Based on discussions this evening, over the past few days with fellow elite, residents, agents, tax advisors, etc....

Dubai looked promising until factor in 9% corporate tax for a corporate i am shareholder off, but has largish returns in 5/10yr ranges.

Personal tax Dubai was ok...

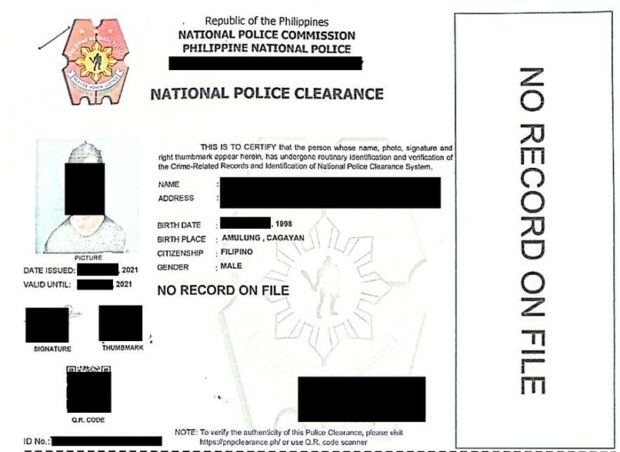

This is based on the Labuan + Malaysia

Expatriate Visa.

May be of help to others and perhaps build a community in Malaysia.

Personal Aspect:

Under the MM2H visa, expats are not required to pay tax on their income, no matter where it comes from, as long as it's remitted from overseas. This includes interest earned on income sitting in accounts in Malaysia. Currently cash rates are at 3%, while five-year deposit rates are at 5%.

Commercial Aspect:

The rate of tax imposed is

3% of audited net profits for trading activity and zero percent for non-trading activity, provided that the Labuan entities are in compliance with the tax substantial activity requirements.

*Note i have 0% tax written for Labuan as they want companies in specific fields to move there... fit that bracket, not the same for all, but 3% is ok...

View attachment 5418