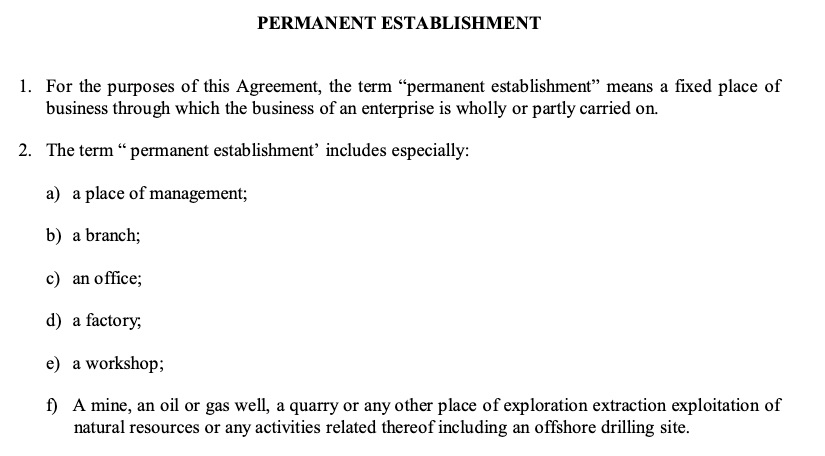

No, what I'm worried about is that in 5 years, someone decides you had a PE in Dubai all the time and slams you with a $125k fine for not registering for CIT during those past 5 years. And they have a lot more data available than any Western taxman could dream of.

Similar to what they pulled off with this UBO stuff, where they even made freelancer license holders register their "UBO", or face steep fines.

For me, the biggest gripe with the UAE is all of this unclear legal framework, where you can ask three different people and get five different answers, of which probably all turn out to be wrong.

You are one of few people whose word I actually trust to some degree, at least you seem like an honest person, in contrast to other people I've dealt with in Dubai, who lie to your face just to make a sale.