I own a digital info-product business. The current corporate structure involves a UAE freezone parent company, a couple of Cyprus based subsidiaries of the UAE company, and a separate US LLC.

I am thinking of relocating to Portugal and want to minimize potential tax liabilities in Portugal under the NHR regime.

The main danger obviously is that the Portuguese tax (wo)man will assume that the UAE co's place of effective management (POEM) is Portugal and therefore the UAE co's profits are taxable in Portugal.

The recommended solution on these forums as well as other websites seems to be to incorporate a Malta/Cyprus parent company, pay the low effective corporate taxes in Malta/Cyprus, and then obtain tax-free dividends in Portugal from the Malta/Cyprus company.

But I am struggling to understand what exactly is the benefit of a Malta/Cyprus parent company setup vs having a UAE parent company?

If the answer is that I can show some sort of economic substance in Malta/Cyprus to escape Portuguese POEM laws, then why can't I do the exact same thing for the UAE co as well and show economic substance in the UAE?

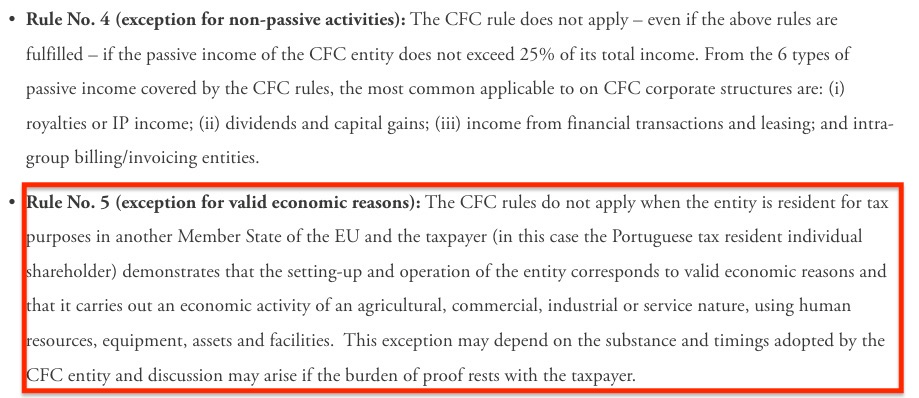

Or, if the answer is that Malta/Cyprus is in the EU, I am not sure how that's relevant under Portuguese law? Even though Portugal has black-listed the UAE, it also has a double-taxation treaty with the UAE. So I am not sure why the fact that Malta/Cyprus is in the EU makes any difference in this situation?

Can someone help me understand why the Malta/Cyprus parent company solution is better than the UAE parent company solution?

Thank you.

I am thinking of relocating to Portugal and want to minimize potential tax liabilities in Portugal under the NHR regime.

The main danger obviously is that the Portuguese tax (wo)man will assume that the UAE co's place of effective management (POEM) is Portugal and therefore the UAE co's profits are taxable in Portugal.

The recommended solution on these forums as well as other websites seems to be to incorporate a Malta/Cyprus parent company, pay the low effective corporate taxes in Malta/Cyprus, and then obtain tax-free dividends in Portugal from the Malta/Cyprus company.

But I am struggling to understand what exactly is the benefit of a Malta/Cyprus parent company setup vs having a UAE parent company?

If the answer is that I can show some sort of economic substance in Malta/Cyprus to escape Portuguese POEM laws, then why can't I do the exact same thing for the UAE co as well and show economic substance in the UAE?

Or, if the answer is that Malta/Cyprus is in the EU, I am not sure how that's relevant under Portuguese law? Even though Portugal has black-listed the UAE, it also has a double-taxation treaty with the UAE. So I am not sure why the fact that Malta/Cyprus is in the EU makes any difference in this situation?

Can someone help me understand why the Malta/Cyprus parent company solution is better than the UAE parent company solution?

Thank you.