Stable coins will increasing replace the Eurodollar market

The Eurodollar market is an offshore dollar market and some of it is just paper contracts but it’s serviced with real dollars (usually)

To put into perspective the Eurodollar market is 350-420 trillion $ of Eurodollar contracts which rolls over at 75 trillion$ a year with interest rates from 5-25% which is the demand point for the $

The city of London constructed it as the empire fell over time in part to move “dirty” trading off clean books regulated in the city to offshore havens operating banks owned by the city via cover and then in the latter to build out the Eurodollar market as the world increasingly wanted dollar based contracts but the US had capital flight restrictions making onshore and offshore interactions nearly impossible as dollars flooding in could be exchanged for Gold and the gold wasn’t there in the quantities and still isn’t today - hence how they repaid the Germans with different sizes and bars because the NY Fed didn’t have it -> it was much worse when France and co was drawing it down as it had the potential to wipe the trust of the US out.

Fast forward to now - the world is more digital tomorrow than it is today.

Part 1

Stable coins will increasing replace the Eurodollar market

The Eurodollar market is an offshore dollar market and some of it is just paper contracts but it’s serviced with real dollars (usually)

To put into perspective the Eurodollar market is 350-420 trillion $ of Eurodollar contracts which rolls over at 75 trillion$ a year with interest rates from 5-25% which is the demand point for the $

The city of London constructed it as the empire fell over time in part to move “dirty” trading off clean books regulated in the city to offshore havens operating banks owned by the city via cover and then in the latter to build out the Eurodollar market as the world increasingly wanted dollar based contracts but the US had capital flight restrictions making onshore and offshore interactions nearly impossible as dollars flooding in could be exchanged for Gold and the gold wasn’t there in the quantities and still isn’t today - hence how they repaid the Germans with different sizes and bars because the NY Fed didn’t have it -> it was much worse when France and co was drawing it down as it had the potential to wipe the trust of the US out.

Fast forward to now - the world is more digital tomorrow than it is today.

Part this with sovereigns dropping dollar demand due to sanctions and trust in the US ability to repay its debt the US has a issue - it needs debt refinancing of roughly 6 trillion this year alone without all corporate debt etc

They debase to achieve this printing the difference etc but you can only do that if there is liquidity and demand for US debt

Stable coins increasingly are eating into that demand what’s more it’s from peasants and industry opposed to sovereign’s which look to the dollar strength against their own currencies

What’s more it’s a method to get more control on the dollar offshore without having to actively be involved hence it has and is eating into the Eurodollar market both in trade and investment whilst soaking up US debt keeping it locked up akin to a balance sheet

Tether earns a princely sum - and there’s pressure that can be plied that can’t be plied on say China etc

So for the US it’s a win, for tether it’s a win

The looser is the city of London thus the UK economy long term

City of London directly or indirectly managed 40% of wealth and largest % of Eurodollar settlements

That’s now going to decrease dramatically

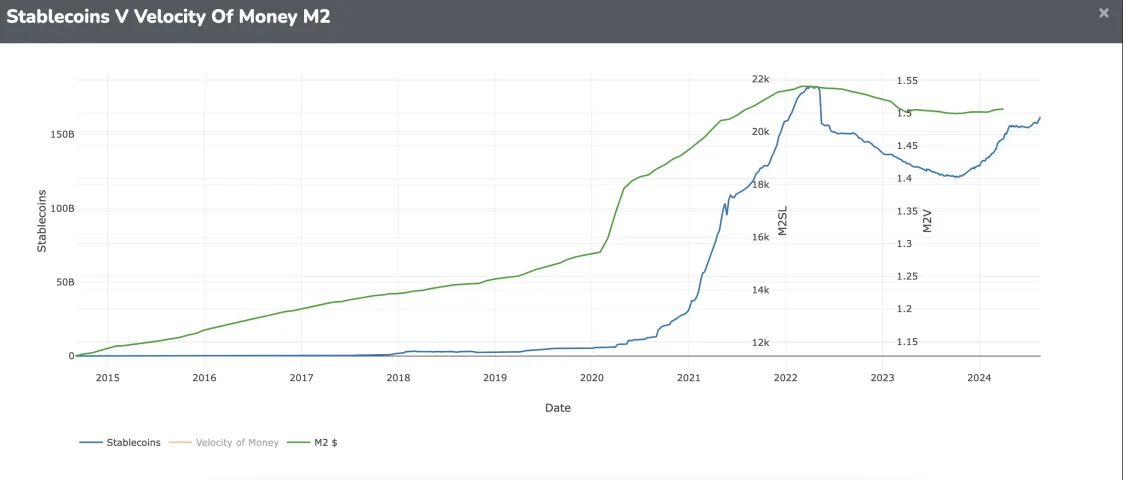

Notice Stablecoins tracking M2.

38 mins into this watch that segment