you have world msci index, which offers better diversification (includes some same positions as S&P)

Overvalued against liquidity last time I checked (yesterday)

The problem is that everybody understand real estate. And everybody wants that. So it's hard to get good deals.. Unless ofc you find that one or two unique opportunities with a seller that needs money fast, and nobody else able to snatch it. But that is close to market timing the SE

Real estate - hmm all currencies get fucked worse than the $ mainly because it’s the cleanest shirt in the laundry at this time… few years out not sure - but will lay out some facts maybe overlooked.

You would therefore be benchmarking against US Real Estate.

This is based on Shillers

Historically - loose 2.5% against debasement as it’s a ‘fixed asset’ and not really impacted by the same degree in inflation but is impacted by material/labour costs which brings price up against supply/demand bubbles

So over the span of time if forecasting forward based on history from 2013

That’s 2.5% in real value loss even as price nominally rises - pre tax - pre maintenance.

For other countries I honestly don’t take much notice.

One thing I will say in the UK it might be different as the supply is so much smaller (we build real houses made from bricks not wood lol) will run a bench mark to see at some point to see.

Urth (msci world) etf performance since 2012 is around 30% less than s&p.

70% of Urth geo is USA

So result is same, if s&p collapse so will your world index.

Agriculture means business and that is risky. I'm talking about residential real estate below market value. These type of deals you don't find on Internet.

Only through networking.

I’d take a pic of my hand but i would then be identifiable lol / agriculture can be painful especially if you are moving a thorny fruit tree like the wife had me doing last night.

My wife’s family are “huge” land holders in agricultural terms - usually all the work is carried out by other parties and the profits shared just because of the size and work ethic required.

So day to day you won’t get wealthy off - bit over the span of time land prices appreciate either for demand for repurpose or speculation.

In the UK 20 yrs ago my father was offered land by a farmer for 5000 an acre - (our horses needed more land to destroy) today I suspect it’s about 15,000 an acre there - and they’ve debased much more than that % wise. So you would have lost funds in real terms.

@wellington so what do you suggest then?

unfortunately i lost a lot of money already by sticking to bonds, due to fear of loosing in the markets (i wasn't greedy, which is a bad thing in capitalism). all the money i ever made was made organic + some bond's interest, meaning i suck at this.

There’s probably only one solution

Gold has been a horrendous hedge against debasement between 2013-2020 it lost roughly 4% pa - it’s catching up - but at some point there will need to liquidate pristine collateral in the event around the corner - that’s usually not a couple of hundred dollars over a few weeks like the past few weeks but a big and sudden collapse with a v-Bottom over time.

Nasdaq 100 has consistently outperformed debasement because it offsets the reason for debasement - population growth - labour workforce decline - rising debts - offsetting GDP decline by printing the difference to cover the shortfall in rolling over debt (not paying it). Nasdaq 100 represents technology - technology offsets the productivity/population thus paves a way for GDP and the idea of a productivity miracle dealing with the debt.

The only other asset class that is also world wide - everywhere but nowhere - technology but also finance and outperforms is bitcoin over the span of time.

* and cryptos for the risk curve

,,

The other important thing on real estate - demographics are the future - today in Japan you can buy property for next to nothing.

Across the West our demographics are collapsing - that impacts real estate, agriculture - and technology impacts commercial real estate.

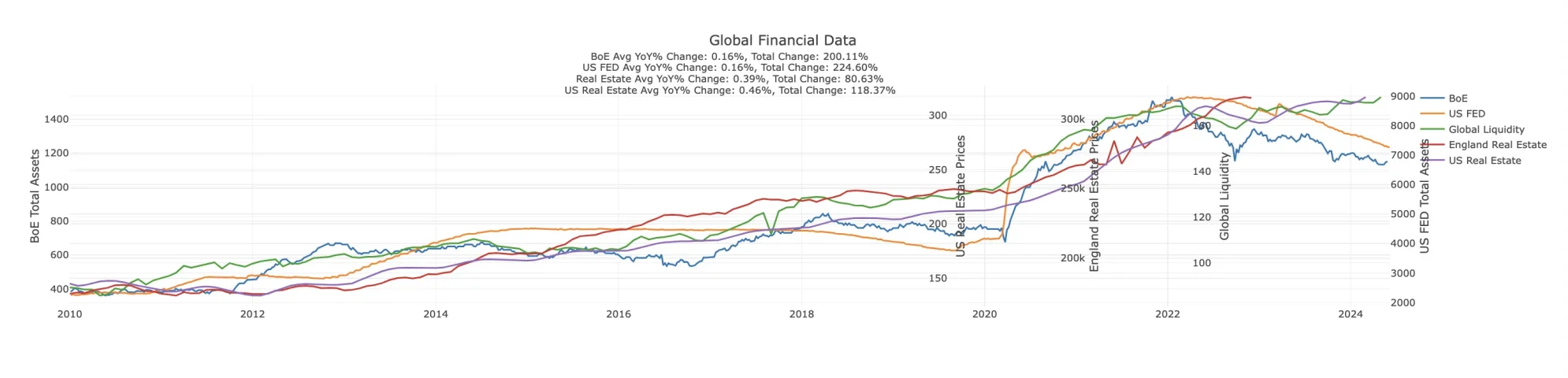

Ref Real-Estate, thats Real Estate *UK-Red* against BOE Debasement *Blue*, and US Real Estate *Purple* against US Debasement *Orange*

Pre-maitenance/Fees/taxes.

So it's underperforming but optically rises via nominal rises.

Now if you are a non-UK citizen for example you'd probably convert to $ transfer to the UK and convert to pounds or if a US Citizen you'd transfer $ to UK - which brings in a secondary debasement after currency conversion loss/growth against US Fed debasement.

If a third party country then you have most likely gains in your local currency but will still have losses in $ invested in UK real Estate.

Hence the aim has to be to outperform US $ debasement.