It will affect Elite Visa holders staying more than 180 days. With the rise of Elite Visa prices and the new taxation, Thailand Privilege will go bankrupt lol.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thailand 0% tax

- Thread starter yngmind

- Start date

Looks like they're implementing a tax on worldwide income, not just plugging the remittance hole.

"From now on, people who have earned overseas income either from their occupation or doing business abroad or from wealth that is located abroad but has been exempted from PIT for nearly 40 years, must factor this into their PIT for the year."

https://www.bangkokpost.com/business/general/2652846/amendment-to-see-overseas-income-taxed

"From now on, people who have earned overseas income either from their occupation or doing business abroad or from wealth that is located abroad but has been exempted from PIT for nearly 40 years, must factor this into their PIT for the year."

https://www.bangkokpost.com/business/general/2652846/amendment-to-see-overseas-income-taxed

Looks like they're implementing a tax on worldwide income, not just plugging the remittance hole.

"From now on, people who have earned overseas income either from their occupation or doing business abroad or from wealth that is located abroad but has been exempted from PIT for nearly 40 years, must factor this into their PIT for the year."

https://www.bangkokpost.com/business/general/2652846/amendment-to-see-overseas-income-taxed

It's possible, but I wouldn't rely solely on that poorly written article until information from a reliable source comes out.

Most reliable sources at the moment agree that it will be remittance based. Furthermore, Thailand doesn't really have a system in place to collect worldwide income like other countries; it's highly unlikey that they could build that in only a few months.

They receive CRS reporting so they are able to know your foreign assets.It's possible, but I wouldn't rely solely on that poorly written article until information from a reliable source comes out.

Most reliable sources at the moment agree that it will be remittance based. Furthermore, Thailand doesn't really have a system in place to collect worldwide income like other countries; it's highly unlikey that they could build that in only a few months.

They receive CRS reporting so they are able to know your foreign assets.

That's not enough to tax it when the whole fiscal system is built only for local income and remittances.

It will take years for them to be able to tax worldwide income like countries such as Spain do.

can you please be more specific on that? why will this be problematic? Lets say they know you got 200k$ on Wise from offshore business registered somewhere in Europe or even US LLC. Why can't thai authorities reach out to Wise or to the country where business is registered to tax this money or freeze account? CRS make them aware of your funds offshore.That's not enough to tax it when the whole fiscal system is built only for local income and remittances.

It will take years for them to be able to tax worldwide income like countries such as Spain do.

In Switzerland I pay a wealth tax, my accountant set the amount, it's remained the same since, the Government seems happy, i stomach it and pay it, but the world moves on.

If Thailand introduced a Wealth Tax 0.05% i'd pay that, they'd earn enough of that without having to destroy their economy trying to tax people on their world wide income etc.

If Thailand introduced a Wealth Tax 0.05% i'd pay that, they'd earn enough of that without having to destroy their economy trying to tax people on their world wide income etc.

That's not enough to tax it when the whole fiscal system is built only for local income and remittances.

It will take years for them to be able to tax worldwide income like countries such as Spain do.

Yep, that's correct.Looks like they're implementing a tax on worldwide income, not just plugging the remittance hole.

"From now on, people who have earned overseas income either from their occupation or doing business abroad or from wealth that is located abroad but has been exempted from PIT for nearly 40 years, must factor this into their PIT for the year."

https://www.bangkokpost.com/business/general/2652846/amendment-to-see-overseas-income-taxed

Unfortunately, many people who post in this thread do not understand that times have changed.

No "system" needed for that. Just an amended form for self-assessment. What you declare will then be matched (electronically) with CRS data.Furthermore, Thailand doesn't really have a system in place to collect worldwide income like other countries; it's highly unlikey that they could build that in only a few months.

They have more than 18 months to set this up.

Last edited:

why 18 months? what will be done in next 18 months? so possible 2024 will be last year to live tax free in Thailand?Yep, that's correct.

Unfortunately, many people who post in this thread do not understand that times have changed.

No "system" needed for that. Just an amended form for self-assessment. What you declare will then be matched (electronically) with CRS data.

They have more than 18 months to set this up.

Hehe nomads in Thailand already forgot whats tax returns. You will file your 2024 income tax returns in April 2025.why 18 months? what will be done in next 18 months? so possible 2024 will be last year to live tax free in Thailand?

If offshore financial institution accounts are not registered with Thai address, nothing will ever be sent to Thailand.They receive CRS reporting so they are able to know your foreign assets.

Can't see that going through... there's a lot of wealth here, i mean old money, billionaires, family banks etc (expats), the'd all exit and it would cause intense pain.

The yacht industry alone... the real-estate industry there after.

Going on remittance is bad enough, but to castrate yourself on going after the wealth of non citizens residing in your country instead of a private island in the Caribbean... reckless.

Lot of my friends are already going or spending less time (and money) in Thailand and they are north of 100m$ in networth.

One fortunately - unfortunately passed away a few months ago, but he was spending about 3m Euro a year in Thailand (old European family bank). Another one (Family financer/Investor in one of the first SLR companies) spends about 5m Francs a year.. you start adding all these people up, especially walking around catch, etc at the weekends, you end up with billions.

Come to think of it you even have Gulu Lalvani - billionaire british-indian national - another example, lives here all year round...

A lot of the OAP's with about 1m$ networth seem to think it won't impact them (i've given up talking about it with them).

What's actually reported under CRS these days?

The yacht industry alone... the real-estate industry there after.

Going on remittance is bad enough, but to castrate yourself on going after the wealth of non citizens residing in your country instead of a private island in the Caribbean... reckless.

Lot of my friends are already going or spending less time (and money) in Thailand and they are north of 100m$ in networth.

One fortunately - unfortunately passed away a few months ago, but he was spending about 3m Euro a year in Thailand (old European family bank). Another one (Family financer/Investor in one of the first SLR companies) spends about 5m Francs a year.. you start adding all these people up, especially walking around catch, etc at the weekends, you end up with billions.

Come to think of it you even have Gulu Lalvani - billionaire british-indian national - another example, lives here all year round...

A lot of the OAP's with about 1m$ networth seem to think it won't impact them (i've given up talking about it with them).

Just for clarity sake.If offshore financial institution accounts are not registered with Thai address, nothing will ever be sent to Thailand.

What's actually reported under CRS these days?

Last edited:

well if your tax residency is in Thailand you are legally obligated to put your thai adress for financial institutions unless you practise tax evasion.If offshore financial institution accounts are not registered with Thai address, nothing will ever be sent to Thailand.

I doubt thats true.well if your tax residency is in Thailand you are legally obligated to put your thai adress for financial institutions unless you practise tax evasion.

1) Not putting a Thai address wouldn't by default make it evasion.

2) Numerous (400,000+) expats from Europe have their European address in their financial accounts whilst residing in Thailand, or they'd loose access to their accounts...

3) It's not a law.

4) It doesn't equate to tax evasion as its aligned against national ID, which is aligned against CRS, which Thailand will have access to.

So calling BS.

so it hasn't gone through yet? I think all articles mention it's going into live from 1st JanuaryCan't see that going through... there's a lot of wealth here, i mean old money, billionaires, family banks etc (expats), the'd all exit and it would cause intense pain.

The yacht industry alone... the real-estate industry there after.

Going on remittance is bad enough, but to castrate yourself on going after the wealth of non citizens residing in your country instead of a private island in the Caribbean... reckless.

Lot of my friends are already going or spending less time (and money) in Thailand and they are north of 100m$ in networth.

One fortunately - unfortunately passed away a few months ago, but he was spending about 3m Euro a year in Thailand (old European family bank). Another one (Family financer/Investor in one of the first SLR companies) spends about 5m Francs a year.. you start adding all these people up, especially walking around catch, etc at the weekends, you end up with billions.

Come to think of it you even have Gulu Lalvani - billionaire british-indian national - another example, lives here all year round...

A lot of the OAP's with about 1m$ networth seem to think it won't impact them (i've given up talking about it with them).

Just for clarity sake.

What's actually reported under CRS these days?

Please elaborate. You are requested by every financial institution to put info about your personal tax residency. What do you put in case you are living 183+ days in Thailand? If someone is not living 183+ days then no need to worry at all.I doubt thats true.

Yep, that's correct.

Unfortunately, many people who post in this thread do not understand that times have changed.

No "system" needed for that. Just an amended form for self-assessment. What you declare will then be matched (electronically) with CRS data.

They have more than 18 months to set this up.

You have an oversimplified view of how bureaucracy, tax systems, offshore business and companies, PE, tax treaties, tax deductions, multiple residencies, etc. work if you think that "matching data with CRS" is all a tax office will need to rely on to start taxing foreign income in a country that has only territorial tax rules and laws.

It may happen in the future, but it's not what's going to happen in 2024. The decree is already in place and it's remittance-based. Its number is "161/2566", in case you want to google it.

Not all financial institutions ask for tax residency, in fact I only know one, and that was in Eastern Europe many years ago.

I don't bank in the West, the account i last had there (bank) was in Switzerland and I closed that down this year due to the fees (private) and the fact i don't or rather hadn't done a transaction on it in a very long time, they were probably the last bank that verified my residency.

EMI's were surprised when i updated one to the country years ago, but don't even think they do reporting.

Besides i pay wealth tax in Europe so i am taxed there.

Elsewhere Asia they have never asked.

It's a bit of annoyance, but like i pointed out above, the annoyance is that I need to get in the air again, like i mentioned a long while back, they enact and there's no way around - then i enact, which results in less expenditure in the country, as i don't support socialist/communism which this new process is supporting populist politics.

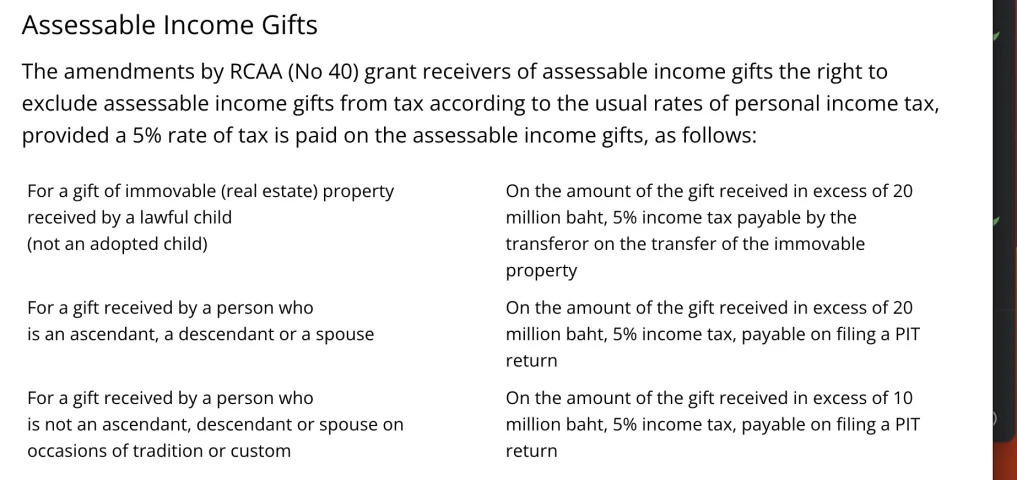

Otherwise I suspect i may be ok, (example) I'm able to give each child 20m THB and wife 20m THB tax free (think thats 550k per year).

They can likewise give me the money tax free up-to 20m THB. or there about

updated 5% tax on (that's ok).

Until that law changes i guess lol

Thailand Gift Allowance Thailand Gift Tax Compliance.

Being honest the real pain in all this, is what to do with the cat. If we decide to do a year in Malaysia its ok, if Dubai not so sure.

Wife, Kids, one thing, Nannies another immovable and movable already have solutions, but the cat...

I don't bank in the West, the account i last had there (bank) was in Switzerland and I closed that down this year due to the fees (private) and the fact i don't or rather hadn't done a transaction on it in a very long time, they were probably the last bank that verified my residency.

EMI's were surprised when i updated one to the country years ago, but don't even think they do reporting.

Besides i pay wealth tax in Europe so i am taxed there.

Elsewhere Asia they have never asked.

It's a bit of annoyance, but like i pointed out above, the annoyance is that I need to get in the air again, like i mentioned a long while back, they enact and there's no way around - then i enact, which results in less expenditure in the country, as i don't support socialist/communism which this new process is supporting populist politics.

Otherwise I suspect i may be ok, (example) I'm able to give each child 20m THB and wife 20m THB tax free (think thats 550k per year).

They can likewise give me the money tax free up-to 20m THB. or there about

updated 5% tax on (that's ok).

Until that law changes i guess lol

so it hasn't gone through yet? I think all articles mention it's going into live from 1st January

Please elaborate. You are requested by every financial institution to put info about your personal tax residency. What do you put in case you are living 183+ days in Thailand? If someone is not living 183+ days then no need to worry at all.

Thailand Gift Allowance Thailand Gift Tax Compliance.

Being honest the real pain in all this, is what to do with the cat. If we decide to do a year in Malaysia its ok, if Dubai not so sure.

Wife, Kids, one thing, Nannies another immovable and movable already have solutions, but the cat...

Attachments

Last edited:

So, where do these non-Western banks send your data, if applicable?Not all financial institutions ask for tax residency, in fact I only know one, and that was in Eastern Europe many years ago.

I don't bank in the West, the account i last had there (bank) was in Switzerland and I closed that down this year due to the fees (private) and the fact i don't or rather hadn't done a transaction on it in a very long time, they were probably the last bank that verified my residency.

Never asked, you must be American... the expectation to be surveilled.So, where do these non-Western banks send your data, if applicable?

1) Don't care

2) Not breaking the law, so don't care.

3) No clue where they send the information.

4) Accounts are very old.

5) As discussion above, they will probably reach out or not to determine where to send information.

--- NEXT ----

Last edited:

Share: