georgian company.

Of course it's done by big groups but those big groups employ thousands of people in the country where the profits are shifted and those employee do some form of work.

You can't shift profits only becuse your contract says so with a shell company.

Or better said, why would you license your software to a company other than shifting profits?

Of course it's done by big groups but those big groups employ thousands of people in the country where the profits are shifted and those employee do some form of work.

You can't shift profits only becuse your contract says so with a shell company.

Or better said, why would you license your software to a company other than shifting profits?

I talked with several CPAs and if done in the proper way this is completely legal and doable, the important thing is doing it in the correct way.

Clearly the company needs to have some substance like a local director or employee. Since the software is yours you can license it two whom you want and also you are shareholder of that company so there is an economic nexus.

Also if you demonstrate that the software is finished and runs with minimum maintenance like in my case there is no need to have thousands employees, there is no law that says this. If it is completely passive income there can be even a single person handling the day to day operations of the company.

Last edited:

I talked with several CPAs and if done in the proper why this is completely legal and doable, the important thing is doing it in the correct way.

I agree with the fact that's legal and doable, i'm just wondering what they mean by "doing it in the correct way"

I'm saying what i said because there are other measures that are put in place right now that nobody is talking about that are actively preventing profits shifting.

Take a read at this: Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS - OECD

Latest Threads

-

-

Offshore Crypto without license (Where to move from SVG?)

- Started by off42

- Replies: 3

-

Saudi Arabia permits GCC residents to invest in its main stock market Tawadul - thoughts?

- Started by OKboomer

- Replies: 4

-

-

Incorporating, Payment Processing, and General Privacy and Advice for College Cheating Software Company

- Started by westudytools

- Replies: 0