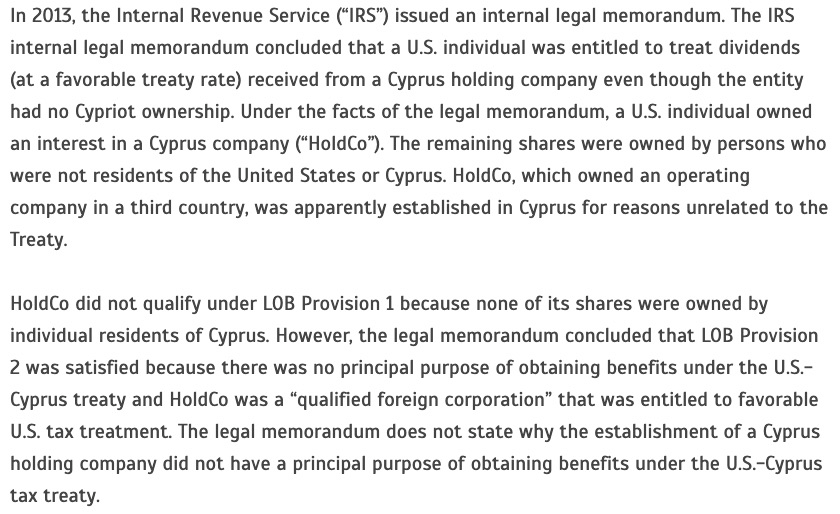

Then there are structures which involves more countries where the company is resident in one country and the shareholder in another but this game is a magnitude harder to play because there are new enemies that you need to defeat that you probably don't even know.

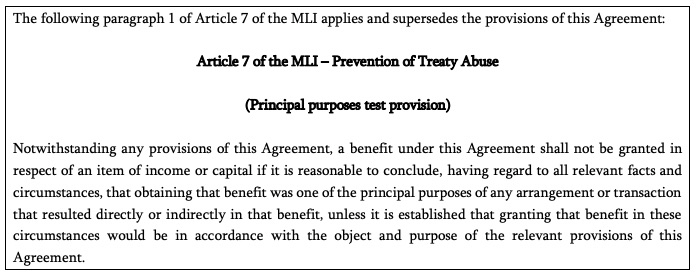

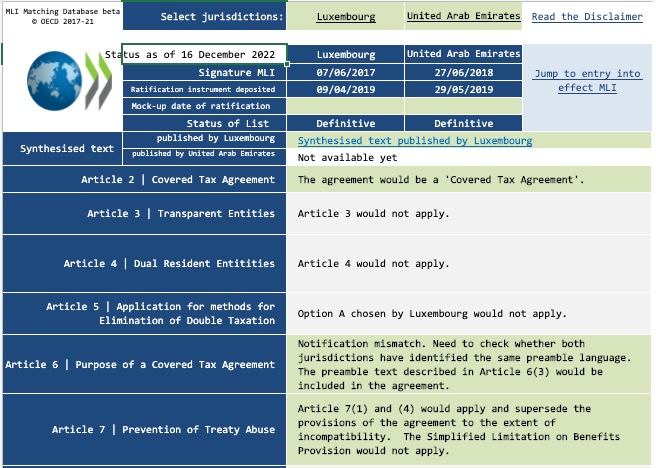

One enemy is MLI.

Multi Lateral Instrument was released to prevent abusive structures like conduit companies that would make us of tax treaties to funnel profits in low tax jurisdictions.

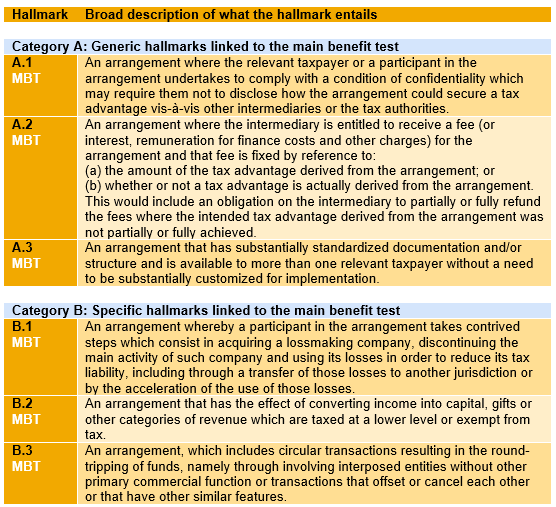

Another enemy is

DAC6

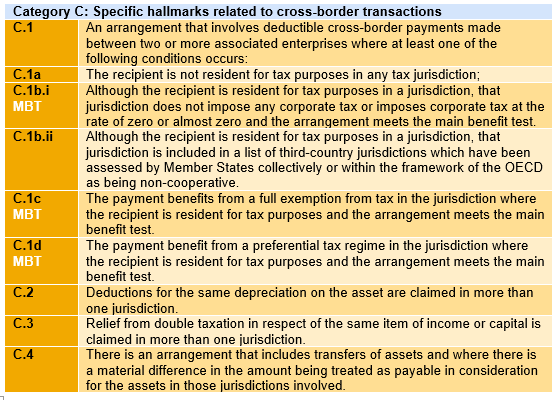

DAC6 applies to cross-border tax arrangements, which meet one or more specified characteristics (hallmarks), and which concern either more than one EU country or an EU country and a non-EU country.

It mandates a reporting obligation for these tax arrangements if in scope no matter whether the arrangement is justified according to national law.

Another enemy is the

Unshell initiative

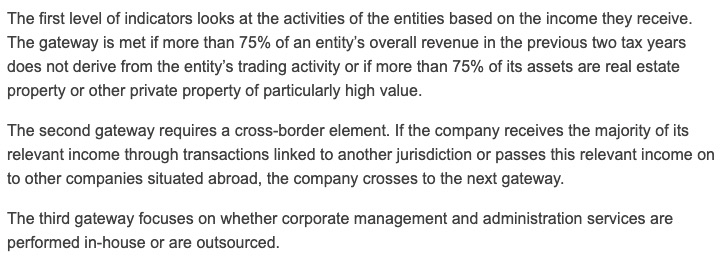

Unshell initiative was released so that entities that have no or minimal economic activity are unable to benefit from tax treaties

Here are the main tests

All those enemies have something in common: they all target cross-border transactions from different angles.

Now lets take a look at another part of the equation: where to receive income tax free.

Lets imagine that we found a country with a 0% US WHT and we defeated all the OECD enemies, profits are still in the company and we need to transfer those to us.

The question is where those profits are not subject to tax at the personal level?

As of today those are the most popular options.

- UAE

- Portugal under NHR: only lasts for 10 years + CFC rules + potential DAC6 reporting + uncertainty

- Singapore:

foreign-sourced royalty income is taxable when it is remitted

- Malaysia:

foreign income remitted to MY is taxed +

MM2H residency requirements

- Hong Kong:

stricter regulations on foreign source income

- Philippines:

SIRV program

- Panama

Once you compare those options side by side it becomes apparent that there's a trend in making it difficult for people to receve royalties tax free, even if foreign sourced, even if received in a territorial taxation country.

And this trend is only going to get worse.

That's why i'd chose UAE because despite its sharia law it has a pro-business attitude, it's smart enough to please OECD monkeys but relentlessly moving towards becoming an international financial hub.

Also UAE knows that its empire is build on "

0% taxation" so they will do anything they can to maintain the status quo for as long as they can to prevent millionaires leaving UAE.

Assuming OP would agree with my analysys lets see how to receive royalties tax free in UAE.

We are looking for a company in a country that has:

- 0% US WHT on royalties

- 0% WHT on royalties paid to UAE

- No LOB

- No MLI

- No DAC6

- No Unshell

There's only one country that fits all the above criteria and it's Georgia.

That doesn't mean that it will be easy because you would still need to form a company, hire a director, employees, rent an office, accounting, pay taxes (only upon dividends distribution) but it will be a lot less stressful than a Luxembourg company that has to comply with LOB, MLI, DAC6, Unshell and any other bulls**t directive that will EU come up in the future.

Last but not least do not forget about potential headaches with incoming / outgoing USD payements in Georgia because lets face it, it's not the best place in the world to send USD to.

https://www.offshorecorptalk.com/threads/banking-in-georgia.39475/page-2#post-241358