You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thailand tax update 20/11/23

- Thread starter wellington

- Start date

Thank you for excellent explanation.Kraken to Thailand should be fine.

That falls under US law so they are at least regulated.

The thing is if you have funds coming from a regulated entity you yourself shift the compliance from yourself to the entity, i.e if you do a trade with a Iranian (think Binance indictment) that's on them, if you however do a trade P2P with someone of Iranian nationality on P2P on Binance and you route through $ via Binance to your account (their account to yours) or someone laundering funds in Thailand P2P via Binance -> That's on you because the issue will rear over your incoming /outgoing transactions direct to the subject rather than a entity in the middle.

If its P2P (physical = cash) then the risk goes down (a) you can vet, (b) its not utilising the banking system.

If you do OTC well thats usually a financially regulated entity on top of the OTC which carries out the KYC/AML before funds enter the pool.

So Kraken should be fine (if not P2P) -> Funds from a financially regulated entity (Kraken) if you get tainted funds -> it's on them.

Over the years i've read on Aseannow.com about expats arrested due to

a) tainted funds

b) charge backs for fraud (chargeback fraud that entraps the expat by fraud carried out by their P2P party).

That's not to say i am not a supporter of P2P -> I am, i just wouldn't do any transaction P2P which passes through the US (SDNY) OR in a country i hold assets...

Because being ensnared in some laundering activity will cost years and a tonne of money, and possibly criminal charges, because of the size and then the statement of no "money transmitter license" etc for carrying out a P2P transaction.

Nooms or something looks interesting but there's unknown counterparty risk and reliance on utilising the banking rails.

Just one last thought... Kraken oddly is the laundering capital of the world in Crypto -> I know tonnes of Ponzi schemes and the parties involved that have laundered their funds through Kraken.

Oddly i've never see an action against Kraken lol.

I have a Kraken account and also Bitstamp so it's all good if needed.

I'll probably try to do P2P meetup if it's money I can't show has been there from before 2024.

But then again, I wonder, back to my original questions above.. As far as I understand the new tax law, if I had savings in a bankaccount, I could put them in a timedeposit and transfer into Thailand upon expiry of the timedepsoit without tax? It's savings that was there before 2024, except for the interest. I have a paper trail from before 2024.

How will they interpret crypto staking? I have a large amount of crypto in various staking pools for years (not only USDT/USDC). What if I withdraw those funds and transfer via for instance Kraken to Thailand. Will I be taxed because I don't have a "paper trail" or will this be interpreted as savings in a "savings" (staking) account that has been there since before 2024?

I once had to deal with the TCSD in Bangkok.... they were completely clueless to crypto and how it worked. I had to do crypto forensic tracing and follow the crypto on my own and show them and still they didn't understand. I had to write their reports to Binance and a few other exchanges that were involved. In the end obviously nothing happened as most of the time with police in this country. Mind you this was just 1-2 years ago. So how about the revenue department?

On another note.

I assume you entered the telegram group and posted the question?

I am a bit surprised no one has answered as it's usually a lively and helpful group.

Maybe it's weekend or maybe because it's not related to Bkk. I'm not sure..

This was just question of time. I have always been skeptic of territorial tax countries. Sad for those who believed and built their lives/home in Thailand

It's not too bad, i mean it sucks for those that earn a income and were bringing in the same year hoping they were not checked, or even those that deferred for a year before bringing in.

But otherwise for those that have savings overseas built up over numerous years, it's not a bad turn of events (could have been worse).

I don't know what a time deposit is (CD?) -> American thing i think?But then again, I wonder, back to my original questions above.. As far as I understand the new tax law, if I had savings in a bankaccount, I could put them in a timedeposit and transfer into Thailand upon expiry of the timedepsoit without tax? It's savings that was there before 2024, except for the interest. I have a paper trail from before 2024.

But i can say from my discussions with the revenue department -> which were extensive.

If you have savings overseas -> and you put those into stocks/similar and then draw that down and bring those funds into Thailand later, only the capital gains side of it would be taxed as income, the principle wouldn't.

But it needs to be documented.

Crypto Staking if personal would be taxable, if via a overseas company then not.How will they interpret crypto staking? I have a large amount of crypto in various staking pools for years (not only USDT/USDC). What if I withdraw those funds and transfer via for instance Kraken to Thailand. Will I be taxed because I don't have a "paper trail" or will this be interpreted as savings in a "savings" (staking) account that has been there since before 2024?

I once had to deal with the TCSD in Bangkok.... they were completely clueless to crypto and how it worked. I had to do crypto forensic tracing and follow the crypto on my own and show them and still they didn't understand. I had to write their reports to Binance and a few other exchanges that were involved. In the end obviously nothing happened as most of the time with police in this country. Mind you this was just 1-2 years ago. So how about the revenue department?How will they understand crypto?

The difference being crypto is consider to be in Thailand if you are a resident regardless of where its actually based.

If its a company then its entirely different, so...

Company Asset -> Staked -> Staking Rewards -> Liquidated -> Dividend -> Remitted % taxed, rest un-taxed.

IF TCSD were involved with you -> that would be to do with something else...I once had to deal with the TCSD in Bangkok.... they were completely clueless to crypto and how it worked. I had to do crypto forensic tracing and follow the crypto on my own and show them and still they didn't understand. I had to write their reports to Binance and a few other exchanges that were involved. In the end obviously nothing happened as most of the time with police in this country. Mind you this was just 1-2 years ago. So how about the revenue department?How will they understand crypto?

P2P that went wrong ? (i.e tainted funds)?

Last edited:

Term deposit? You lock your cash for a specific time for increased interest ratesI don't know what a time deposit is (CD?) -> American thing i think?

But i can say from my discussions with the revenue department -> which were extensive.

If you have savings overseas -> and you put those into stocks/similar and then draw that down and bring those funds into Thailand later, only the capital gains side of it would be taxed as income, the principle wouldn't.

But it needs to be documented.

Ok Understood

Crypto Staking if personal would be taxable, if via a overseas company then not.

The difference being crypto is consider to be in Thailand if you are a resident regardless of where its actually based.

If its a company then its entirely different, so...

Company Asset -> Staked -> Staking Rewards -> Liquidated -> Dividend -> Remitted % taxed, rest un-taxed.

Yes all is outside of Thailand

So basically just transfer amounts that has been sitting idle would be better and hope they do not catch other amounts in your wallet.

IF TCSD were involved with you -> that would be to do with something else...

P2P that went wrong ? (i.e tainted funds)?

I had a wallet hacked and tried to get the help of the TCSD. I should have known it was a waste of time.

In the end I took it as a tax on my other profits in other wallets

Have a good evening!

Super interesting thread guys.

I'm willing to convert some USDT/USDC to THB to buy a condo or something (so, not a small deal), and I wanna do it in a super clean way. If someone can advise a contact to discuss the matter, even for paid advice, it'd help a lot.

PS. The tricky part, that I still have to fully understand, is that money for an expat (fiscally resident in Thailand but not with a work permit), has to come from abroad with the explicit intent (reason of payment?) of buying real estate. But it must be a pretty new procedure cause many agents and banks have no idea how this actually works!

thanks.

I'm willing to convert some USDT/USDC to THB to buy a condo or something (so, not a small deal), and I wanna do it in a super clean way. If someone can advise a contact to discuss the matter, even for paid advice, it'd help a lot.

PS. The tricky part, that I still have to fully understand, is that money for an expat (fiscally resident in Thailand but not with a work permit), has to come from abroad with the explicit intent (reason of payment?) of buying real estate. But it must be a pretty new procedure cause many agents and banks have no idea how this actually works!

thanks.

Last edited:

@wellington might be able to, at the very least, guide you on what NOT to do, so you stay out of trouble. Trouble = ammunition to the state and their henchmen.Super interesting thread guys.

I'm willing to convert some USDT/USDC to THB to buy a condo or something (so, not a small deal), and I wanna do it in a super clean way. If someone can advise a contact to discuss the matter, even for paid advice, it'd help a lot.

PS. The tricky part, that I still have to fully understand, is that money for an expat (fiscally resident in Thailand but not with a work permit), has to come from abroad with the explicit intent (reason of payment?) of buying real estate. But it must be a pretty new procedure cause many agents and banks have no idea how this actually works!

thanks.

Term deposit? You lock your cash for a specific time for increased interest rates

Ok Understood

Yes all is outside of Thailand

So basically just transfer amounts that has been sitting idle would be better and hope they do not catch other amounts in

I had a wallet hacked and tried to get the help of the TCSD. I should have known it was a waste of time.

In the end I took it as a tax on my other profits in other wallets

Have a good evening!

Answered somewhere aboveSuper interesting thread guys.

I'm willing to convert some USDT/USDC to THB to buy a condo or something (so, not a small deal), and I wanna do it in a super clean way. If someone can advise a contact to discuss the matter, even for paid advice, it'd help a lot.

PS. The tricky part, that I still have to fully understand, is that money for an expat (fiscally resident in Thailand but not with a work permit), has to come from abroad with the explicit intent (reason of payment?) of buying real estate. But it must be a pretty new procedure cause many agents and banks have no idea how this actually works!

thanks.

HK crypto exchange / OTC -> HKD -> Kasikorn HKD account (Thailand - foreign currency account) -> convert to THB in branch -> paper trail and fund import docs provided -> Buy condo

* note can send over in HKD to THB account but fees will be higher with less control on currency conversion decision.

** Note I know Kasikorn has foreign currency accounts as Elite established mine years ago.

I previously (company) had a Euro account with bangkok bank for commercial but it was costly to maintain and a pain in the a*s to do anything - with Kasikorn you can have Euro, SGD , HKD and I believe $ (I don’t use dollars so not 100% sure in that one).

Note there is zero digital access - it’s all managed in branch - normally the City/Provincial head branch, with Bangkok Bank it’s any branch I believe or was for commercial.

Not sure on other banks as never asked .

Reference OTC can’t give you any specifics - because a lot has changed over the past few years - will say a lot of Japanese OTCs route through Taiwan Merchant Banks.

In HK they route through Chinese or European rails or ripple (I know)

One that comes up immediately in google - so your research Crypto HK: Homepage , Crypto HK

Or look for established exchanges / crypto OTC regional companies.

Last edited:

Thanks for taking the time to reply, I appreciate it.Answered somewhere above

HK crypto exchange / OTC -> HKD -> Kasikorn HKD account (Thailand - foreign currency account) -> convert to THB in branch -> paper trail and fund import docs provided -> Buy condo

* note can send over in HKD to THB account but fees will be higher with less control on currency conversion decision.

** Note I know Kasikorn has foreign currency accounts as Elite established mine years ago.

I previously (company) had a Euro account with bangkok bank for commercial but it was costly to maintain and a pain in the a*s to do anything - with Kasikorn you can have Euro, SGD , HKD and I believe $ (I don’t use dollars so not 100% sure in that one).

Note there is zero digital access - it’s all managed in branch - normally the City/Provincial head branch, with Bangkok Bank it’s any branch I believe or was for commercial.

Not sure on other banks as never asked .

Reference OTC can’t give you any specifics - because a lot has changed over the past few years - will say a lot of Japanese OTCs route through Taiwan Merchant Banks.

In HK they route through Chinese or European rails or ripple (I know)

One that comes up immediately in google - so your research Crypto HK: Homepage , Crypto HK

Or look for established exchanges / crypto OTC regional companies.

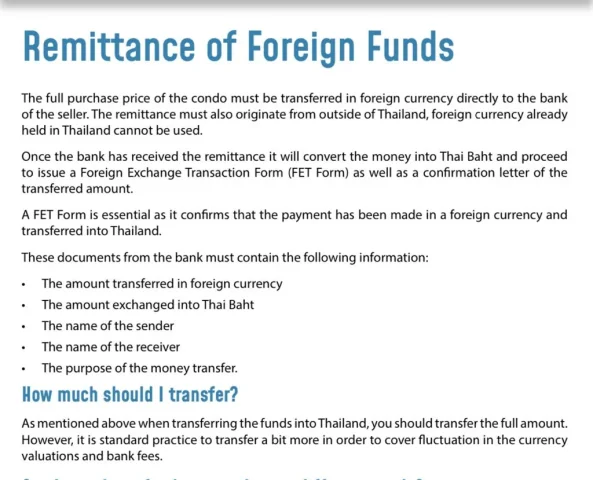

I well understand the process you are suggesting, but what I miss is the "remittance of foreign funds" as I read in the attached ebook. Sounds like the funds cannot be moved and used in a second moment, but must be used directly to pay the purchase.

Need to find the right person/agent I guess, until now I've got just a generic answer about it (from realtor and banks).

Attachments

I well understand the process you are suggesting, but what I miss is the "remittance of foreign funds" as I read in the attached ebook. Sounds like the funds cannot be moved and used in a second moment, but must be used directly to pay the purchase.

These links can help:

https://thethaiger.com/thai-life/pr...hailand-for-property-purchase#google_vignette

https://www.siam-legal.com/realestate/transfer-money-to-thailand-property-purchase.php

https://freshbangkok.com/guide/the-ultimate-guide-to-buying-bangkok-condos-and-homes/

If you buy a condo in your name money has to come from abroad (Thereafter FET document will be useful to repatriate this money outside of Thailand) but if you buy through a Thai company (mandatory to buy land/house) it can be funded different ways and no document will be needed to prove money comes from offshore.

Getting a FET is standard process, when making the wire transfer need to write "Property Purchase" as purpose.

AFAIK, there's no obligation to precise unit/address because you may have not made your choice yet (buying on plan) but seller could ask you detail it in order to "close" the sale. Once money is in your TH bank there's no deadline/purpose to spend it either (you have the right to change your mind if no sales agreement has been signed yet).

Realtors/developers may help with RE legal services when you buy, I strongly suggest you take legal advice.

Important note: be aware that foreign remittance will potentially (still no clarity) be taxable starting 01/01/2024 onwards, unless you have evidence that money has been earned prior 2024 or you are not TH tax resident the year you remit money.

Bringing funds into a HKD account is bringing them into the country (remitting) - moving to your THB account is part of that process - you are however controlling the conversion ratio.Thanks for taking the time to reply, I appreciate it.

I well understand the process you are suggesting, but what I miss is the "remittance of foreign funds" as I read in the attached ebook. Sounds like the funds cannot be moved and used in a second moment, but must be used directly to pay the purchase.

Need to find the right person/agent I guess, until now I've got just a generic answer about it (from realtor and banks).

Alternatively check with the bank you should be able to buy the property using the HKD account with a cheque from the bank

Just don’t loose the cheque as they are bearer assets - meaning can be cashed out unless a specific entity is put on them by anyone

This is an important point

“Realtors/developers may help with RE legal services when you buy, I strongly suggest you take legal advice.”

Sometimes they split the payments part on shore and part offshore

As their funding unless domestic is offshore and they need to service those payments

So it won’t be unusual to pay a Affilated entity in HK or Singapore for part of the payment - depends on the developer ofcourse.

In experience a 100m$ development I had experience with a decade ago had offshore and onshore - onshore servicing via SCB director loan 10m$ and rest in HK or BVI.

On top of that payroll was onshore and offshore.

So you might find they may ask to be paid part offshore.

Last edited:

Maybe the easiest solution is to only spend 5 months in Thailand the year that you buy a condo there.

What do you mean ?Maybe the easiest solution is to only spend 5 months in Thailand the year that you buy a condo there.

These links can help:

https://thethaiger.com/thai-life/pr...hailand-for-property-purchase#google_vignette

https://www.siam-legal.com/realestate/transfer-money-to-thailand-property-purchase.php

https://freshbangkok.com/guide/the-ultimate-guide-to-buying-bangkok-condos-and-homes/

If you buy a condo in your name money has to come from abroad (Thereafter FET document will be useful to repatriate this money outside of Thailand) but if you buy through a Thai company (mandatory to buy land/house) it can be funded different ways and no document will be needed to prove money comes from offshore.

Getting a FET is standard process, when making the wire transfer need to write "Property Purchase" as purpose.

AFAIK, there's no obligation to precise unit/address because you may have not made your choice yet (buying on plan) but seller could ask you detail it in order to "close" the sale. Once money is in your TH bank there's no deadline/purpose to spend it either (you have the right to change your mind if no sales agreement has been signed yet).

Realtors/developers may help with RE legal services when you buy, I strongly suggest you take legal advice.

Important note: be aware that foreign remittance will potentially (still no clarity) be taxable starting 01/01/2024 onwards, unless you have evidence that money has been earned prior 2024 or you are not TH tax resident the year you remit money.

Thanks guys for taking the time again.Bringing funds into a HKD account is bringing them into the country (remitting) - moving to your THB account is part of that process - you are however controlling the conversion ratio.

Alternatively check with the bank you should be able to buy the property using the HKD account with a cheque from the bank

Just don’t loose the cheque as they are bearer assets - meaning can be cashed out unless a specific entity is put on them by anyone

This is an important point

“Realtors/developers may help with RE legal services when you buy, I strongly suggest you take legal advice.”

Sometimes they split the payments part on shore and part offshore

As their funding unless domestic is offshore and they need to service those payments

So it won’t be unusual to pay a Affilated entity in HK or Singapore for part of the payment - depends on the developer ofcourse.

In experience a 100m$ development I had experience with a decade ago had offshore and onshore - onshore servicing via SCB director loan 10m$ and rest in HK or BVI.

On top of that payroll was onshore and offshore.

So you might find they may ask to be paid part offshore.

So what I read in the ebook I've attached earlier is simply wrong (full ebook here JFYI: Purchasing A Condo In Thailand As A Foreigner Ebook.pdf). They write on the website to be both experts in real estate and crypto so I would have been interested in taking advice from them...

Can I use these funds to purchase a different condo?

If the condo you are trying to purchase, for whatever reason, becomes unavailable you CANNOT

use the same funds to complete another transaction. If you find another condo to purchase, even

if it is next door to your original intended purchase and costs exactly the same, the whole process

must start again. You will have to transfer the money into Thailand as a foreign currency under a

new transaction.

Would you recommend sending the money to Thailand before January 1 even if it was earned this same year?These links can help:

https://thethaiger.com/thai-life/pr...hailand-for-property-purchase#google_vignette

https://www.siam-legal.com/realestate/transfer-money-to-thailand-property-purchase.php

https://freshbangkok.com/guide/the-ultimate-guide-to-buying-bangkok-condos-and-homes/

If you buy a condo in your name money has to come from abroad (Thereafter FET document will be useful to repatriate this money outside of Thailand) but if you buy through a Thai company (mandatory to buy land/house) it can be funded different ways and no document will be needed to prove money comes from offshore.

Getting a FET is standard process, when making the wire transfer need to write "Property Purchase" as purpose.

AFAIK, there's no obligation to precise unit/address because you may have not made your choice yet (buying on plan) but seller could ask you detail it in order to "close" the sale. Once money is in your TH bank there's no deadline/purpose to spend it either (you have the right to change your mind if no sales agreement has been signed yet).

Realtors/developers may help with RE legal services when you buy, I strongly suggest you take legal advice.

Important note: be aware that foreign remittance will potentially (still no clarity) be taxable starting 01/01/2024 onwards, unless you have evidence that money has been earned prior 2024 or you are not TH tax resident the year you remit money.

I keep hearing that the tax law changes from January 1, so not sure if that means that a large amount still could be sent on December without any taxation or checks from the Thai tax authorities.

It is for a condo purchase.

Last update on tax law changes states that all offshore money earned prior 01/01/2024 can be remitted tax-free in 2024.Would you recommend sending the money to Thailand before January 1 even if it was earned this same year?

I keep hearing that the tax law changes from January 1, so not sure if that means that a large amount still could be sent on December without any taxation or checks from the Thai tax authorities.

It is for a condo purchase.

So better send this money after January 1st.

If you want to remit money this year 2023, current old rule still applies: If money was earned in 2023 it's taxable else (before 2023) it's tax-free.

This is interesting, I have a bunch of 'money' tied up long term in the MtGox bankruptcy, repayments are apparently going to begin soon and I do expect SWIFT transfers to hit my account in the first 3 to 6 months of 2024.

I will get both crypto (Bitcoin and Bitcoin Cash) which I'm not worried about - I can handle that as it's going to an American exchange were I already verified KYC/AML to a decent level. I'll likely just keep it as crypto for a while, I've been forced to hold it for nearly 10 years now so what's a few more.....

The cash portion however will go to my Thai bank account, it's going to be a little under 2 million Baht.

Now this is most definitely money from 2014 when they went under, it will be transferred directly to me from the MtGox company I believe - the company still exists in civil rehabilitation.

What happened is the trustee sold about $650 million worth of Bitcoin back in around 2018 so he had enough funds to bring the company out of 'liquidation bankruptcy' and give us the option of civil rehabilitation which we all voted to accept. This kind of resurrected the company minus the old shareholders with the trustee in charge.

So now they're using that $650 million which has just been sitting there losing value for the last 5 years to pay back everyone whatever they held on the day of the bankruptcy, no matter if the account balance was crypto or USD, but we also get a proportional share of the Bitcoin the company holds, and they have a lot, they have 137,000 Bitcoin - the crypto payments in my case will be on top of the original USD value at the date it was declared insolvent.

So this is a very rare moment where the creditors in a bankruptcy will actually receive far more than was lost - at current JPY prices it's like 20 times the amount back in 2014 due to Bitcoin price appreciation.

In my case the value of everything I had on there was all in Bitcoin and worth about $60-80k back in Feb 2014 (that's quit a bit of Bitcoin to lose even back then) but I'm getting this cash plus a bunch of crypto, the cash represents only a small amount of the total returned but it's also just what I had on there at the point it collapsed.

Now I don't want to pay tax on this - it's 100% older money but I'm not sure how I'm going to prove this is old money in Thailand when they come looking to tax me on the wires which I'm sure they will - this is definitely not money 'earned' recently - it exists right now and has been allocated to me for years - I'm just waiting for payment.

I guess I kind of think of it as like a bank account balance in Japan but it's an accepted bankruptcy claim and not in a bank.

Any thoughts?

I appreciate that this is an unusual situation but I'm pretty sure I shouldn't pay any tax on that and would like to know what to do to prove it's old money - I don't have records from 2014 but I do have claim acceptance screenshots. Also I did not pay any tax on the original $80k, I put like $10k in and traded it up over a couple of years to get this amount. I have been in Thailand the entire time and not paid any tax at all.

I will get both crypto (Bitcoin and Bitcoin Cash) which I'm not worried about - I can handle that as it's going to an American exchange were I already verified KYC/AML to a decent level. I'll likely just keep it as crypto for a while, I've been forced to hold it for nearly 10 years now so what's a few more.....

The cash portion however will go to my Thai bank account, it's going to be a little under 2 million Baht.

Now this is most definitely money from 2014 when they went under, it will be transferred directly to me from the MtGox company I believe - the company still exists in civil rehabilitation.

What happened is the trustee sold about $650 million worth of Bitcoin back in around 2018 so he had enough funds to bring the company out of 'liquidation bankruptcy' and give us the option of civil rehabilitation which we all voted to accept. This kind of resurrected the company minus the old shareholders with the trustee in charge.

So now they're using that $650 million which has just been sitting there losing value for the last 5 years to pay back everyone whatever they held on the day of the bankruptcy, no matter if the account balance was crypto or USD, but we also get a proportional share of the Bitcoin the company holds, and they have a lot, they have 137,000 Bitcoin - the crypto payments in my case will be on top of the original USD value at the date it was declared insolvent.

So this is a very rare moment where the creditors in a bankruptcy will actually receive far more than was lost - at current JPY prices it's like 20 times the amount back in 2014 due to Bitcoin price appreciation.

In my case the value of everything I had on there was all in Bitcoin and worth about $60-80k back in Feb 2014 (that's quit a bit of Bitcoin to lose even back then) but I'm getting this cash plus a bunch of crypto, the cash represents only a small amount of the total returned but it's also just what I had on there at the point it collapsed.

Now I don't want to pay tax on this - it's 100% older money but I'm not sure how I'm going to prove this is old money in Thailand when they come looking to tax me on the wires which I'm sure they will - this is definitely not money 'earned' recently - it exists right now and has been allocated to me for years - I'm just waiting for payment.

I guess I kind of think of it as like a bank account balance in Japan but it's an accepted bankruptcy claim and not in a bank.

Any thoughts?

I appreciate that this is an unusual situation but I'm pretty sure I shouldn't pay any tax on that and would like to know what to do to prove it's old money - I don't have records from 2014 but I do have claim acceptance screenshots. Also I did not pay any tax on the original $80k, I put like $10k in and traded it up over a couple of years to get this amount. I have been in Thailand the entire time and not paid any tax at all.

Would be treated as income.This is interesting, I have a bunch of 'money' tied up long term in the MtGox bankruptcy, repayments are apparently going to begin soon and I do expect SWIFT transfers to hit my account in the first 3 to 6 months of 2024.

I will get both crypto (Bitcoin and Bitcoin Cash) which I'm not worried about - I can handle that as it's going to an American exchange were I already verified KYC/AML to a decent level. I'll likely just keep it as crypto for a while, I've been forced to hold it for nearly 10 years now so what's a few more.....

The cash portion however will go to my Thai bank account, it's going to be a little under 2 million Baht.

Now this is most definitely money from 2014 when they went under, it will be transferred directly to me from the MtGox company I believe - the company still exists in civil rehabilitation.

What happened is the trustee sold about $650 million worth of Bitcoin back in around 2018 so he had enough funds to bring the company out of 'liquidation bankruptcy' and give us the option of civil rehabilitation which we all voted to accept. This kind of resurrected the company minus the old shareholders with the trustee in charge.

So now they're using that $650 million which has just been sitting there losing value for the last 5 years to pay back everyone whatever they held on the day of the bankruptcy, no matter if the account balance was crypto or USD, but we also get a proportional share of the Bitcoin the company holds, and they have a lot, they have 137,000 Bitcoin - the crypto payments in my case will be on top of the original USD value at the date it was declared insolvent.

So this is a very rare moment where the creditors in a bankruptcy will actually receive far more than was lost - at current JPY prices it's like 20 times the amount back in 2014 due to Bitcoin price appreciation.

In my case the value of everything I had on there was all in Bitcoin and worth about $60-80k back in Feb 2014 (that's quit a bit of Bitcoin to lose even back then) but I'm getting this cash plus a bunch of crypto, the cash represents only a small amount of the total returned but it's also just what I had on there at the point it collapsed.

Now I don't want to pay tax on this - it's 100% older money but I'm not sure how I'm going to prove this is old money in Thailand when they come looking to tax me on the wires which I'm sure they will - this is definitely not money 'earned' recently - it exists right now and has been allocated to me for years - I'm just waiting for payment.

I guess I kind of think of it as like a bank account balance in Japan but it's an accepted bankruptcy claim and not in a bank.

Any thoughts?

I appreciate that this is an unusual situation but I'm pretty sure I shouldn't pay any tax on that and would like to know what to do to prove it's old money - I don't have records from 2014 but I do have claim acceptance screenshots. Also I did not pay any tax on the original $80k, I put like $10k in and traded it up over a couple of years to get this amount. I have been in Thailand the entire time and not paid any tax at all.

If you'd been paid in 2022, and left out and brought in after (or 1/1/23) 1/1/24 would be savings.

Would be treated as income.

Well that sucks, maybe I'll have to suck it up and pay some tax. I do expect to have to pay some as I transfer living expenses into the country as well.

I've got a Thailand Elite membership until 2040 so I guess I'll be looking at loopholes like leaving the country when I bring any larger amount in at some point in the future but I'll hold off on that until there's more clarity on the local regulations in a year or two.

However I will be in their system by then which I don't like and I'm not leaving for 6.5 months making myself non resident over just a couple of million Baht but I would do it for maybe 10 or more million Baht.

I guess I'll need to consult an accountant about this, going into their tax system on a voluntary basis goes against everything I believe in and have practiced since the 90's.

If you are not in the Thai system yet, I'll suggest not to declare anything beforehand.Well that sucks, maybe I'll have to suck it up and pay some tax. I do expect to have to pay some as I transfer living expenses into the country as well.

Wait until you get official information personally of any tax change. Then, if further asked to justify your remittance in Thailand, your first answer will be "I don't know" like locals do, and negotiations begin.

Share:

Latest Threads

-

Crypto to Fiat Suddenly More Expensive on Kraken

- Started by bubbledouble

- Replies: 2

-

-

Driver’s License in the Philippines – Fast and Painless

- Started by Overtrade

- Replies: 2

-

Remote Company Formation Options for Sanctioned Country IT Professional with Minimal Bureaucracy and Zero Local Taxes

- Started by IllIlllIII

- Replies: 1

-